The FTSE 100 (^FTSE) and European stocks were in positive territory on Friday amid a strengthening pound and growing bets for a September rate cut from the Federal Reserve. Sterling hovered around a one-year high after stronger-than-expected GDP data on Thursday, which showed that the British economy expanded 0.4% in May.

It came along separate data which revealed US inflation came in lower than expected last month, falling to an annual rate of 3%, down from 3.3% in May. This has boosted hopes for a September interest rate cut, driving the dollar lower.

The pound hit a peak of $1.2947 against the US greenback on Thursday, the highest level since late July 2023. It is now approaching the $1.30 mark.

It has also been boosted by hawkish comments from the Bank of England’s chief economist this week.

Huw Pill said recent economic data pointed towards some “upside risks to my assessment of inflation persistence,” suggesting that he is not yet convinced by the case for an August interest rate cut.

-

London’s benchmark index was 0.3% higher in afternoon trade

-

Germany’s DAX (^GDAXI) rose 0.4% and the CAC (^FCHI) in Paris headed 0.7% into the green

-

The pan-European STOXX 600 (^STOXX) was up 0.4%

-

Wall Street is set for a muted open as S&P 500 futures (ES=F), Dow futures (YM=F) and Nasdaq futures (NQ=F) were all fairly subdued

-

The pound hovered near its one-year high against the US dollar (GBPUSD=X) at 1.2960, up 0.4% on the day

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, said: “Combined with rising hawkish voices at the Bank of England, waning political risks and softening US dollar, we could see cable make an attempt on the $1.30 level. But the fact that the BoE hawks cry louder doesn’t mean that the doves are not around…”

Follow along for live updates throughout the day:

