-

Robust recovery in passenger ticket revenues showcasing a strong market comeback.

-

Significant increase in net income indicating improved operational efficiency.

-

Strategic capital management reflected in successful debt restructuring.

-

Challenges in operating expenses and potential legal proceedings remain a concern.

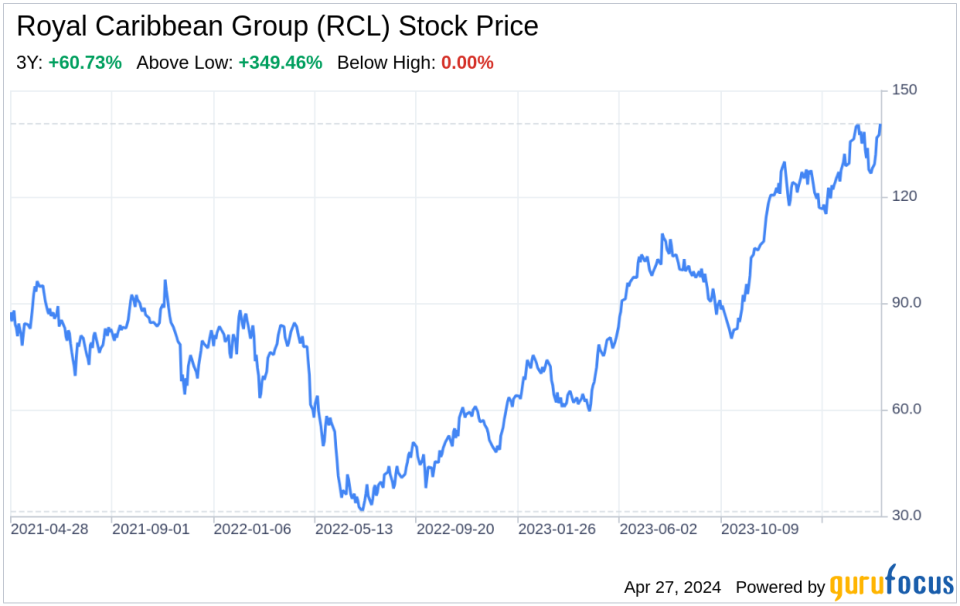

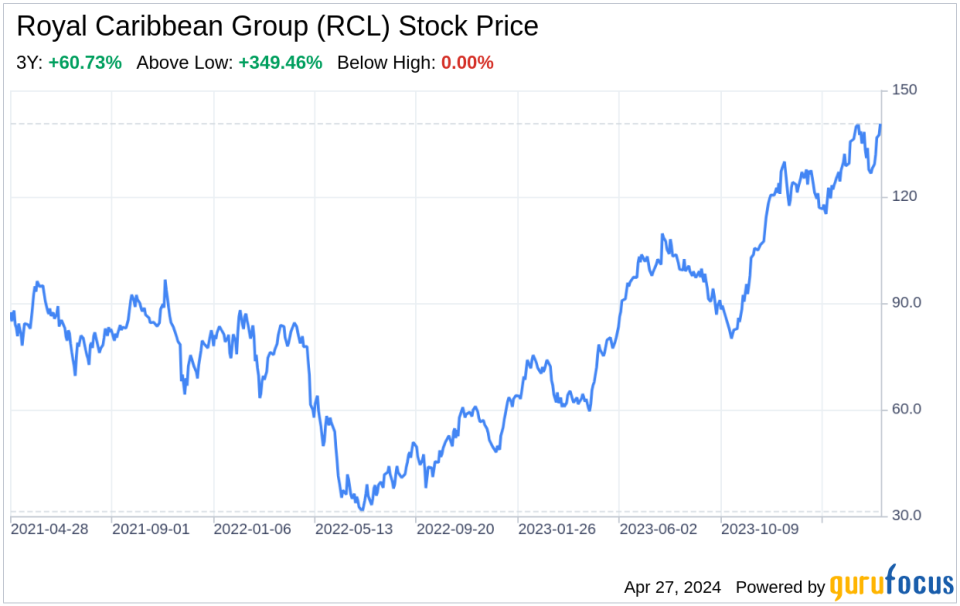

On April 25, 2024, Royal Caribbean Group (NYSE:RCL), the world’s second-largest cruise company, filed its 10-Q with the SEC, revealing a significant recovery from the previous year’s financial turbulence. The company, which operates a fleet of 65 ships across various brands, including Royal Caribbean International, Celebrity Cruises, and Silversea, reported a substantial increase in passenger ticket revenues from $1,897 million in Q1 2023 to $2,542 million in Q1 2024. Onboard and other revenues also saw a healthy rise, contributing to a total revenue jump to $3,728 million, up from $2,886 million in the prior year. This financial rebound is further underscored by a swing from a net loss of $(48) million in Q1 2023 to a net income of $360 million in Q1 2024, reflecting Royal Caribbean’s resilience and strategic agility in navigating the post-pandemic market landscape.

Strengths

Revenue Growth and Brand Equity: Royal Caribbean Group’s impressive revenue growth is a testament to its strong brand equity and successful marketing strategies. The company’s ability to increase ticket prices and onboard spending indicates a loyal customer base willing to pay a premium for the Royal Caribbean experience. This brand strength is further supported by the company’s diversified portfolio, which caters to a wide range of demographics and preferences, allowing it to capture a significant share of the cruise market.

Operational Efficiency: The notable increase in net income from a loss in the previous year to a substantial gain demonstrates Royal Caribbean’s operational efficiency. Cost management and improved operational practices have likely contributed to this turnaround, positioning the company for sustainable profitability. The strategic deployment of ships to capitalize on seasonal demand also reflects the company’s adeptness in maximizing revenue opportunities.

Weaknesses

Rising Operating Costs: Despite the revenue growth, Royal Caribbean faces rising operating costs, with total cruise operating expenses increasing by $263 million year-over-year. This uptick is attributed to higher capacity and occupancy, as well as additional drydock days. The company must continue to innovate in cost management to maintain its profitability margins in the face of these escalating expenses.

