The global securities finance industry has faced a 16 per cent year-over-year (YoY) decline in revenue in the second quarter of 2024, generating US$2.53 billion for lenders, according to DataLend.

In June, the industry generated US$790 million for lenders, representing an 11 per cent fall from the previous year.

Broker-to-broker activity for the month totalled an additional US$207 million in revenue for June, also leading to an 11 per cent decrease YoY.

For Q2 2024, DataLend reports that global broker-to-broker activity, where broker-dealers lend and borrow securities from each other, produced an additional US$696 million in revenue, a 9 per cent decline YoY.

Regionally, equity revenue was down 33 per cent in Europe, the Middle East, and Africa (EMEA) and 19 per cent in North America, compared to the same period last year.

A 22 per cent decline in fees in North America and a 23 per cent dip in EMEA accounted for the majority of the decreased revenue, says the market data service of fintech EquiLend.

On the other hand, equity revenue in Asia Pacific increased by 8 per cent due to a 13 per cent increase in fees.

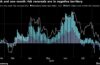

Global fixed income performance declined 11 per cent YoY in Q2.

While revenue from government securities was “roughly flat”, corporate debt revenue fell by 32 per cent — a regression of a trend which saw corporate bonds “running hot” through much of 2022 and 2023, reports DataLend.

The top five earning securities in June 2024 were Lucid Group (LCID US), Trump Media & Technology Group (DJT US), Canopy Growth Corporation NPV (CGC US & WEED CN), Beyond Meat Inc. (BYND US) and ImmunityBio Inc. (IBRX US).

In total, the five securities generated US$56 million in revenue for the month.