shih-wei

Right at the start of this year, I circulated an article on PennantPark Investment Corporation (NYSE:PNNT) arguing that it lacks several qualities that are necessary for sound defense.

In my opinion, having fundamentals that are tilted towards the conservative end of the risk spectrum is vital against the backdrop of looming recessionary risk and some industry-specific headwinds such as declining investment volumes and spread compression.

In PNNT’s case, there were two aspects that made me uncomfortable in assigning a buy rating:

- Almost half of the portfolio exposed to other investment types than senior secured first lien.

- Thin margin of safety in terms of PNNT’s ability to accommodate dividend with its underlying NII generation.

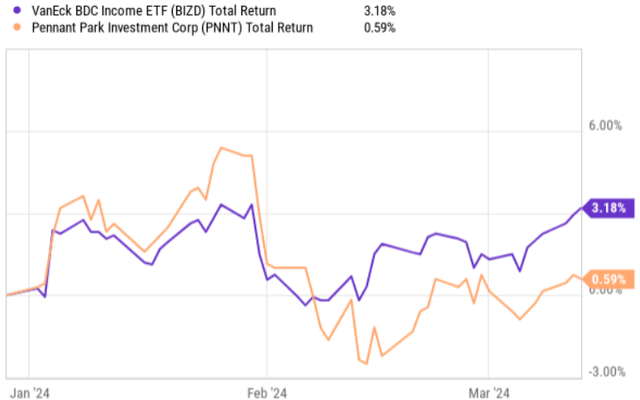

Looking below at the total return chart, we can see that PNNT has underperformed the benchmark as mostly driven by a suboptimal earnings report.

Let’s now dissect the earnings report and have a look whether there are any notable changes or new dynamics that could warrant a change from “hold” to ” buy” rating.

Thesis update

On February 7, 2024, PNNT issued Q1, 2024 earnings report, which surpassed the market’s expectation on the core NII. The core NII per share landed at $0.24, which was $0.01 per share above the consensus estimate, but unchanged from the previous quarter.

Here it is worth underscoring the fact that Q1, 2024 figures broke the previously assumed momentum in core NII growth. We can find really three major reasons behind this result:

- Negative net investment flows during the first three quarters of 2023, which imposed a pressure on PNNT’s asset base (i.e., lowering the base from which core NII could be extracted)

- New debt financings on top of debt rollovers that together have inflicted damage on the cost of financing / interest expense front.

- Falling credit spreads across core middle and upper middle markets.

However, I would argue that the first bullet is already largely mitigated since Q1, 2024 turned out to be very rich in terms of the deal activity and signed investments.

During the quarter, PNNT invested ~ $231 million in 12 new and 32 existing portfolio companies at a weighted average yield of 11.9%. The sales and repayments over the comparable period amounted to $71 million, which implies that PNNT has managed to fully offset the negative investment flows that were accumulated in the prior quarters of 2023.

With that being said, in my humble opinion, PNNT has become a less attractive investment case after the Q1, 2024 results.

First, PNNT’s debt to equity ratio has increased to 1.41x from 1.05x level that was recorded in the prior quarter. It means that the BDC has relied almost fully on external leverage to underwrite all of the new investments that were made during the most recent quarter. This is fully logical given the aggressive dividend payout of 88% from the core NII generation.

The issue here is that with this level of debt to equity, PNNT is heavily exposed to financial risk and compared to the sector median of 1.15x is easily considered an outlier on the aggressive end. In practice, it boils down to having even less margin of safety in the books as each new non-accrual or general spread compression will lead to a magnified reduction in the underlying equity (including sending higher the current core NII payout ratio in case of a slight negative change in the performance).

Second, the spread compression is an important challenge. We have to understand that currently, PNNT faces two problems at once: increasing cost of capital and declining portfolio yield. Both of these dynamics cannot be solved or somehow reversed. Theoretically, PNNT could go further up in the risk curve by funding riskier investments, but given that ~42% of the total portfolio is outside of the first lien bucket and the emerging patterns of raising corporate defaults, such a step seems highly unlikely. Plus, if we look at the Q1, 2024 yields captured via new investments (~ 11.9%), we will already here notice that the spreads are tightening (relative to the overall portfolio yield of 12.6%).

Third, PNNT’s portfolio structure and allocation is just too aggressive given the aforementioned dynamics. While PNNT has made some efforts on growing the share of first lien investments, other (i.e., higher risk) investments such as second lien and subordinated debt still account for a notable chunk of the total portfolio. In addition, even with the increase in asset base and leverage as well as considering the fact of no new non-accruals in during the quarter, PNNT’s dividend payout remains still remains in aggressive territory, constituting ~85% of the core NII.

The bottom line

On the surface, PennantPark Investment Corporation has indeed delivered sound results, exceeding the market’s expectation on the core NII front and registering well-needed surplus net investment volumes.

Yet, if we peel back the onion a bit, we will notice that the elements, which warranted my conservative stance on PNNT before Q1, 2024 have all deteriorated.

PNNT has become more indebted, and it has also funded incremental investments at lower yields than what were already embedded in the portfolio. Exposure to lower grade investment types still remains elevated, just as the core NII payout of 88%.

The combination of high debt, structural spread compression and low margin of safety due to aggressive dividend payout and exposure to aggressive investment types makes PNNT an unattractive investment against the backdrop of unfavorable market environment (e.g., slowdown in M&A and increasing non-accruals in the BDC space).

With that being said, I am reluctant to issue a recommendation to go short the Stock. PNNT is still a hold because of the “beta” factor, which currently exhibits rather positive momentum, providing support for BDCs in general. For example, as it is highlighted in the very first chart of this article – while PNNT has indeed struggled fundamentally and from the share price perspective, it is still up on a YTD basis just as the BDC index. In other words, I do not think that it is a good idea to go against the systematic factor, which currently provides tailwinds across the sector (due to constrained banking sector and the notion of higher for longer that is extremely positive for BDCs).