“To get the full restoration of the relationship, you need what we had during the boom period with mining capex, and that’s hard to see given that there aren’t the mineral resource opportunities that there used to be and there are environmental constraints around investing in some sectors,” he added.

Tim Baker, head of macro research at Deutsche Bank, is not as optimistic about China because iron ore prices do not reflect the true state of the Asian giant’s economy.

He noted that Australia’s trade balance was also softening. “LNG and iron ore volumes have barely grown over the past few years and iron ore is in outright decline,” he said. “That leaves Australia’s commodity export earnings completely at the mercy of commodity prices for the foreseeable future.”

“FX markets are sceptical on how long iron ore prices will remain elevated,” he said, adding that prices of the steelmaking ingredient might be driven by supply issues. “Currencies are much more interested in demand-side moods,” he said.

The view is shared by other currency pundits. “We need to get back into an environment where most of the volatility in commodity prices is driven by the demand side of the equation, rather than the supply side,” said Ray Attrill, head of FX strategy at National Australia Bank.

He said it was too premature to abandon the idea of $A’s strong correlation with commodity prices, predicting that China’s demand for resources next year will be “healthier” than it has been in the past 12 months.

Even so, he argues that the primary influence for the currency next year will remain US Federal Reserve policy and risk appetite. “They’re going to be the most significant drivers, at least for 2024, rather than what happens with commodity prices.”

Markets imply the US central bank will cut interest rates by more than a full percentage point in 2024, starting in May. The RBA is expected to keep the cash rate at 4.35 per cent until November 2024.

The $A is currently trading just under US66¢ and is forecast to remain under pressure until the Fed starts easing.

Deutsche Bank predicts it will ease to US64¢ mid-next year before bouncing to US70¢ by year-end. JPMorgan expects the $A to rise to US69¢ in 2024. Commonwealth Bank tips US66¢ by June and US72¢ by year-end, and NAB is the most bullish, forecasting US71¢ by mid-2024 and US73¢ by December.

“If Australia can deliver on its potential to become a ‘renewable energy superpower’, the price of hydrogen or its derivatives could become an important driver of the Australian dollar in coming decades,” said Joseph Capurso, head of international economics at CBA.

He noted that battery metals such as lithium and other minerals such as rare earths used in the manufacturing of sustainable assets could support the $A if Australia can develop its potential.

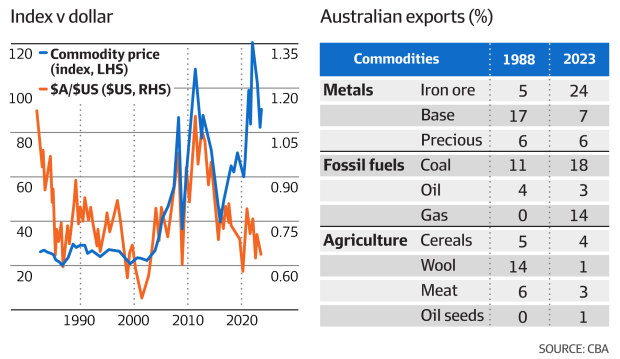

He highlighted that the composition of Australia’s key commodity exports earners had shifted from wool, base metals, and meat prices in the 1980s to iron ore today.

“In the next 40 years, maybe hydrogen will be big and other things, like fossil fuels, will be smaller,” said Mr Capurso.