The Indian rupee started near a fresh record low against the US dollar, tracking weak Asian currencies

The rupee started near a fresh record low against the US dollar, tracking weak Asian currencies amid expectations of a less hawkish Federal Reserve.

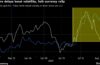

The home currency hit a fresh record low of 83.40 against the greenback. At 9.10am, the rupee was trading at 83.38 a dollar, down 0.02 percent from its previous close.

Despite the Nifty hitting new highs, the rupee trades near its all-time low largely because of restrained RBI intervention caused by a five-year low liquidity. Robust demand for dollars from importers and a widening trade deficit have kept the rupee in a limited range of 83.00-83.40, traders said.

The increasing likelihood of a Fed rate cut, expected strong inflows, a decrease in inflation to 4.87 percent, and the resilient stance of the rupee offer some positive outlook, though, traders said.

Key economic data from around the world also contributed to the sentiment. Eyes were on the Reserve Bank of Australia meeting, anticipated to maintain interest rates at 4.35 percent. Caution prevailed ahead of crucial nonfarm payroll data this Friday, expected to offer insights into the labor market.

Globally, equity markets declined as a recent rally eased. Although expectations persisted that the Fed was done raising interest rates, uncertainty about rate cuts in 2024 prompted investor hesitation.

Asian currencies were trading weaker. The South Korean won fell 0.72 percent, Taiwan dollar 0.31 percent, Indonesian rupiah 0.3 percent, Malaysian ringgit 0.18 percent, Thai Baht 0.15 percent, Philippines peso 0.11 percent, while Singapore dollar and China renminbi lost 0.04 percent each.

The dollar index, which measures the US currency’s strength against major currencies, was trading at 103.655, down 0.06 percent from its previous close of 103.71.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!