Live15 updates

-

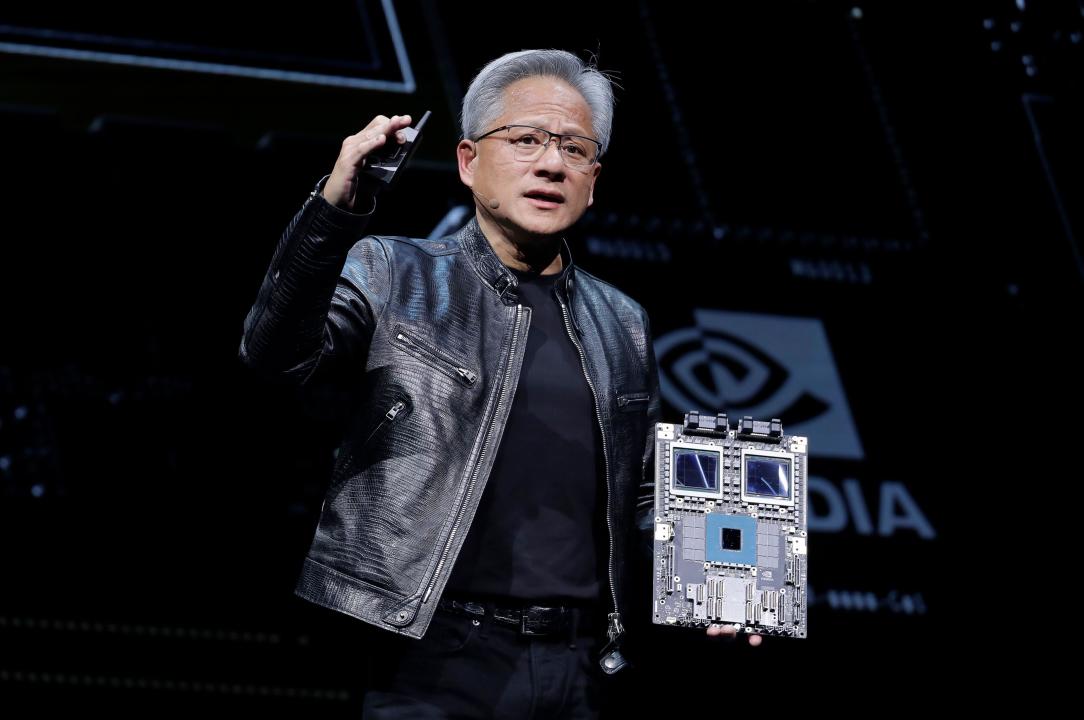

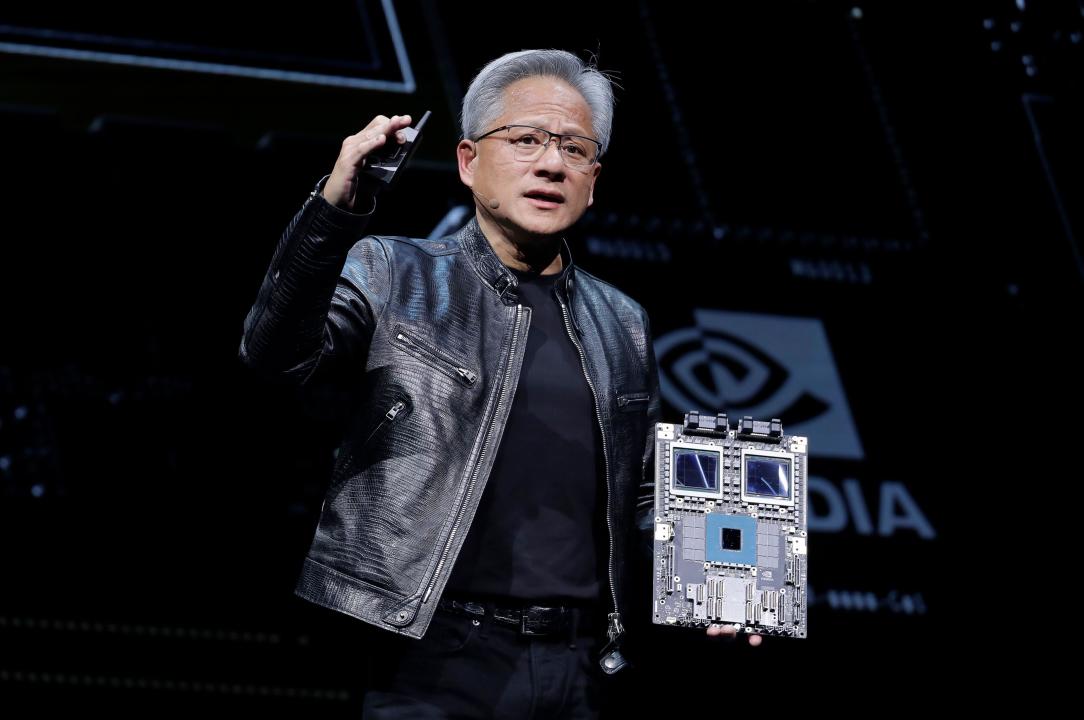

Nvidia falls as investors shift to interest rate-sensitive stocks

FILE – President and CEO of Nvidia Corporation Jensen Huang delivers a speech during the Computex 2024 exhibition in Taipei, Taiwan, June 2, 2024. A rebound for Nvidia on Tuesday, June 25, 2024, is helping keep U.S. indexes close to their records Tuesday. (AP Photo/Chiang Ying-ying) (Chiang Ying-ying, Associated Press) Nvidia (NVDA) lost almost 6% in the last session and was 1% lower in pre-market trading after a “sell the news” reaction to the latest inflation figures appeared to drag on the chip maker.

Investors flocked to interest rate-sensitive stocks after the consumer price index report showed inflation fell last month for the first time since May 2020, raising the prospects of Federal Reserve rate cuts this year.

NVDA stock closed the latest trading session at a valuation of $134.91 after adding 2.68% and 10.92% in the previous five trading days.

Tech heavyweights Meta (META), Apple (AAPL), Microsoft (MSFT), and Alphabet (GOOGL) all fell more than 1%.

In 2023, the AI stock had a huge 239% run and it’s up around 159% so far this year, even after the recent drop.

-

Best UK savings accounts offering above inflation rates

UK households are always looking for ways to make their money go further amid the cost of living crisis and savings accounts can help.

After years of low rates, high-yield savings accounts are having a moment as the Bank of England has kept interest rates at a 16-year high of 5.25%. While homeowners face higher mortgages, there is a silver lining in higher borrowing costs and consumers can now find UK savings accounts offering higher than inflation rates.

