By David R. Guttery, RFC, RFS, CAM, President, Keystone Financial Group, Trussville

So far, this year has been a roller coaster of emotion and sentiment to say the least. At a high level, as I’ve mentioned in previous articles, I believe that we continue to emerge into economic Spring, from economic winter, and this kind of evolution doesn’t occur in a straight line. It evolves in fits, and starts, and periods of panic and optimism. In my opinion, the last four years, and even today, is like walking through a fun house of mirrors at the circus.

So far, this year has been a roller coaster of emotion and sentiment to say the least. At a high level, as I’ve mentioned in previous articles, I believe that we continue to emerge into economic Spring, from economic winter, and this kind of evolution doesn’t occur in a straight line. It evolves in fits, and starts, and periods of panic and optimism. In my opinion, the last four years, and even today, is like walking through a fun house of mirrors at the circus.

As I’ve evaluated economic data and other metrics, more often than not, I’m left with the impression that nothing is as it initially seems. There’s distortion, and we can’t be satisfied with superficial observations. We must look more deeply to decipher between that which is technical or fundamental as we evaluate opportunities, and threats.

To me, the activity that we’ve seen in the markets over the last month comes down to four things.

To me, the activity that we’ve seen in the markets over the last month comes down to four things.

First, the Magnificent Seven stocks retraced quite a bit of gain in the month of July. Second, economic concerns manifest in the unwinding of something called carry trade, and I’ll unpack that in greater detail. Third, it was the market’s largely pessimistic reaction to otherwise seasonally slow economic data, and lastly, all of the above at the same time as Chairman Powell hinted that accommodation could arrive as early as September. I believe that market participants may have construed this negatively as being necessary to stave off a recession. Remember, markets can worry about anything, at any time. It doesn’t mean that they’re always right.

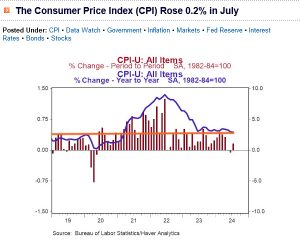

It’s interesting that at the beginning of the year, market participants were clamoring for as many as three rate cuts over the course of 2024. It was just two months ago that the fixed income market seemingly reversed course, and began to price into itself the thought of two rate hikes before the end of the year. On the 14th of August, we received fresh CPI data, and it showed a year over year change of 2.9%. As we’ve discussed in previous videos, the rate of inflationary change seems to be back to levels experienced prior to the pandemic.

So far this year, inflation just seemed stubbornly stuck at a 3 % level. The fear over the early summer was that the Federal Reserve might lose its patience, and offer a new series of excessive rate hikes in an effort to plunge through this 3% barrier, to achieve their target of a 2% rate of inflation. That thought stood in stark contrast to what the Federal Reserve was actually suggesting about their thought process, and what could lie ahead in the future.

So far this year, inflation just seemed stubbornly stuck at a 3 % level. The fear over the early summer was that the Federal Reserve might lose its patience, and offer a new series of excessive rate hikes in an effort to plunge through this 3% barrier, to achieve their target of a 2% rate of inflation. That thought stood in stark contrast to what the Federal Reserve was actually suggesting about their thought process, and what could lie ahead in the future.

Here we are in August, and once again we are pricing in the thought of potentially having three rate cuts before the end of the year.

What a roller coaster. We go from expecting three rate cuts, to two rate hikes, and now we’re back to three rate cuts. In my opinion, that alone demonstrates the degree by which we remain with nervous lemming mentality in the market.

Sure enough, at the end of last month, Chairman Powell suggested that easing could be in our near-term future, and market participants seemingly discerned from the Fed speak between the lines, that such accommodation could begin as early as September.

