The market’s rebound from 2022’s bear market wasn’t just unexpected. It’s also been bigger than expected. The S&P 500 is up a hefty 60% from that bear market low despite no clear signs at the time that such a recovery was brewing. The odds are good that you missed out on at least a piece of this current rally.

If that’s the case, don’t beat yourself up — you’re in good company. You’re also far from being in financial ruin. Although you can’t go back in time and recapture the missed opportunity, for long-term investors there’s much, much more potential upside ahead.

If you want to make sure you don’t miss out on the next big bull run, though, you might want to change your strategy just a bit. This time around, you might try buying fewer stocks and instead focus more on exchange-traded funds (or ETFs), which are often easier to stick with when things get rocky for the overall market.

On that note, here’s a closer look at three very different ETFs to consider buying that could — collectively — brilliantly round out your portfolio.

Start with the basics: Dividend growth

Most investors understandably prioritize growth, choosing growth stocks to meet this goal. And the strategy usually works out. What most true long-termers might not realize, however, is that they can achieve the same sort of net returns with boring dividend-paying stocks like those held within the Vanguard Dividend Appreciation ETF (NYSEMKT: VIG) which mirrors the S&P U.S. Dividend Growers Index.

Just as the name suggests, this Vanguard fund and its underlying index hold stocks that not only pay regular dividends but also have a track record of regular dividend increases. To be included in the S&P U.S. Dividend Growers Index, a company must have raised its dividend annually in a minimum of the past 10 years. In most cases, however, they’ve done so for far longer.

The ETF’s current dividend yield of just under 1.8% admittedly isn’t thrilling. In fact, it’s so low that investors might be wondering how this fund even comes close to keeping up with the broad market, let alone growth stocks. What’s largely being underestimated here is the sheer scope of these stocks’ dividend growth. Over the course of the past 10 years, its per-share payout has roughly doubled, and more than tripled from its payments 15 years ago.

The reason is that solid dividend-paying stocks generally do outperform their non-dividend-paying peers. Number-crunching performed by mutual fund company Hartford indicates that since 1973, S&P 500 stocks with a long history of dividend growth boast an average annual return of just over 10% versus a much more modest annual gain of 4.3% for non-dividend payers, and versus average yearly return of only 7.7% for an equal-weighted version of the S&P 500 index. The numbers confirm that there’s much to be said for reliable, consistent income.

Then add tech-driven capital appreciation

That being said, there’s no particular reason your portfolio can’t also own something a little more explosive than a dividend-oriented holding. If you can stomach the volatility that’s sure to continue, also take on a stake in the Invesco QQQ Trust (NASDAQ: QQQ).

This Invesco ETF (often referred to as the “cubes,” or the triple-Qs) is based on the Nasdaq-100 index. Generally speaking, this index consists of 100 of the Nasdaq Composite‘s largest non-financial listings at any given time. It’s updated every quarter, although there are circumstances of extreme imbalance that can prompt an unscheduled rebalancing of the index.

This in and of itself isn’t what makes this fund a must-have for many investors though. As it also happens, most of the highest-growth technology companies choose to list their stock via the Nasdaq Stock Exchange rather than other exchanges like the New York Stock Exchange or the American Stock Exchange. Names like Apple, Microsoft, and Nvidia aren’t just Nasdaq-listed tickers. They’re also this ETF’s top holdings, along with Amazon, Meta Platforms, and Google parent Alphabet. These of course are many of the market’s most rewarding stocks for the past several years.

This won’t always be the case. Just as companies like Nvidia and Apple pushed other names out of the index to make room for their stocks, these current top names could also eventually be displaced by other names (although it’s apt to be a while before that happens). That’s just the market’s proverbial circle of life.

This displacement, however, will most likely be done by and because of technology companies behind game-changing products and services. Holding a stake in the Invesco QQQ Trust is an easy, low-maintenance way to ensure you’re invested in at least most of their stocks at the ideal time.

