Tandem

When Michelle Winterfield launched the relationship finance app Tandem in January 2023, it marked the beginning of her journey to address an issue that many couples face when dating becomes serious —

“I moved in with my now husband, years before we got married, and the very first financial experience we had was, how do we manage all these new joint expenses,” Winterfield said. “We were not ready to completely combine our finances yet.”

Winterfield and her husband opened a joint account in the early stages of their relationship to handle bill payments and eventually signed up for individual cards tied to the new account “to avoid sending multiple requests back and forth or tracking everything in a spreadsheet,” she said. But when the former private equity investor sought options outside of traditional accounts and payment splitting apps, she found that very few tools were designed with couples in mind.

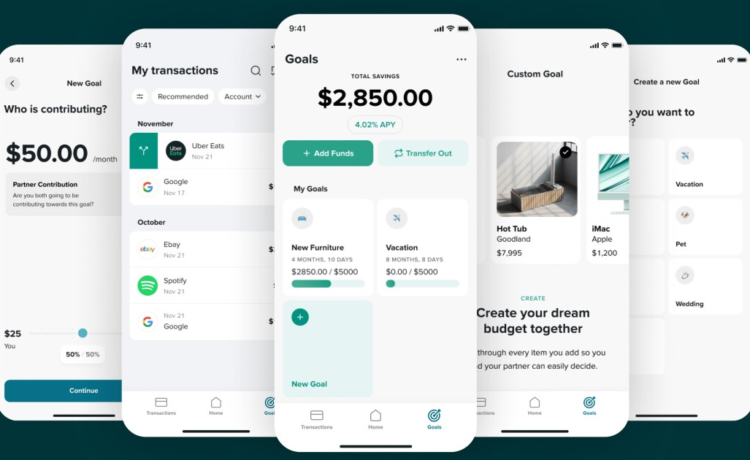

Thus, the Ann Arbor, Michigan-based Tandem was born. The fintech’s subscription-driven platform allows consumers to connect their bank accounts and card products to the platform, which keeps a ledger of individual purchases and allows users to split and share multiple transactions like groceries or meals with their significant others. Couples are charged $12 per month to use Tandem’s services.

While the services offered by Tandem and other couples finance platforms

With more than 25,000 active couples registered and splitting roughly $60 million in expenses across last year, Tandem

Tandem

Couples seeking to jointly purchase an item can first search for it using what Winterfield describes as a “Pinterest-like” experience within the platform, then establish a fund tied to the purchase of the item. Monthly contributions from each party are tracked within Tandem, and can be split by the organizing partner if one chooses to allocate more than the other.

After the target savings amount has been set, consumers can begin setting aside money within the platform. If they wish, deposits are placed in a high-yield savings account supported by the fintech’s partnership with the $4.4 billion-asset Third Coast Bank in Humble, Texas.

“It’s not really easy to collaborate on this stuff, so we tried to put forth the ethos of not just the financial product, but really bringing an experience that allows both partners to have equitable involvement in the finances of the relationship,” Winterfield said.

Purchase splitting is a small, but important part of the overall shared-finance picture.

Apps like HoneyDue, EveryDollar and Monarch Money seek to occupy the same niche while offering an expanded suite of services such as budgeting, spending report generation, debt tracking and more.

“There’s often one person who kind of takes the driver’s seat on the financial side, and the other partner often feels like they’re kind of along for the ride or sort of in the dark,” said Val Agostino, cofounder and CEO of Monarch Money. “What we’re really trying to do is make it feel like it is a team sport.”

Many forward-thinking executives of credit unions understand that engaging with the next generation of products often starts by

Tandem

Following a

“As [our members] are graduating, they’re in these relationships where they’re sending endless money back and forth through Cash App or Venmo or whatever peer-to-peer service they have, and it’s not easy to keep track of everything,” said Ben Maxim, chief digital strategy and innovation officer at the $7.7 billion-asset MSUFCU.

Maxim and his team are still in the initial exploratory stages with MSUFCU members, but remain hopeful that offering this product during the early stages of a consumer’s financial life cycle will help both meet their current needs and use the credit union’s other products over time.

“As these personal relationships are forming, eventually they will need [more traditional] services and it’s a natural option to bring them to us as a referral,” Maxim said. “We’re able to be the partner when they’re ready.”

Also exploring a collaboration with Tandem is Tansley Stearns, president and chief executive of Community Financial Credit Union in Plymouth, Michigan. The head of the $1.6 billion-asset CFCU said that while economies of scale impact the credit union’s ability to “build the member facing technology that [they] want to bring to bear,” finding outside partners can help reduce the cost barrier.

“We think that it’s important for us to find the right partners that are building technologies that we think are going to have a strong impact on our members,” Stearns said.

Having a neutral platform to help couples navigate money discussions is helpful when settling disputes, but advisory experts say that while these apps are helpful, few can truly account for the underlying emotions that are tied to money.

Platforms like Tandem are “never going to be a replacement for dealing with the emotional aspects of money,” especially when most “presume that people are rational actors around money,” said Stephanie Genkin, a certified divorce financial analyst, certified financial planner and certified financial therapist.

“I’m always thinking about ‘how do we split assets when the party is over’ and it’s not so easy, because if you bought something together and one person did the fixing up and the other person contributed more [financially], it’s not so easy,” to say who gets what, Genkin said. “The sweat equity and labor play a part in this discussion.”

Relationships can be complicated long before money is involved, but sitting down to discuss the financial aspects before the relationships moves forward can help consumers in the long run.

“When you’re dating somebody or you’re starting to cohabitate or whatever you’re doing, you’re not just cohabitating with this person, you’re also cohabitating with their money,” said Cary Carbonaro, senior vice president and director of women and wealth with Advisors Capital Management.