An Aussie dad has revealed how he turned $82,000 into a $10.5m empire of 14 properties spread around the country thanks to some clever financing tricks.

Ryan Beck, 35, started investing in 2016 and now nets close to $250,000 a year in gross rent from his properties, which include investments in NSW, Queensland, Tasmania, SA, Victoria and WA.

The Yorkshire native, who arrived in the country shortly after finishing university in the early 2000s and works in marketing, said he benefited from having a clearly defined goal of what he wanted to achieve from the start.

This allowed him to think strategically about what properties he bought, where and how.

It also helped him develop savvy tactics that he used to buy properties without raiding his savings, while also avoiding excessive mortgage costs that would have otherwise drained his income.

Property investor Ryan Beck, with wife Erin, son York, and baby daughter Elle. Picture: supplied.

“In the beginning I wanted to create a passive income stream of $300,000 to support retirement, maybe even an early retirement,” Mr Beck said.

“I also just focused really hard on educating myself. I read about 30 different property investment books. I listened to podcasts. I tried to get as much information as I could.”

Mr Beck said his investment strategy was simple, but required a high risk appetite and the large knowledge base he attained from all his time spent studying investment.

He typically buys properties with subdivision potential, such as duplexes on one title. He then applies to the local council to split the property into smaller pieces that are worth more money.

From here, he refinances his original loans and draws out the equity he has created through the subdivisions to use as deposits for his subsequent purchases.

One of Mr Beck’s properties on the Sunshine Coast.

Mr Beck said a vital component to making this approach work was mixing his purchases with some high yielding properties where the rents were higher than the mortgage repayments.

This meant he was drawing little of his personal income to pay his debts and could continue to get new loans for subsequent properties.

In addition, many of his properties were purchased in high price growth locations. His rapid value gains improved the equity to debt ratio of his investments – improving his borrowing capacity further.

“Property investing is really a game of financing,” he said. “You go through layers of buying and have to find new ways to get loans and go to different tier lenders. I lean heavily on mortgage brokers for this.

“You need to present yourself well to the bank. I use a property profit and loss statement and work on cash flow forecasts. I treat the whole thing like a business.”

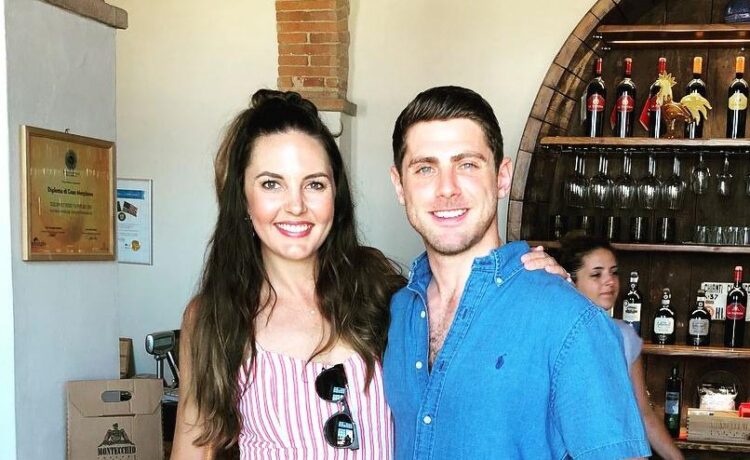

Property investor Ryan Beck with wife Erin.

Mr Beck’s investment approach is largely a copy and paste of his first property purchase: a dual occupancy property in Evanston Park in northern Adelaide.

He had seen the property advertised in a newspaper and saw an opportunity to make money from a subdivision.

After confirming with local council that the project would be possible, he bought the property for $400,000, using savings as the deposit. His upfront expenses, including the deposit, stamp duty and $20,000 subdivision costs, totalled $82,000.

The subdivision was completed in a few months and when Mr Beck had the property revalued he realised he had created about $260,000 in quick equity.

He used that equity to fund the upfront costs of his next purchase: duplexes in Armidale that he had retitled in 2017.

One of Mr Beck’s houses on Cambridge Street in Thornton in the Newcastle region.

It was another huge value generator and he used some of the equity to purchase a duplex development, this time in the Newcastle area. That project soon netted him $200,000 in quick equity.

Some of his recent purchases were properties in Perth, the Sunshine Coast, Armidale in regional NSW, Prospect in Tasmania and Melbourne suburb Southbank.

MORE:Train driver on $39k salary explains how we got 13 homes

Mr Beck said recent interest rate hikes have been manageable for him. “The rises have doubled my outgoings but that’s OK because I have sufficient cash flow in my portfolio to support that. I always sense check how things are going, if something needs to change, then I negotiate a lower rate with (the lender). I’ve done that three times in the last 12 months.”

The father of two, who now bides his time between Sydney and the Sunshine Coast, said the horse hadn’t bolted for the property market and it would be possible for a committed a rookie investor to replicate his success even in the current climate.

This property in Evanston Park, a suburb for Adelaide, was part of Mr Beck’s first purchase.

This Evanston Park property was the other half of his first purchase, which saw him make money from a subdivision.

“The hardest part is ignoring all the noise,” he said. “At the moment it’s all doom and gloom, but you have to understand the market moves in cycles and if you can still manage your own cash flow, there’s no reason to be reactive. And if you’ve bought right the property will go up in value.”

RYAN’S TIPS AND TACTICS

• Write down what you want to achieve. Define your goal before you start

• Get educated, learn as much about property investment as you can

• Find properties with dual occupancy. There’s more potential to add value and two sources of rent pay down the mortgage faster

• Continually refinance high performing properties and use the equity for deposits

• Buy a mix of high cash flow and high value growth properties to improve your borrowing capacity

• Be prepared to look outside your backyard. The best opportunities may be in other states

• Manage your properties like a business. Keep track of whether you can get better rates on existing loans by refinancing

• Buy counter-cyclically. Sometimes you get better deals in a falling market when other buyers are nervous