However, existing SIPs and STPs will continue without any changes.

ICICI Prudential Mutual Fund’s decision affects several of its international schemes:

- ICICI Prudential US Bluechip Equity Fund

- ICICI Prudential Global Stable Equity Fund (FOF)

- ICICI Prudential Global Advantage Fund (FOF)

- ICICI Prudential Nasdaq 100 Index Fund

- ICICI Prudential Strategic Metal and Energy Equity Fund of Funds

Why the suspension?

ICICI Prudential is taking this step to manage its international investment capacity.

The Reserve Bank of India (RBI) has set a cap of $7 billion on investments in international entities through mutual funds.

There is also an additional $1 billion limit for Exchange-Traded Funds (ETFs).

In January 2022, SEBI halted new investments in international mutual funds to avoid exceeding these limits.

Although SEBI lifted this restriction in June 2022, mutual funds must still adhere to these caps.

ICICI Prudential will review the situation and might lift the suspension if there is more capacity available within the limits set by regulators.

Broader context

This suspension comes at a time when recent changes in the Budget 2024 have significantly altered the landscape for international funds.

Experts believe these changes will enhance the attractiveness of international funds.

Key highlights include:

Reinstatement of Indexation Benefits: The Budget has reinstated indexation benefits for international funds and Funds of Funds (FOF).

This will help investors lower their tax liabilities on long-term investments.

Adjustments in Long-Term Capital Gains Tax: The new rules specify that long-term capital gains tax will apply only if the funds are held for a minimum period.

For international funds, this period is now set at 24 months.

Nirav R Karkera, Head of Research at Fisdom, noted that the new 24-month threshold strikes a favourable balance.

“This will help investors to hold their investments longer to benefit from a more advantageous taxation regime,” he told CNBC-TV18.

Impact on International ETFs: International ETFs now qualify for long-term capital gains after just 12 months, compared to the 24-month period for FOFs.

This change is expected to boost investments in international ETFs and promote longer-term investing in global markets.

Why the suspension despite attractive changes?

Even though Budget 2024 has made international funds more appealing, ICICI Prudential’s suspension is necessary to adhere to regulatory caps on international investments.

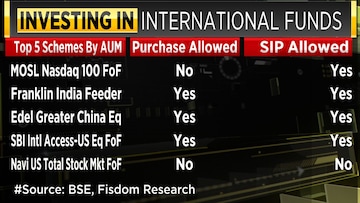

Performance of international funds

The growth in international funds has been notable.

In 2024, there are 63 international funds with assets under management (AUM) of ₹44,059 crore, up from 36 funds with an AUM of ₹13,143 crore in 2020.

This significant increase reflects growing investor interest and awareness.