Guido Mieth

Summary

Many investors may feel cautious in this current market environment with U.S. equity indexes near all-time highs. Although sticky inflation (see the latest CPI report), increasing geopolitical tensions, and slowing economic growth pose considerable risk to equity markets, I believe there is still 1 big elephant in the room that could propel gains further. There is currently $6 trillion still sitting in U.S. money market funds as the Federal Reserve is expected to start cutting rates later this year. While the momentum factor has already been one of the biggest drivers of 2024, it’s possible this trend could continue.

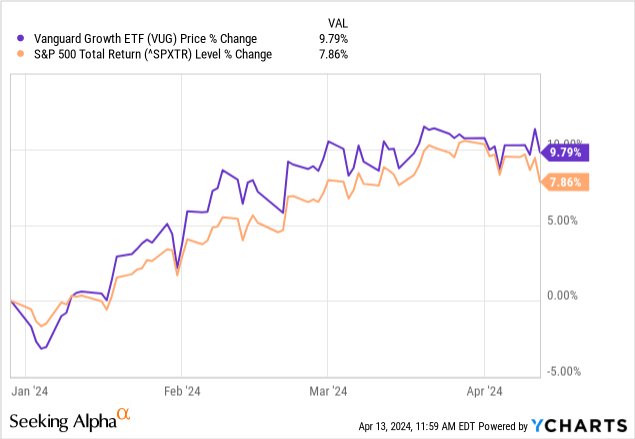

This vast pool of liquidity, coupled with anticipation surrounding potential Federal Reserve rate cuts later in 2024, could set the stage for a continued surge in U.S. equities, as investors seek higher yields in a potential lower interest-rate environment. With the largest sector encompassing the S&P 500 being technology, it’s imperative to maintain exposure to this sector. The Vanguard Growth ETF (NYSEARCA:VUG) is an excellent way to achieve some exposure to tech while also diversifying to growth in other sectors, such as consumer discretionary and industrials. The fund has a low cost fee structure, with an expense ratio of only 0.04%, and seeks to track the performance of the CRSP US Large Cap Growth Index. YTD this fund has outperformed the S&P 500 marginally by almost 2%.

VUG vs. S&P 500 YTD Total Return

While VUG is technically considered a growth ETF, more than half of fund consists of technology stocks. Its top holdings include well-known names such as Microsoft, Apple, NVIDIA, and Amazon, which makes up almost 40% of the fund.

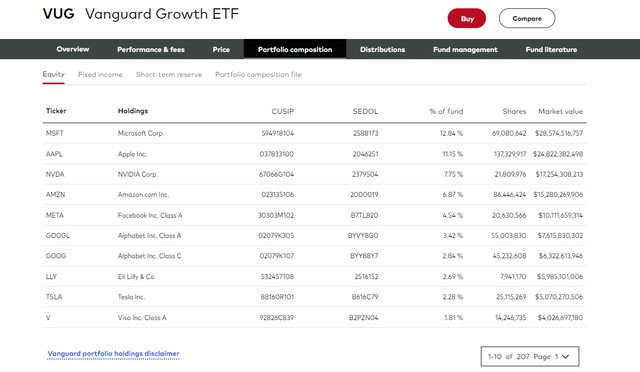

VUG’s Top Holdings

The $6 Trillion Dilemma

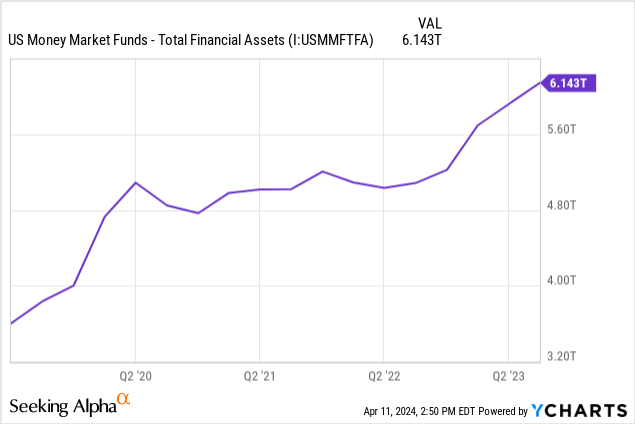

Since the start of the COVID-19 pandemic, U.S. money market funds have seen an influx of financial assets. There are multiple factors driving this, including increased savings and large government stimulus packages such as The American Rescue Plan Act of 2021 (American Rescue Plan), enacted in early March 2021, provided Economic Impact Payments of up to $1,400 for eligible individuals or $2,800 for married couples filing jointly, plus $1,400 for each qualifying dependent, including adult dependents. There is unquestionably large money supply currently in the U.S., as evidence in money market funds.

U.S. Money Market Funds – Total Financial Assets

While this explosive growth since early 2020 from $3.2 trillion to over $6 trillion appears significant in absolute terms, I want to take it step further and view this number as a percent of the S&P 500 market cap. This paints a better picture in view of how much cash is actually on the sidelines.

U.S. Money Market Funds as % of S&P 500 Market Cap

Seeking Alpha

This chart puts things into better perspective. Since 2015, the average amount of U.S. money market funds as a percentage of the S&P 500 market cap has been roughly between 12% and 24%. During March 2020, when markets were in free fall, investors piled into cash. This, combined with a declining S&P 500, led to that spike near 24%. Since then, it’s steadily declined as the S&P 500 continues to make new all-time highs. However, since short-term interest rates were hiked to a range of 5.25-5.50%, it appears there has been an increase in money market funds as expected. Investors want to earn higher risk free returns.

Now, the amount of dollars currently in money market funds represent around 17% of the S&P 500 market cap. It has not been this high since the spring 2020 market hysteria where equities ended up surging for quite some time.

Risks To Consider & Conclusion

There are many factors to consider in this current market, specifically deciding where to invest and when. It can be quite overwhelming. There are obvious red flags to consider, such high valuations (see S&P 500 P/E relative to historical averages, earnings yield, etc.) and potential for higher interest rates for longer. This would negatively impact tech and growth companies that VUG currently holds. Growth and technology stocks tend to have higher price-to-earnings (P/E) ratios compared to value stocks. When interest rates rise in response to high inflation, the present value of future cash flows from these high-growth companies may be discounted at a higher rate, leading to lower stock prices. Additionally, rising interest rates can increase borrowing costs for companies, potentially impacting their ability to fund growth initiatives. However, if the Federal Reserve does start cutting interest rates, I believe the momentum of investors flocking from money market funds to equities could be significant.