Crews mill and pave Washington Avenue in Wheeling as part of a past project. Wheeling’s 2024-25 budget includes $800,000 for street paving. (File Photo)

WHEELING — Revenues in the city of Wheeling are expected to increase by around $416,771 during the next fiscal year, when nearly 400 full-time city employees will receive pay raises estimated to total $537,000.

Members of Wheeling City Council are slated during tonight’s meeting to approve the 2024-25 general fund budget for the fiscal year that begins in July.

The proposed city budget totals $38,576,345 and reflects a balance between total revenues and expenditures.

Tonight’s meeting is scheduled to begin at 5:30 p.m. at the City-County Building.

During budget work sessions held earlier this year, officials agreed to award 3% pay increases for all full-time employees in the city. Wheeling City Manager Robert Herron said city leaders review budget requests from department heads early in the calendar year before budget work sessions take place.

City leaders also agreed to budget $800,000 for paving projects in 2024-25. During the current fiscal year, the city also dedicated the same amount for paving from the city’s general fund, but that money was not originally budgeted as a line item for paving — it was drawn from a cash carryover from the previous year.

The city’s cash balance at the beginning of the next fiscal year on July 1 is expected to be $300,000.

Once the proposed budget is passed, it will be forwarded to the West Virginia State Auditor’s Office.

REVENUES

Breaking down the budgeted figures for revenues, the budget summary provided by the city for the current fiscal year only lists actual income from July through January since this current fiscal year continues through June and is not yet complete.

“We’re trending ahead, from a revenue perspective,” Herron said. “Sales tax is up. Property taxes are strong.”

Total property taxes for 2024-25 are projected to tally $6,114,032.

Other taxes are budgeted to generate a total of $16,216,600. This includes $6,300,000 in current Business and Occupation Tax and $4,131,000 in delinquent B&O Tax revenues. The Utility Excise Tax is set to generate $1,320,800, the Gas & Oil Severance Tax is slated to pull in $275,000, the Hotel/Motel tax is projected to collect $1,342,000, the Utility Business Tax is set to bring in $2,372,000 and the Wine & Liquor Tax is slated to generate $453,000.

Municipal Sales Tax revenues are projected to be strong at $4,275,000.

Fines from parking violations, traffic tickets, and various police and jail fees generate a total of $401,100. Business License, Insurance License and Private Club License fees total $223,780. Collections from various fees such as cemetery revenues, cable franchises, swimming pools, recreation programs and sports camps, sanitation collections and parking meter revenues are projected to total $3,695,373.

Fire fees rake in a total of $2,310,000, while charges for police and fire services total $560,000.

Miscellaneous revenue from state and federal grants, video lottery revenues and table gaming fees, ambulance fees, city auction proceeds and other are expected to total $4,153,937.

EXPENDITURES

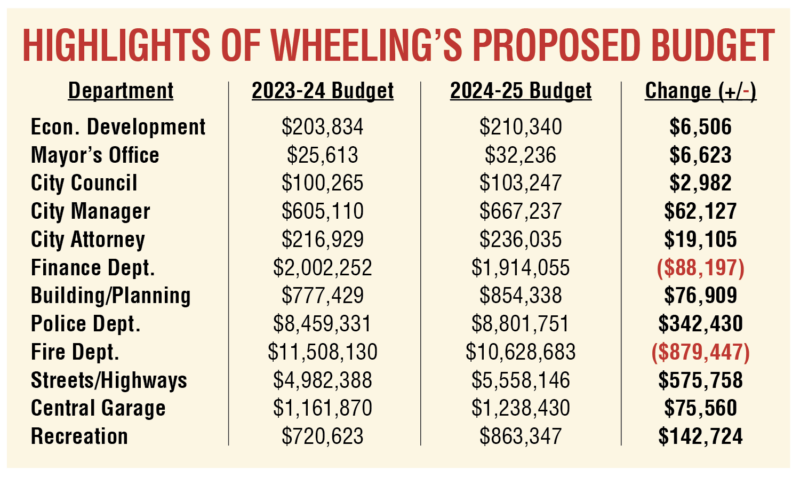

The city of Wheeling’s proposed 2024-25 general fund budget reflects all salaries and expenses from more than two dozen city departments.

Almost all departments are seeing an increase for the next fiscal year. Currently, the Finance Department is operating without a director — that position has remained unfilled since former Finance Director Seth McIntyre stepped down from that post nearly one year ago. The position of Public Works director also was never filled after former Director Rusty Jebbia retired in 2022. Superintendents under the Public Works departments now report to Assistant City Manager Bill Lanham.

Herron has noted that a significant savings is being realized by the city because of the new state law allowing municipalities to sell pension obligation bonds to fund unfunded liabilities for police and fire pensions, as long as their pensions are already at least 40% funded.

Officials said that over the next 25 years, the city of Wheeling was expected to save a total of around $17 million from police and fire pensions, which are now fully funded under the new method of addressing this expense.

Still, operating expenses increase every year in all departments, and the budgets for the city police and fire departments remain the biggest of the general fund expenses. During the next fiscal year, the Wheeling Police Department budget will be around $8,801,752, and the Wheeling Fire Department budget will be more than $10,628,683.

Herron noted that certain city positions are occasionally given market rate adjustments. Pay rates for part-time employees, which do not receive the 3% pay raise, are adjusted as needed in order to attract potential workers to vacant positions. This is also the case for positions like those in the police department, which Herron said must offer wages that remain competitive with other regional law enforcement agencies.

Despite incentives and market rate adjustments, however, “we still have vacancies” on the police force, Herron noted.

Almost all of the pay rates listed in the proposed 2024-25 budget reflect a standard 3% wage increase for the fiscal year, the city manager explained.

“In a few cases, adjustments have been made during the year, but the numbers in the proposed budget should be accurate,” he said. “It is a proposed 3% increase.”

Some key departmental salaries in the proposed budget include those for the city manager Herron at $142,234, assistant city manager Lanham at $103,975, city solicitor Rosemary Humway-Warmuth at $102,588, fire chief James Blazier at nearly $99,900, police chief Shawn Schwertfeger at $94,348, information technology director Michael Lloyd at $84,460, human resources director Kayla Graham at $83,811, building and planning director Brenda Delbert at $82,485, economic development director Nancy Prager at $77,685, recreation director Rochelle Barry at $72,100, city clerk Jessica Zalenski at $59,915, marketing and community relations specialist Michele Rejonis at $59,226, Centre Market manager Brooke Price at $56,650 and homeless liaison Melissa Adams at $53,560 – a position that was created three years ago and designed to “sunset” unless the next city council that takes office in July choses to renew the position.

Compensation for the mayor and members of city council are considered stipends and are set by the city charter. Voters agreed to give the mayor and city council positions a slight pay raise when they approved a referendum to do so in 2018. The new rates went into effect beginning in 2020. It was the first charter amendment allowing a pay raise for these elected positions in decades.

Under the amended charter, the mayor is paid $19,700, and each of the six council members receive $14,800 per year.

Overall, the proposed fiscal year budget for the city of Wheeling is very similar to the current budget.

“We’re very fortunate in the fact that our liability insurance has been stable, but there are cost increases,” Herron said. “With our revenue projections, we try to be conservative.”

Aside from the city’s general fund, Wheeling has other funds on hand, Herron explained. The city’s Budget Stabilization Fund or “Rainy Day Fund” has remained untapped for years. It was bolstered during the COVID-19 pandemic by funds received through the original Coronavirus Aid, Relieve and Economic Security (CARES) Act reimbursements and today carries a balance of about $5.1 million, Herron said.