(Bloomberg) — Stocks kicked off the week on a cautious note, with traders refraining from big bets ahead of key economic data and meetings from major central banks that will test the market’s optimism on rate cuts in 2024.

Most Read from Bloomberg

Wall Street is about to get a sense on whether the disinflation trend is continuing, with the consumer price index due Tuesday. The report will be released a day before the last scheduled Federal Reserve decision of 2023, with officials widely expected to hold rates and announce their Summary of Economic Projections. The question is whether the Fed will try to temper policy easing expectations after investors aggressive dovish repricing.

“A lackluster start to the week, but there’s so much to come over the next few days — which could determine how markets end the year and start 2024,” said Craig Erlam at Oanda. “The Fed decision on Wednesday is unlikely to be controversial, but the forecasts, dot plot and press conference that accompany it may well be.”

To Greg Marcus at UBS Private Wealth Management, the recent strength in stocks is largely based on expectations of a soft landing and rates coming down in 2024. The Fed will likely cut rates next year, but that may be because the economy is slowing, in which case markets would look different than they do now, Marcus added.

The S&P 500 held above 4,600, while the tech-heavy Nasdaq 100 outperformed. Treasury 10-year yields were little changed at 4.23%. The dollar fluctuated. Bitcoin tumbled 7.5% to below $41,000, following a rally of more than 150% this year.

A survey conducted by 22V Research shows 46% of the investors polled think the market reaction to CPI will be mixed or negligible, 28% are betting on a “risk-off” event and only 26% see a “risk-on” response.

US consumers’ near-term inflation expectations dropped in November to the lowest level since April 2021, according to a Fed Bank of New York survey released Monday.

Growing speculation that the Fed is done hiking rates and will start easing by mid-2024 recently fueled a sharp drop in Treasury yields while rekindling investors’ risk appetite. The S&P 500 has added roughly $4 trillion in market value since late October.

That said, a closer look reveals investor concerns about the week ahead, with a measure of expected equity volatility showing expectations of more pronounced swings in coming days. At one point last week, the gap reached the widest since March for such a period — signaling rising demand to hedge against turbulence.

To Matthew Weller at Forex.com and City Index, some investors might expect the potential for some volatility around the CPI data, but with the Fed seemingly committed to leaving rates higher for longer, we may not see as much movement as we have around past reports.

“Ultimately, regardless of what this week’s US inflation report shows, Jerome Powell and company will want to see at least a few more months of job and inflation data before tweaking the current monetary policy settings,” he noted.

As the market adjusts to the Fed potentially holding rates higher for longer, Alexandra Wilson-Elizondo at Goldman Sachs Asset Management, said that any pullback under that premise would be deemed a head fake, with prices moving in one direction before quickly reversing.

“If the market trades down, it is a good opportunity to rebalance or buy the dip” she noted. “It’s too early to be underweighting the risk premium of equities.”

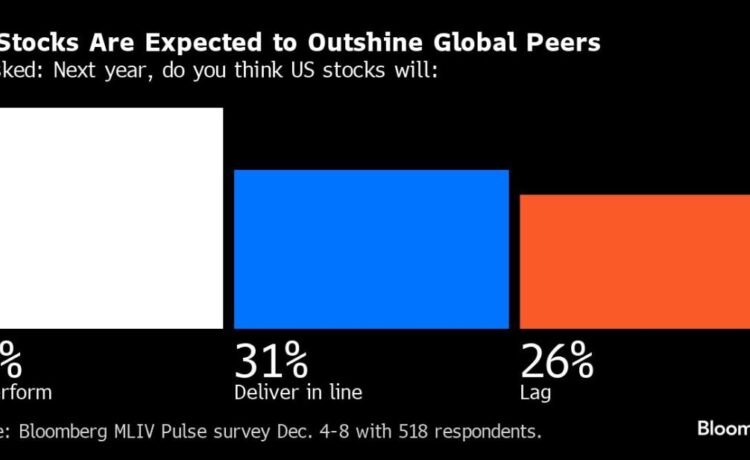

The S&P 500 will hit a record high in 2024 as the US avoids sinking into a recession, although a weaker consumer will mean the index gains less than this year’s 20% surge, according to Bloomberg’s latest Markets Live Pulse survey.

A median of 518 respondents expect the S&P 500 to climb to 4,808 points next year — topping its previous closing peak of 4,797 hit in January 2022 — and the 10-year Treasury yield to drop to 3.8% from this year’s high of 5%. More than two thirds of respondents indicated they don’t see a hard economic landing as the top risk to markets and majority expects Fed interest rate cuts to begin before July.

One of Wall Street’s biggest bulls estimates that the S&P 500 will hit 5,200 points next year to set a fresh record.