The UK rate of inflation came in at 2% in May for the first time in nearly three years, according to figures from the Office for National Statistics (ONS).

Savers should shop around to find the best deals and check what rate they are on – as they could still be sitting on a product that does not beat inflation.

The main factor you should be aware of when choosing a savings account is the difference between easy-access and fixed-term.

Easy-access accounts allow you to access your money when you need it. Fixed-term, as the name implies, are accounts where you can’t access your cash for the duration of the deal. They usually offer better rates, but you must be comfortable with not touching your savings for a long period, usually between one and five years.

-

Unilever to cut up to 3,200 jobs in Europe

Unilever is looking to cut as many as 3,200 jobs by the end of next year as part of a major global restructure announced in March.

This represents a third of all office roles in Europe. The company employs between 10,000 and 11,000 office-based staff in Europe.

The company, which owns brands such as Marmite and Dove soap, has come under pressure from shareholders including activist investor Nelson Peltz.

It told senior executives about the planned cuts on Wednesday, according to details of a company-wide call shared with the Financial Times.

The job cuts are part of Unilever’s “productivity programme” announced in March that includes up to 7,500 job losses globally.

According to the FT, Constantina Tribou, a chief human resources officer, said:

“The expected net impact in roles in Europe between now and the end of 2025 is in the range of 3,000 to 3,200 roles.”

Earlier this year it announced plans earlier this year to sell its ice cream business.

-

Lidl to open later on Monday after Euros final

London, UK. 18th June 2024. A Lidl store in London. Campaigners from the animal welfare group Open Cages have claimed that their research has found antibiotic-resistant superbugs in more than half of chicken meat sold at Lidl supermarkets, as well as E. Coli. Credit: Vuk Valcic/Alamy Live News (Vuk Valcic) The supermarket chain Lidl, a sponsor of the Euros tournament, said it would open all its stores in England an hour later on Monday so workers could enjoy post-match celebrations.

Ryan McDonnell, the chief executive of Lidl in Great Britain, said:

“We know how much this game means to England fans and we want to ensure that our colleagues have the chance to celebrate such a significant moment in English football history.”

The game starts at 8pm and could last until 11pm if it goes to penalties.

-

How FTSE All-Share index listings are changing

The Financial Conduct Authority (FCA) has unveiled the biggest change to UK listing rules in 30 years, in a bid to stimulate growth after a slowdown in initial public offerings (IPOs).

It comes as a number of firms have shunned London in recent years, preferring to make their market debuts on the New York Stock Exchange or in other places across Europe.

According to the UK Listing Review, the number of listed companies in Britain has fallen by about 40% from a recent peak in 2008. Between 2015 and 2020, the UK accounted for only 5% of IPOs globally.

The FCA said the new regulations will better align UK stock market rules with wider international standards.

“A thriving capital market is vital in delivering investment to growing companies plus returns and choice to investors,” Sarah Pritchard, executive director for markets and international at the FCA, said.

“That’s why we are acting to make it more straightforward for those seeking to list in the UK while retaining vital protections so investors can help steer the businesses they co-own.

“Regulation is only part of the answer in helping the UK achieve sustainable growth. Other factors also play a significant role in influencing where a company decides to list.

“We’re committed to continually working together with all those who have a part to play in supporting a thriving UK capital market and thank everyone who has contributed to this work so far.”

-

Oil prices rise for third day

Oil prices climbed higher on Friday amid stronger demand and signs of easing inflationary pressures in the United States, the world’s biggest oil consumer.

Brent crude futures (BZ=F) rose by 51 cents, or 0.7%, to $85.91 a barrel while US West Texas intermediate crude futures climbed by 59 cents, or 0.7%, to $83.21 a barrel.

Both contracts also gained in the past two days, but Brent is poised for a drop of around 1% this week following four weekly gains.

US inflation cooled broadly in June to the slowest pace since 2021, boosting bets that the Fed will start to reduce borrowing costs this quarter. That followed data this week showing falling inventories at the storage hub of Cushing, Oklahoma, as well as a drop in US crude stockpiles.

Yeap Jung Rong, market strategist at IG, told Reuters:

Cooling US inflation numbers may support the case for the Fed to kickstart its policy easing process earlier rather than later, but it also adds to the series of downside surprises in US economic data, which points to a clear weakening of the US economy.

