Relatively few corporations have published transition plans that detail investments they’re making to support their net-zero targets. It’s hardly surprising, then, that investors are using the 2024 proxy season to demand more information about corporate climate transition plans and how, exactly, they’re being financed.

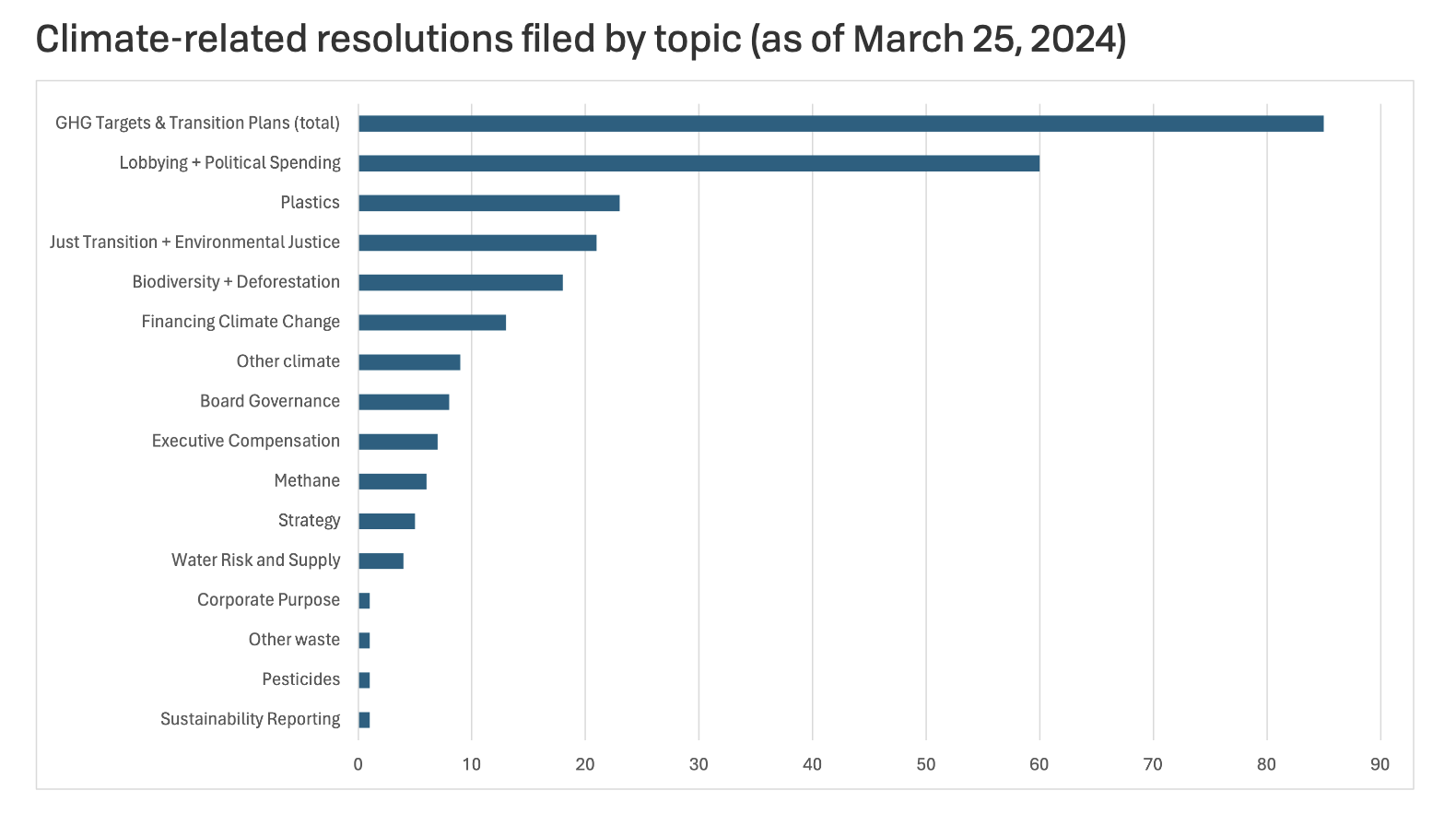

ESG-focused shareholder proposals relating to greenhouse gas emission reduction goals or climate transition plans are the leading category of filed resolutions so far this year, according to a March 25 analysis by nonprofit Ceres

