Scott Schatz, Executive Vice President of Finance Operations and Technology, has sold 131,929 shares of Townsquare Media Inc (NYSE:TSQ) on April 4, 2024, according to a recent SEC Filing. This transaction has been part of a series of sales by the insider over the past year, with a total of 195,709 shares sold and no shares purchased.

Townsquare Media Inc is a media, entertainment, and digital marketing solutions company that primarily owns and operates radio stations, digital properties, and live events in small and mid-sized markets across the United States. The company focuses on creating and distributing original and motivating media experiences that connect communities with the content they love, people they trust, and products they want.

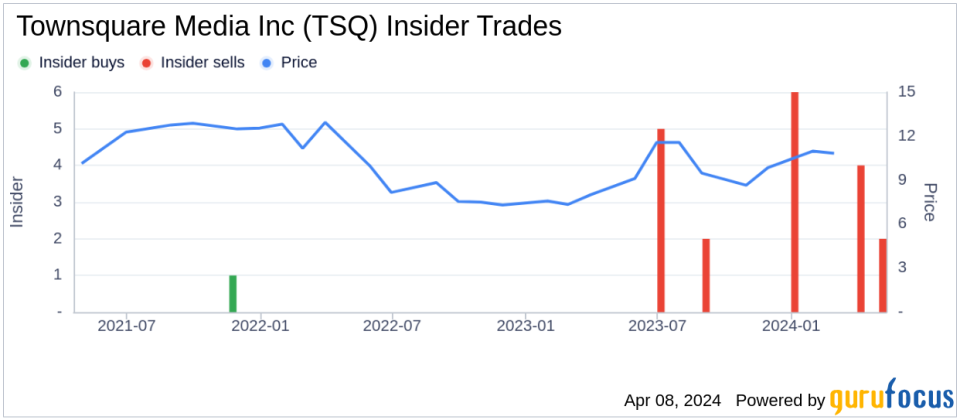

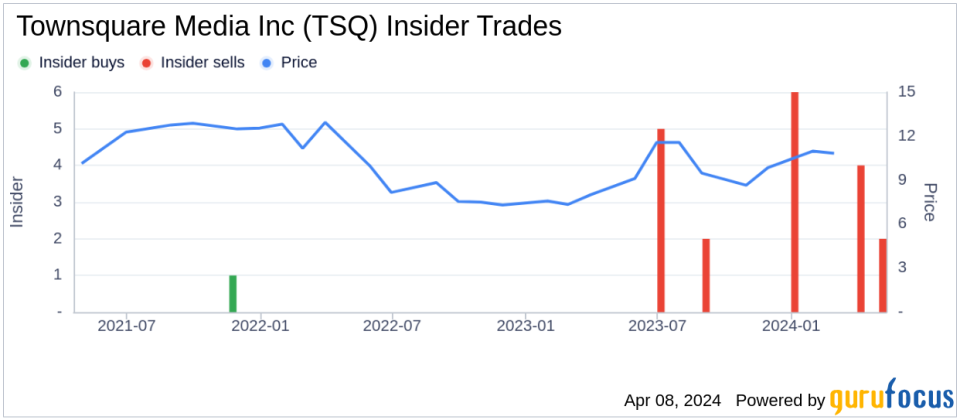

The insider transaction history for Townsquare Media Inc shows a pattern of insider sales, with 25 insider sells and no insider buys over the past year.

