Shares of Super Micro Computer (NASDAQ: SMCI) have set the market on fire in the past year with outstanding gains of 795%, and one analyst believes this red-hot rally is set to continue.

Supermicro’s business is booming thanks to the rapidly growing demand for its artificial intelligence (AI) server solutions, and Loop Capital analyst Ananda Baruah predicts Supermicro’s red-hot growth is here to stay. He’s upgraded his price target on the stock from $600 to $1,500. The updated price target is 54% higher than where the stock trades as of this writing.

Let’s look at the reasons why the analyst bumped his price target 2.5 times higher, and consider whether Supermicro could indeed hit that mark by 2026 per Loop Capital’s prediction.

Tremendous growth lies ahead for Supermicro

Supermicro’s fiscal 2024 (ending June 30, 2024) revenue is expected to land at $14.5 billion based on the midpoint of management’s guidance. That would be slightly more than double the company’s fiscal 2023 revenue of $7.1 billion. Consensus estimates are calling for Supermicro’s earnings to nearly double from $11.81 to $22.10 per share over the same period.

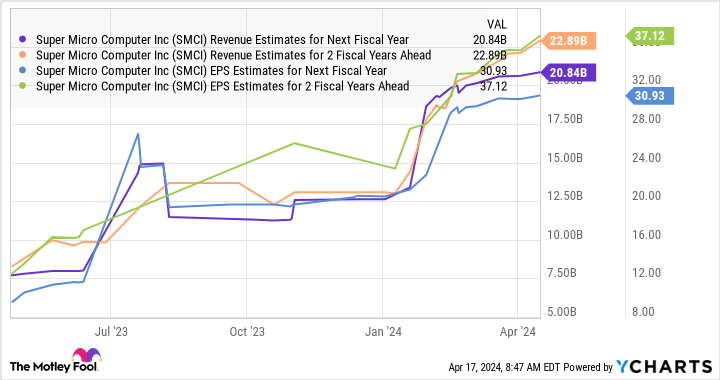

However, as the following chart indicates, analysts are projecting Supermicro’s pace of growth to slow down over the next two fiscal years (through fiscal 2026).

Baruah, however, believes Supermicro could generate between $30 billion and $40 billion of revenue in 2026. Its earnings, on the other hand, could jump to a range of $50 to $60 per share. In other words, the Loop Capital analyst expects both revenue and earnings to at least double over the next two or so years.

Those numbers are far higher than what the consensus estimates indicate. However, a closer look at the AI server market that Supermicro serves and the moves it’s making in this space indicates it could indeed hit Baruah’s numbers.

And comments from management on Supermicro’s January earnings call support Baruah’s target. According to CEO Charles Liang:

Today, our production utilization rate is about 65% across our U.S.A, Netherlands, and Taiwan facilities, and they are quickly filling. To address this immediate capacity challenge, we are adding two new production facilities and warehouses near our Silicon Valley headquarter, which will be operating in a few months. The new Malaysia facility will focus on expanding our building blocks with lower costs and increased volume, while [the] other new facility will support our annual revenue capacity above $25 billion.

So, management already has plans for its top line to exceed $25 billion. Additionally, the company’s focus on further enhancing its manufacturing capacity by investing in more infrastructure could set the stage for additional growth.

Investors can expect tremendous upside

Loop Capital’s $1,500 price target is based on the firm’s baseline earnings per share forecast of $50 in fiscal 2026 and a forward earnings multiple of 30. This forward earnings multiple is in line with the Nasdaq 100 (using the index as a proxy for tech stocks).

However, AI stocks tend to command a premium valuation thanks to their rapid growth, so there’s a chance Supermicro could deliver even stronger upside than what the firm is forecasting. For instance, if Supermicro’s top line increases to $30 billion in fiscal 2026, but the stock maintains its current price-to-sales multiple of 6, its market cap would jump to $180 billion, more than triple its current level.

It’s also worth noting Supermicro’s price-to-sales ratio is lower than the tech sector’s average of 7. Investors, therefore, could still be getting a good deal on this AI stock.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $466,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Where Will Super Micro Computer’s Soaring Stock Be in 2026? was originally published by The Motley Fool