“We look for 2024 to be a year of transition as markets navigate what we expect will be the Fed’s pivot from a restrictive monetary policy setting to an easier stance,” Oppenheimer Asset Management chief strategist John Stoltzfus said.

The S&P 500 is likely to hit a record high next year, underpinned by “consistent” sector-level earnings growth and a broadening of the rally beyond mega cap tech stocks, according to Citigroup Inc.’s Scott Chronert, who expects the gauge to finish 2024 around 5,100 points.

To David Kostin at Goldman Sachs Group Inc., US growth stocks will outperform value peers next year as economic growth remains modest and rates do not rise much further.

US company earnings are likely to weaken in the fourth quarter before a rebound in 2024, Morgan Stanley’s Michael Wilson said. The strategist highlights a “steep downward revision” to consensus fourth-quarter estimates, and adds that he is less optimistic than other strategists about the magnitude of margin expansion next year.

Elsewhere, natural gas futures plunged the most in nine months as forecasts shifted warmer for the US into early next year, signaling lackluster demand as production hits fresh records. Oil steadied after concerns that supplies are overtaking demand triggered the longest weekly losing streak in five years.

Bank of Japan officials see little need to rush into scrapping the world’s last negative interest rate this month as they have yet to see enough evidence of wage growth that would support sustainable inflation, according to people familiar with the matter.

Corporate Highlights:

-

Macy’s Inc. received a $5.8 billion buyout offer from Arkhouse Management and Brigade Capital Management, a wager that the venerable retailer can execute its turnaround better as a private firm.

-

Advance Auto Parts Inc., whose sales and share price has lagged its peers, should proceed with its divestiture of WorldPac stores to generate $2 billion to $3 billion, according to activist investor Legion Partners Asset Management.

-

Cigna Group walking away from talks with Humana Inc. put an early end to what would have been one of the biggest deals of the decade.

-

Occidental Petroleum Corp. agreed to acquire Texas shale driller CrownRock LP in a cash-and-stock deal valued at about $10.8 billion as consolidation heats up in North America’s most-prolific oil basin.

-

Apple Inc.’s price target was raised to $250 from $240 at Wedbush, which sees strong growth potential for the iPhone maker.

-

Nike Inc. was upgraded at Citigroup Inc. which cited an attractive margin recovery play within “a choppy macro.”

-

BlackBerry Ltd. will no longer spin off its its internet-of-things business, a reversal from a previously announced turnaround plan.

-

DoorDash Inc. and MongoDB Inc. are set to be added to the Nasdaq 100, among other names. The changes will take effect prior to market open on Dec. 18.

-

Manulife Financial Corp. agreed to reinsure C$13 billion ($10 billion) of reserves with KKR & Co.’s Global Atlantic Financial Group and its partners in a deal the company said is the largest long-term care reinsurance transaction in the industry’s history.

Key events this week:

-

Japan PPI, Tuesday

-

Germany ZEW survey expectations, Tuesday

-

UK jobless claims, unemployment, Tuesday

-

US CPI, Tuesday

-

Reserve Bank of Australia Governor Michele Bullock speaks at AusPayNet Summit in Sydney, Tuesday

-

Eurozone industrial production, Wednesday

-

US PPI, Wednesday

-

Federal Reserve policy meeting and news conference with Chair Jerome Powell, Wednesday

-

European Central Bank policy meeting followed by news conference with ECB President Christine Lagarde, Thursday

-

Bank of England policy meeting, Thursday

-

Swiss National Bank policy meeting, Thursday

-

US initial jobless claims, retail sales, business inventories, Thursday

-

China 1-yr MLF rate and volume, property prices, retail sales, industrial production, jobless rate, Friday

-

Eurozone S&P Global Manufacturing PMI, S&P Global Services PMI, Friday

-

US industrial production, Empire manufacturing, cross-border investment, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 rose 0.3% as of 2:33 p.m. New York time

-

The Nasdaq 100 rose 0.8%

-

The Dow Jones Industrial Average rose 0.3%

-

The MSCI World index rose 0.3%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.1%

-

The euro was little changed at $1.0766

-

The British pound rose 0.1% to $1.2564

-

The Japanese yen fell 0.8% to 146.10 per dollar

Cryptocurrencies

-

Bitcoin fell 7.5% to $40,534.09

-

Ether fell 7.9% to $2,173.95

Bonds

-

The yield on 10-year Treasuries was little changed at 4.23%

-

Germany’s 10-year yield was little changed at 2.27%

-

Britain’s 10-year yield advanced four basis points to 4.08%

Commodities

-

West Texas Intermediate crude rose 0.1% to $71.33 a barrel

-

Spot gold fell 1.2% to $1,981.53 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Emily Graffeo, Sunil Jagtiani, Farah Elbahrawy, Sagarika Jaisinghani, Kasia Klimasinska, Jessica Menton, Elena Popina and Carly Wanna.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.