-

Swedish inflation hits lowest in three years

Inflation in Sweden fell to its lowest level in almost three years in June, increasing the odds of an interest rate cut in the county.

Consumer prices increased 2.6% last month, down from 3.7% in May, according to Statistics Sweden. It was the lowest reading of the consumer price index since September 2021.

The inflation measure used by Sweden’s central bank to guide monetary policy, which is adjusted for interest rates, fell to 1.3%, well below its 2% target.

It comes as the Riksbank left its main interest rate unchanged in late June at 3.75% after it made its first cut in eight years in May.

-

British chipmaker Graphcore bought by Japan’s SoftBank

Graphcore, a British chipmaker once seen as a potential competitor to Nvidia, has been bought by Japan’s SoftBank in a deal that secures the company’s future.

The Guardian has the details this morning…

The Bristol-based startup’s products are focused on artificial intelligence and it has been acquired by the powerful Japanese tech investor for an undisclosed sum. Last year, Graphcore warned that there was a “material uncertainty” over its survival and that it needed fresh funding by May 2024.

Peter Kyle, the secretary of state for science, innovation and technology, alluded to Graphcore’s problems as he backed the deal, saying it was a “welcome end to the uncertainty that has faced Graphcore and its employees”.

Graphcore is the latest UK tech company to be bought by SoftBank, which acquired the Cambridge-based chip designer Arm for £24bn in 2016.

SoftBank remains the biggest shareholder in Arm after its listing in New York last year. It also recently led a $1bn (£774m) investment in the British self-driving technology startup Wayve.

-

China’s imports knocked by weak demand

Imports to China unexpectedly declined in June amid weak demand, official figures have shown.

Imports dropped 2.3%, according to China’s customs department, reversing May’s 1.8% growth. Analysts were expecting a growth of 2.5%.

Meanwhile, exports rose sharply during the month, and overseas sales of products and services overseas surged 8.6%, up from 7.6pc in May. This was better than the 8% forecast.

Zhiwei Zhang, chief economist at Pinpoint Asset Management, said:

This reflects the economic condition in China, with weak domestic demand and strong production capacity relying on exports. The sustainability of strong exports is a major risk for China’s economy in the second half of the year.

-

Tesla slides on self-driving taxis delay

In this photo illustration, the Tesla logo is seen displayed on a smartphone screen and a computer screen displaying a portrait of Elon Musk, who is the owner of Tesla. The company recently lost clients due to Elon Musk’s right wing shift. (SOPA Images, SOPA Images Limited) Tesla (TSLA) shares were lower in pre-market trading after dropping over 8% during Thursday’s session as the company’s share of US electric vehicle sales slid below 50% for the first time.

Elon Musk’s group saw its share in the battery-run car market fall to 49.7% in the second quarter, down from 59% a year earlier, according to Cox Automotive, a car services and data group.

Investors were also spooked after Tesla said it was postponing its planned robotaxi unveiling to October to allow teams working on the project more time to build additional prototypes.

The delay has been communicated internally to Tesla employees but has yet to be announced publicly, Bloomberg reported.

In its last earnings report, Tesla said the robotaxi will be “purpose built”, which is a term used in the autonomous vehicle industry to describe vehicles built from the ground up to be self-driving and that often lack traditional controls like steering wheels and pedals.

-

Pound hovers near one-year high

Sterling hovered around a one-year high on Friday after stronger-than-expected GDP data on Thursday, which showed that the British economy expanded 0.4% in May.

It came alongside separate data which revealed US inflation came in lower than expected last month, falling to an annual rate of 3%, down from 3.3% in May. This has boosted hopes for a September interest rate cut, driving the dollar lower.

The pound hit a peak of $1.2947 against the US greenback on Thursday, the highest level since late July 2023. It is now approaching the $1.30 mark.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, said:

“Combined with rising hawkish voices at the Bank of England, waning political risks and softening US dollar, we could see cable make an attempt on the $1.30 level. But the fact that the BoE hawks cry louder doesn’t mean that the doves are not around…”

-

A big bank rally is about to be put to the test

Earnings season in the US will kick off with the big banks reporting before the bell today…

The stocks of big banks are outperforming the rest of the S&P 500 (^GSPC) this year, and that investor confidence is about to be put to the test.