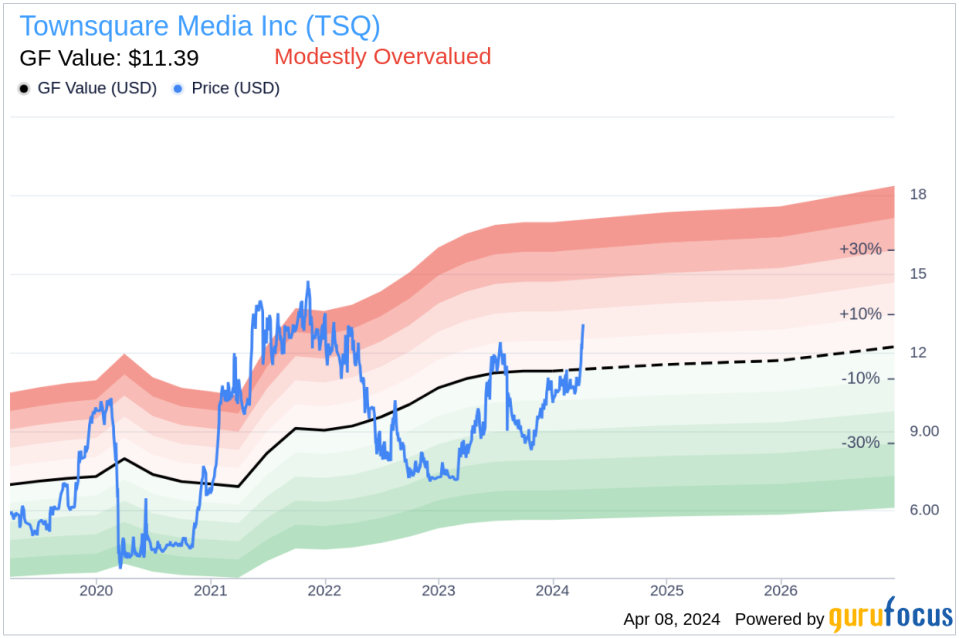

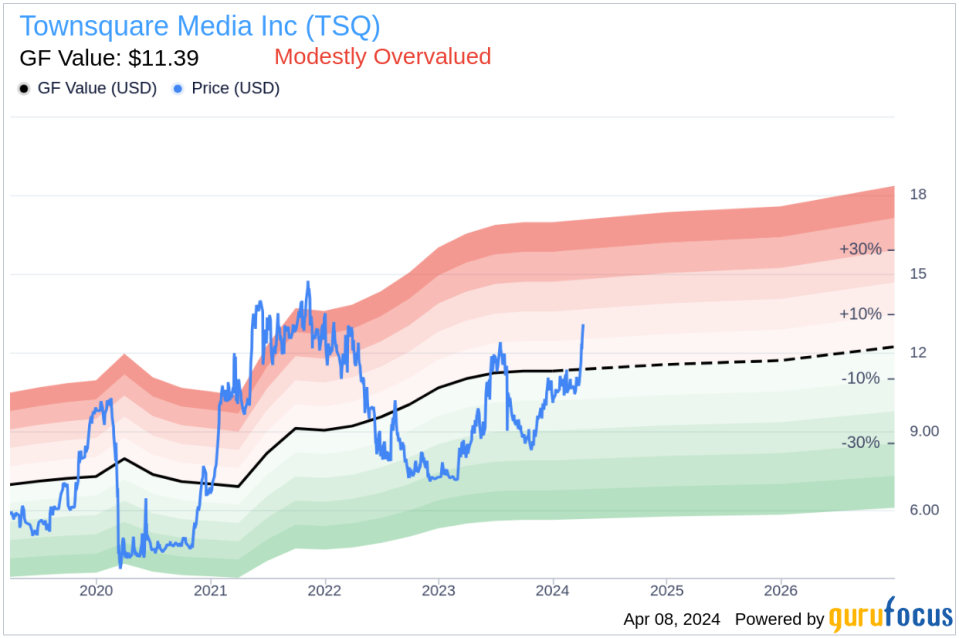

On the valuation front, shares of Townsquare Media Inc were trading at $12.36 on the day of the insider’s recent sale, resulting in a market cap of $199.12 million. The stock’s price-to-GF-Value ratio stands at 1.09, indicating that the stock is modestly overvalued when compared to the GF Value of $11.39.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which is calculated based on historical trading multiples such as price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow, along with a GuruFocus adjustment factor based on the company’s past returns and growth, and future business performance estimates from Morningstar analysts.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.