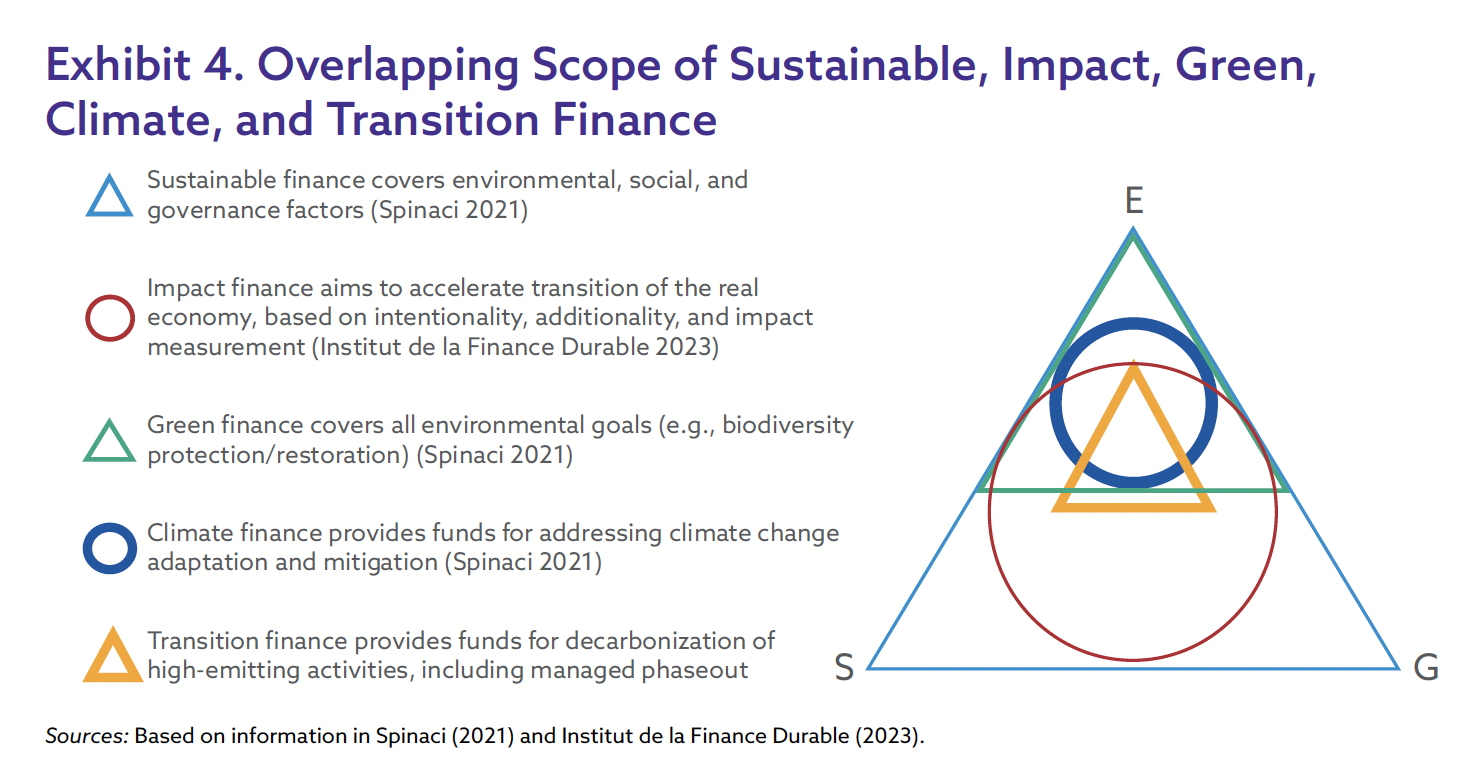

Capital that can be used for the decarbonization of high-emitting activities in support of climate transition plans falls under the category of “transition finance.”

While there’s still no universal standard of eligible activities, transition finance generally supports projects with an “overarching objective to generate material impact, contributing to the realization of a net-zero economy,” according to a report released in March by the CFA Institute Research and Policy Center.

How to recognize ‘transition finance’

So far, transition finance has largely come in the form of debt financing, through bonds and loans where proceeds are used to fund a company’s emissions reductions; or through equity investments, led mostly by private equity funds, in energy transition projects that address high-emitting sectors. These investments might include renewable power plants, carbon capture facilities and electric vehicle factories.

Examples include BlackRock’s investment in Occidental Petroleum to build its first carbon capture plant or the asset manager’s separate offer to help Texas raise $10 billion in private capital to strengthen its power grid.

“Transition finance” is distinct from other forms of capital being deployed on behalf of environmental, social and governance goals in its focus on phasing out energy sources or processes that carry high emissions.

The chart below helps delineate the boundaries between the different sorts of finance corporations might use.

No transition plan, no transition finance

There is a wide gap between corporate sustainability commitments and the funds made available to support them: 93 percent of senior leaders across many industries say sustainability is commercially important, but only 23 percent allocate significant capital to it.

For sustainability professionals at high-emitting companies with substantial exposure to transition risks — such as carbon taxes introduced by governments or mandated transitions to renewable electricity generation — access to transition finance is essential.

Funding the transition for heavy industrial activities and the transport sector will require an additional $370 billion in annual capital expenditures between now and 2050, estimates the World Economic Forum.

A survey cited in the CFA Institute report found that of 500 senior executives in high-emitting sectors, 40 percent have created plans for net zero by 2050. A majority of the 60 percent who haven’t done so cited a lack of reliable financing as the main obstacle.

A high-emitting company without a net-zero target and a plan to get there will find it difficult to secure transition finance. That’s because the financial institutions deploying transition capital would experience an increase in their financed emissions, leaving them open to a heightened risk of greenwashing accusations.

“Financial institutions with net-zero commitments … can justify the consistency of their capital allocation only if high-emitting borrowers/investees present credible transition plans aligning with the Paris Agreement,” the report said.

Getting started where you are

The International Capital Markets Authority, which provides education for capital markets participants, has published principles for green bonds, social bonds and sustainability-linked bonds but not for transition bonds.

It instead offers a handbook that provides guidance and common expectations for the practices, actions and disclosures that should be made when raising funds in debt markets for transition-related purposes.

For example, the International Sustainability Standards Board’s IFRS S2 standard and the Transition Plan Taskforce’s disclosure framework guidance recommend companies disclose decarbonization targets alongside a projection of potential financial impacts. By incorporating analysis of economic feasibility into transition plans, companies will directly address investors’ and lenders’ concerns, and boost confidence that targets are realistic.

As investors become more sophisticated in gauging which companies are credibly dealing with — and planning to act on — climate risks, companies that will need access to transition finance should get started on building transition plans.