JPMorgan Chase (JPM), Wells Fargo (WFC), and Citigroup (C) all report their second quarter results this Friday, kicking off another earnings season for the US banking industry. Bank of America (BAC) reports the following Tuesday.

The stocks of these banks — the four largest in the US — have each climbed more than 20% since January, outperforming the S&P 500. That performance is also roughly double the gains of an index that tracks the wider industry, the KBW Nasdaq Bank Index (^BKX).

Big bank investors are optimistic about the ability of the biggest financial institutions to thrive as the Federal Reserve slowly lowers interest rates, regulators water down a set of new bank capital rules, and Wall Street dealmaking stages a comeback.

-

Number of online jobs ads falls

A hiring sign is displayed at a restaurant in Arlington Heights, Ill., Friday, June 28, 2024. On Tuesday, July 2, 2024, the Labor Department reports on job openings and labor turnover for May. (AP Photo/Nam Y. Huh) (ASSOCIATED PRESS) New data released by the Office for National Statistics (ONS) has revealed that the number of online job adverts is significantly lower this month compared with July 2023 after a boom in activity during the early post-pandemic years.

This year there has been very little fluctuation in the number of online postings with many businesses taking a ‘wait and see’ approach with regards to their growth activity.

However volumes have remained fairly stable during the first half of this year.

Novo Constare, CEO and Co-founder of Indeed Flex, said:

“Employers are understandably reluctant to ramp up recruitment of permanent staff when there is still a lot of uncertainty surrounding the economy.

“Inflation has fallen to a far more manageable level of 2%, but interest rates remain high and are unlikely to come down drastically this year.

“Although there is the possibility of a modest rate cut by the Bank of England next month, some experts predict it is more likely to occur in the latter part of this year.

“Firms are therefore doing the sensible thing in taking a cautious approach to recruitment and this is why we’re not seeing dramatic changes in the number of online jobs ads.

“However, in the face of increased costs and stretched budgets, some businesses are turning to temporary staff to fill labour shortages, which is a viable and often cost-effective solution.

“Having a pool of reliable, committed and flexible staff to call on when needed is a major advantage for businesses still feeling the effects of a turbulent few years.”

-

Asia and US overnight

Stocks in Asia were mixed overnight with the Nikkei (^N225) slumping 2.5% on the day in Japan, while the Hang Seng (^HSI) jumped 2.6% in Hong Kong.

The Shanghai Composite (000001.SS) was flat by the end of the session after data showed that China’s exports increased 8.6% last month, beating market expectations.

It came as the yen swung between losses and gains in volatile trading after Tokyo was believed to have intervened in propping up the Japanese currency amid a cooler-than-expected US inflation report.

Moves in the yen against the dollar and other major currencies stole the spotlight on Friday as surged nearly 3% against the US greenback at one point after the release of the figures.

The dollar was last 0.1% higher at 159.10 yen, after rising more than 0.3% to an intraday high of 159.45 yen and falling 0.7% to a low of 157.75 yen in early trading. It ended the session with a 1.7% loss against the yen, its largest daily decline since May.

Across the pond on Wall Street, Big Tech shares spiralled downwards, as traders piled into smaller companies.

The Dow Jones (^DJI) rose just 0.1% to 39,753.75 while the S&P 500 (^GSPC) lost 0.9% to close at 5,584.54. The tech-heavy Nasdaq Composite (^IXIC) lost 2% during the session.

The Russell 2000 index of small cap US companies rose 3.6%, fuelled by expectations of interest rate cuts that would increase small cap profits.

The yield on benchmark 10-year US Treasury bonds fell to 4.21%, from 4.28% late on Wednesday.

-

Coming up…

Good morning, and welcome back to our live markets blog. As usual we will be taking a look at what’s moving markets and all that’s happening across the global economy.

Here’s a quick look at what’s on the agenda for today:

-

7am: Trading updates: Moonpig, Miton UK

-

7am: German Retail Sales

-

1.30pm: US producer prices for June

-

3pm: US Michigan consumer sentiment for July

-

Download the Yahoo Finance app, available for Apple and Android.