Debt Management: While the company has successfully restructured its debt, as evidenced by the redemption of high-interest senior notes, it still faces the challenge of managing a significant debt load. The interest expense, although reduced, remains a considerable financial obligation that requires careful capital management and strategic financial planning.

Opportunities

Market Expansion: With the cruise industry’s expected growth and the gradual return of international travel, Royal Caribbean has the opportunity to expand its market reach. The introduction of new ships and itineraries can attract new customers and drive further revenue growth. Additionally, the company’s investment in joint ventures, such as TUI Cruises and Hapag-Lloyd Cruises, allows for expansion into new markets and segments.

Technological Advancements: Investing in technology can enhance the customer experience and operational efficiency. Royal Caribbean can leverage data analytics for personalized marketing, implement advanced safety protocols, and explore sustainable technologies to reduce its environmental footprint, which can also serve as a unique selling proposition.

Threats

Competitive Landscape: The cruise industry is highly competitive, with several major players vying for market share. Royal Caribbean must continuously innovate and offer exceptional value to maintain its competitive edge. This includes keeping up with trends such as sustainable cruising and experiential travel, which are becoming increasingly important to consumers.

Regulatory and Legal Risks: The company faces potential legal proceedings, such as the Havana Docks lawsuit, which could result in significant financial liabilities. Additionally, the cruise industry is subject to stringent regulations that can impact operations and costs. Royal Caribbean must navigate these legal and regulatory waters carefully to avoid adverse effects on its financial health.

In conclusion, Royal Caribbean Group’s latest SEC filing paints a picture of a company on the rebound, with strong revenue growth and a solidified market position. However, challenges such as rising operating costs and debt management, as well as external threats from a competitive landscape and regulatory risks, require vigilant attention. The company’s ability to capitalize on market expansion opportunities and technological advancements will be crucial in steering Royal Caribbean towards continued success in the dynamic cruise industry landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.