The report from the £7.7bn Local Government Pension Scheme (LGPS) fund outlined its approach to Levelling Up, with around 13% of its portfolio invested in UK communities.

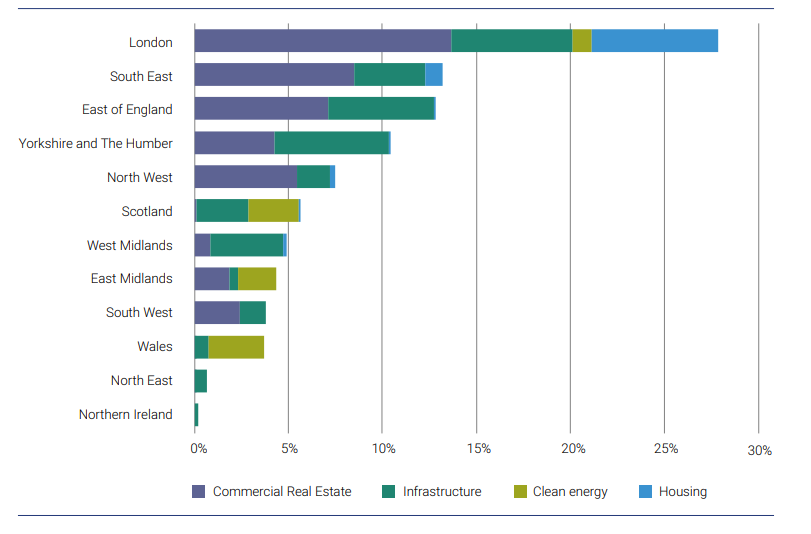

Of the 22% (£1.7bn) invested in real estate and infrastructure, the LGPS fund said 64% (£1bn) of this was invested in the UK, with more than 70% of investments outside London.

This includes 114 commercial real estate assets, which support around 19,600 jobs, and 24 housing investments, which include 13 build-to-rent sites, 3,980 homes built and 5,170 planned.

LPFA is also invested in more than 100 clean energy and infrastructure assets, including an offshore and onshore windfarm capable of powering 1.3m homes in total, an energy storage platform and a biomass facility.

Its 80 social infrastructure assets cover 163 schools catering to more than 141,200 pupils, 41 healthcare facilities, and other public sector facilities including six prisons and several civil buildings.

The report, produced in partnership with The Good Economy and Local Pensions Partnership Investments, also highlighted infrastructure investments in 26 assets in other sectors such as transport, water, energy and waste management.

LPFA chief executive Robert Branagh said: “This report shows the impact that our Fund has on communities and places across the UK through our investment in physical assets: infrastructure and real Estate.

“Understanding where our physical investments are is good risk management, particularly as the impact of climate change becomes more pronounced. We also support the just transition and we recognise the government’s interest in Levelling Up. We know that it is important that we move to a low carbon economy and that this is done in a way that is as fair and inclusive as possible to everyone concerned, creating decent work opportunities and leaving no-one behind.

“Pension Funds have a role to play in contributing to sustainable development, in enhancing local economic resilience in London where we are based and across the UK, in supporting business growth and job creation and improving transport and other types of infrastructure. However, it’s important that we understand what is already taking place so that we can make informed decisions about the future.”