Don’t forget about indexing, but try a different tack

Last but not least, although the triple-Qs and the Vanguard Dividend Appreciation fund are smart ways to diversify your long-term portfolio, the good ol’ indexing strategy still works, too. That is, rather than risk underperforming the market by trying to beat it, be happy with just matching the long-term performance of a broad market index.

Most investors will opt for something like the SPDR S&P 500 ETF Trust (NYSEMKT: SPY), which of course mirrors the S&P 500 large-cap index. And if you already own it, then great — stick with it.

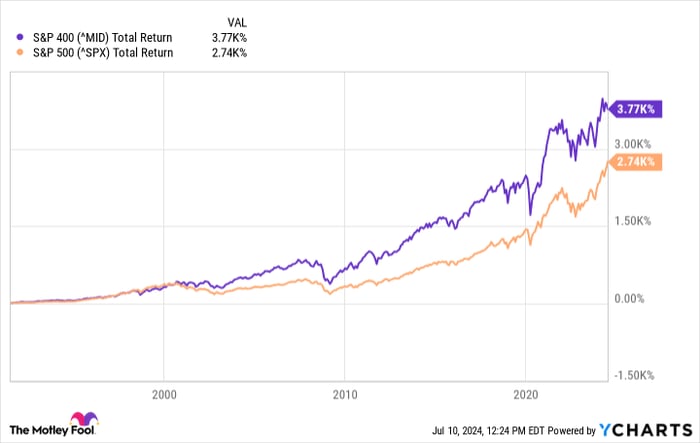

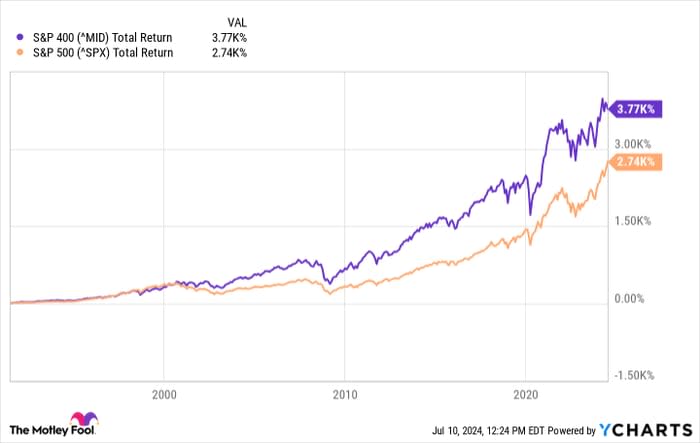

If and when you’ve got some idle cash to put to work though, consider stepping into a mid-cap fund like the iShares Core S&P Mid-Cap ETF (NYSEMKT: IJH) instead. Why? Because you’ll likely do better with this ETF than you will with large-cap index funds. Over the course of the past 30 years, the S&P 400 Mid-Cap Index has measurably outperformed the S&P 500.

The disparate degree of gains actually makes sense. See, while no one disputes the rock-solid foundations that most S&P 500 companies are built on, in many ways they’re victims of their own size — it’s difficult to get bigger when you’re already big. This is in contrast to the midsize companies that make up the S&P 400 Mid Cap Index. These organizations are past their challenging and wobbly early years, and just entering their high-growth eras. Not all of them will survive this phase, but companies like Advanced Micro Devices and Super Micro Computer that do survive end up being incredibly rewarding to their patient shareholders.

Should you invest $1,000 in iShares Trust – iShares Core S&P Mid-Cap ETF right now?

Before you buy stock in iShares Trust – iShares Core S&P Mid-Cap ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and iShares Trust – iShares Core S&P Mid-Cap ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 8, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. James Brumley has positions in Alphabet. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Vanguard Specialized Funds – Vanguard Dividend Appreciation ETF. The Motley Fool recommends Nasdaq and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.