The official arbiter of the nation’s budget outlook issued an update this week, and, well, you already know where this is going.

The debt outlook never gets better. The annual deficit is likely to hit $1.9 trillion for 2024, according to the latest estimate from the Congressional Budget Office. That’s up from an estimate of $1.5 trillion just four months ago. Within 10 years, the gap between spending and revenue will be $2.9 trillion. The deficit in 2034 will be comparable to the entirety of government spending as recently as 2006.

Rather than raw numbers, economists care more about debt and deficits as a percentage of the economy. That outlook is gloomy too. The deficit will total 6.7% of GDP in 2024 and 6.9% in 2034, according to the CBO. For comparison, during the 20 years prior to the COVID pandemic in 2020, deficits averaged just 3.5% of GDP. For the four years from 1998 through 2001, Washington actually ran surpluses, with revenue exceeding spending. The average surplus during those four years was 1.4% of GDP.

Those were the days.

The real outlook is worse than the CBO numbers suggest. The CBO can only forecast budgets based on current law, and under current law, about $4 trillion of tax cuts will expire at the end of 2025. So the CBO has to assume more revenue will be coming in starting in 2026. In reality, Congress is likely to extend some or all of those tax cuts, depending on the outcome of this year’s elections. There will be less federal revenue than the CBO is accounting for during the next 10 years, making the budget outlook worse.

This year’s presidential candidates pretend they recognize the problem and plan to do something about it. But everybody in Washington knows that nobody’s going to make a meaningful effort to bring down deficits and stabilize the national debt until it becomes a crisis and there’s no other choice.

Sure, the politicians are craven, but the politicians also know that voters will punish them for making the hard choices that will be necessary to better align inflows and outflows. Everybody owns the debt follies.

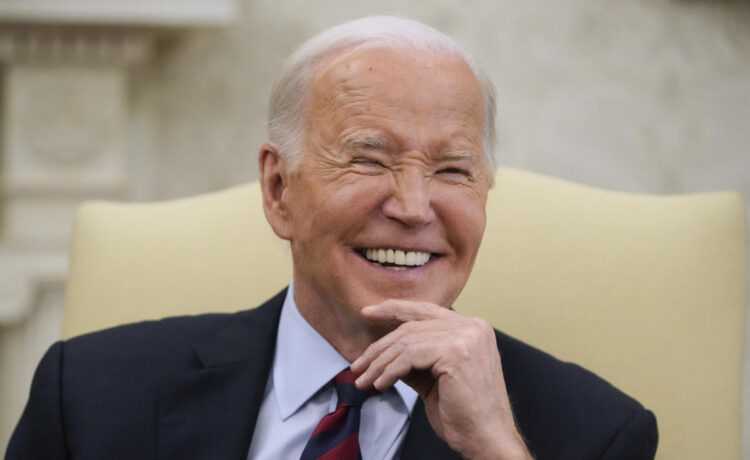

After the CBO released its latest numbers, the Biden administration attacked Donald Trump’s presidential campaign for “plotting to grow the deficit even more.” Trump wants to keep all of the 2017 tax cuts in place while slightly lowering the corporate tax rate. That’s the scenario where federal revenue comes in at least $4 trillion worse than the CBO forecast through 2034.

Biden’s plan is to let all the tax cuts expire except for workers with less than $400,000 in income. He’d also raise the corporate tax rate from 21% to 28% and impose some other taxes on wealthy filers. Biden’s tax plan would, in fact, improve the budget situation by raising about $3.5 trillion in new revenue, according to the Tax Foundation.

But Biden backed roughly the same plan when he ran for president in 2020, and he couldn’t get any of it done, even in 2021 and 2022, when his fellow Democrats controlled both houses of Congress. Republicans took control of the House in 2022 and there’s a good chance they’ll gain the Senate in this year’s elections. So Biden can tout a plan to bring in more federal revenue knowing there’s scant chance it will happen, even if he gets reelected.

Plus, Biden’s various efforts to cancel student debt have pushed the 2024 deficit up by about $150 billion this year, according to Capital Economics. Like most politicians, Biden pays lip service to debt reduction while pushing policies more likely to have a near-term impact and extend his long political career.

Donald Trump, for his part, has promised to pay off the whole national debt, and if you have a good sense of you humor you might still be laughing by the time you get to the bottom of this page.

When running for president the first time around in 2016, Trump said he was the “king of debt” and that, with such vast knowledge, he’d be able to pay off the national debt within eight years. While in office, however, “President Trump did not sign into law a single piece of legislation that reduced deficits,” according to the Committee for a Responsible Federal Budget.

Drop Rick Newman a note, follow him on Twitter, or sign up for his newsletter.

During Trump’s presidency, the national debt rose by more than $7 trillion. The Trump tax cuts of 2017 have added about $1.3 trillion to the national debt. COVID-relief bills Trump signed added $3.2 trillion.

Trump now says the way to reduce deficits is to dramatically cut spending, and he has a plan to do that without congressional approval. The only catch is that’s probably illegal, since the Constitution gives Congress alone the power to spend (and cancel spending). Even if Trump could do it, there’s almost no spending any president could unilaterally cut without generating an unholy uproar.

One of the biggest portions of the budget now goes to paying interest on Treasury securities. Any effort to trim those payments would amount to default and trigger a global financial shock. Other big categories of spending are Medicare and Social Security, which nobody is going to cut without getting shivved by the senior lobby. Then comes defense, which generates jobs and income in nearly every congressional district. Everything after that is small potatoes, and every small potato has a small-potato interest group sure to sue and agitate if Trump threatens their 0.001% of the federal budget pie.

Americans rightly wonder who’s to blame for all this borrowing and the lack of a coherent payback plan. The answer is everybody. CRFB provided analysis to Yahoo Finance earlier this year showing that Republicans and Democrats have added to the national debt more or less equally since 2000. Tax cuts and spending hikes have occurred under both parties. Same with war spending. As markets have absorbed massive amounts of US debt, Congress has approved more and more deficit spending, mainly because they can get away with it.

Voters say they want Washington to fix the problem, but almost nobody wants to be the one whose taxes rise or benefits take a hit. The whole nation is on a fiscal insanity kick.

Some future president will have to deal with the repercussions when financial markets can no longer absorb endless amounts of Treasurys, or the government’s ability to pay it all back comes into question. When that happens, there will be a painful readjustment. Until then, the mounting national debt will continue to be the biggest problem nobody wants to solve.

Rick Newman is a senior columnist for Yahoo Finance. Follow him on Twitter at @rickjnewman.

Read the latest financial and business news from Yahoo Finance