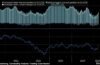

Many investors have an aversion to market volatility and seek a more stable investment experience. Hence, diversifying across various asset classes becomes important. This is primarily because different asset classes exhibit their own cycles, and predicting their ups and downs is inherently challenging.

As financial advisors, we encourage investors to not fall for the “flavour of the season asset class” syndrome in their investment decisions and, instead follow a balanced asset allocation strategy for their portfolio. Which is where multi asset mutual funds fit in and offer the best bet for investors, given that a correction in equity markets may be closer than it appears.

Multi asset funds are hybrid funds and SEBI mandates that they need to invest a minimum of 10% of their corpus in a minimum of three asset classes. These could be a mix of equities (domestic and international), debt, and commodities. Here is where there is a catch. For diversification to work well, there needs to be substantial allocation in all constituting asset classes and it must be held constant irrespective of market volatilities.

These funds also offer attractive returns, with some notable performers in the Multi-Asset category over the past year. Nippon India Multi Asset Fund stands out with an impressive 15.72% return, followed closely by Motilal Oswal at 13.85%, and HDFC Multi Asset Fund at 13.74%. Tata Multi Asset Fund has also delivered commendable results, achieving a return of 12.71%. These figures highlight the potential for favorable returns within the Multi-Asset investment landscape.

HOwever, it is always advisable to conduct thorough research in alignment with your wealth goals. Therefore, to get the best returns from a multi asset fund, investors should keep these 3 factors in mind.

The first is the definition of the fund itself. To get the best returns from each asset class, ensure the fund is true to the label and does not tweak the asset allocation mix. Take the example of the Nippon India Multi Asset Fund, where the asset allocation mix of 50:20:15:15 across domestic equity, overseas equity, commodities and debt have never changed. Such a disciplined investment approach ensures investors always stand to gain.

The second is to choose a fund which has an exposure to international equity as well. Some examples like Nippon Multi Asset Fund, Sundaram, Invesco and Axis invest in global markets.

The third advantage of investing in a multi asset fund can bring in is the indexation benefits investors get. Indexation helps you get more from the fund since the value of investment is calculated keeping factors like inflation in mind and get you more gains.

Disclaimer

Views expressed above are the author’s own.

END OF ARTICLE