December 11 – Rising renewable energy capacity and the deployment of electric vehicles will make energy storage the priority technology for energy transition investments in the coming years, according to the 2023 Reuters Events Energy Transition Insights report.

Batteries are spearheading growth in energy storage but a wider range of technology types will be deployed commercially in the coming years.

The report’s conclusions were formed from an online survey of more than 580 energy industry professionals in Q1 2023. Over half of the respondents’ companies (58%) had oil and gas operations while 36% had renewable energy development activities and 31% had utility operations. Some 28% of the companies had revenues of between $251 million and $5 billion and a further 17% were from organisations with revenues exceeding $5 billion.

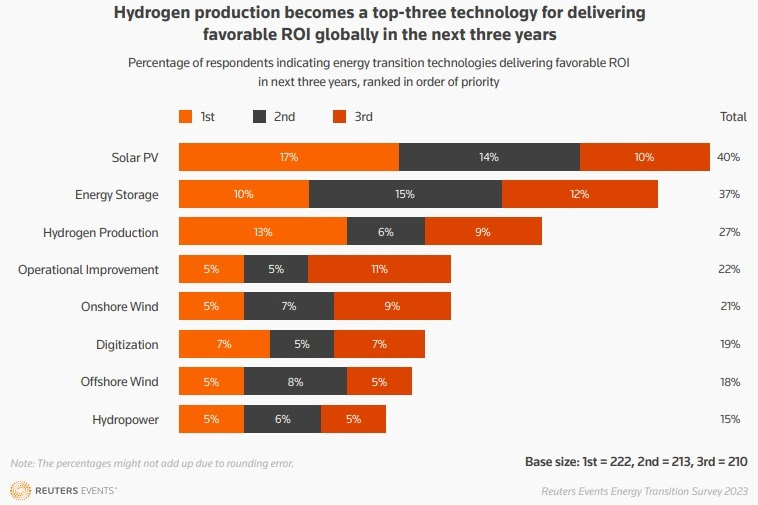

Solar has reigned as the most popular energy transition investment case over the last 12 months, followed by operational improvements, energy storage, hydrogen production and grid infrastructure, the survey showed.

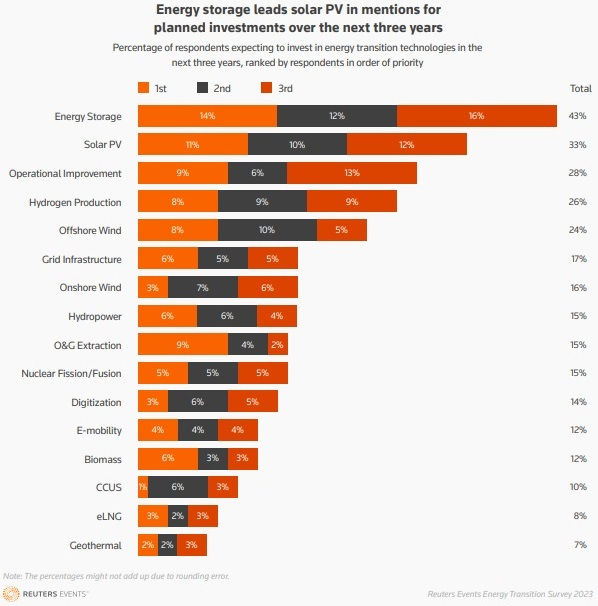

Energy storage will become the priority technology in 2024-2026, the data shows, with 43% of respondents stating that their organisation planned to invest in the technology within the next three years.

Source: Reuters Events Energy Transition Insights Report Acquire Licensing Rights

The report also shows offshore wind will become more of a priority technology in the next few years. Some 24% of respondents plan to invest in offshore wind technology by 2026, compared with 14% of respondents investing in offshore wind in the past 12 months.

Most of the survey respondents were in leadership, senior management or mid-management positions and nearly two-thirds (62%) of their organisations operate in North America while 41% operate in Europe, 25% in Asia and 22% in Central and South America.

A growing number of stakeholders regard hydrogen production as a favourable return on investment (ROI), although not all of these currently plan to invest in this technology class, the data shows.

Source: Reuters Events Energy Transition Insights Report Acquire Licensing Rights

Investment sentiment in oil and gas extraction and carbon capture, utilisation and storage (CCUS) is expected to change little in the coming years.

The full report, which includes more detail on energy transition investment trends and their impact on energy companies, can be accessed here.

Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. Reuters Events, a part of Reuters Professional, is owned by Thomson Reuters and operates independently of Reuters News.