That has seemingly kicked off a new wave of concern that we may be headed into a recession, and this sudden departure from previous guidance could be the Fed tipping its hand, and implying that it knows more about impending economic doom than we may realize. In my opinion, the Federal Reserve has been transparent in their efforts to remove accommodation, and although this has been the most aggressive posture that we’ve seen since Paul Volcker, the Federal Reserve has none the less been very clear that further restriction would likely not be the next move. Again, markets can worry about anything at any time. It doesn’t mean that such worry is rational, or correct.

I’ve drawn reference to herds of nervous lemmings within previous articles. When a herd of nervous lemmings decides to evacuate toward the nearest body of water, the most-healthy course of action may be to at least outfit yourself with a life jacket. In my opinion, the data just does not justify the latest stampede.

I would remind everyone that in any given year, the economic data coming from the summer months is usually the slowest. We normally see a slowdown in hiring, and in production, and across other metrics as the vacation season reaches a peak, and for other seasonal reasons. Also remember that weather can have an impact in quarterly economic data. At the beginning of July, hurricane Beryl impacted nearly two thirds of the United States, as it swept into Texas and eventually made its way through the Midwest, and into the Northeast, bringing torrential rain.

Many economists have cited the economic impact that was felt by such a strong hurricane. To feign oblivion to this is just not rational.

In my opinion, there are many bullish indicators that would suggest that market participants should actually be responding in a different manner. So, what has negatively captivated the attention of the latest lemming stampede?

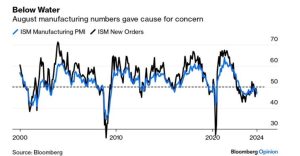

First, in my opinion, markets worried that a slight pull back in manufacturing activity over the summer, may be an indication that recession was on the horizon. Again, we normally see slower data over the summer months, and I think this is more rationally viewed as being nothing more than this.

First, in my opinion, markets worried that a slight pull back in manufacturing activity over the summer, may be an indication that recession was on the horizon. Again, we normally see slower data over the summer months, and I think this is more rationally viewed as being nothing more than this.

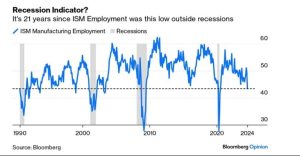

I also believe that participants viewed this glass is half empty headline from Bloomberg in a negative manner. Employment conditions seem to be  moderating toward a historical mean rather than improving. When I look at this chart however, I see that since 1990, when we’ve hit this mean line, we’ve bounced and employment conditions have recovered.

moderating toward a historical mean rather than improving. When I look at this chart however, I see that since 1990, when we’ve hit this mean line, we’ve bounced and employment conditions have recovered.

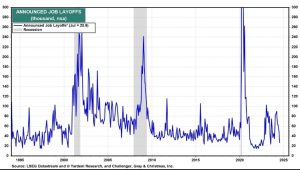

As rebuttal, I would offer this graphic that depicts announced job layoffs. We have seemingly experienced a sharp increase in announced job layoffs just as recessed economic conditions materialized going back to 1995. Look at where we are today on the far right of the chart. That  certainly doesn’t seem to be consistent with some new recession on the horizon.

certainly doesn’t seem to be consistent with some new recession on the horizon.

Last month, in July, the Federal Reserve Bank of Chicago released its financial conditions index. As you can see in the bottom chart, the financial conditions index continues to improve, and continues its upward movement from the bullish breakout indicated in November of last year. Markets as a result have seemingly paid attention to this metric as is evidenced by the top chart.

Over the last 30 days, I have seen no evidence that the financial conditions index has retreated or deteriorated from this positive momentum.

Over the last 30 days, I have seen no evidence that the financial conditions index has retreated or deteriorated from this positive momentum.

Credit spreads between corporate high-yield issues and treasury issues remain very tight. This too is considered a bullish indicator. Normally, investors demand higher yields from companies offering lower credits of quality. In this environment, as late as June of this year, there was a very thin margin between yields of lower credit quality issues, and higher credit quality issues, implying that fixed income market participants saw little economic concern to warrant higher yields from lower credit quality  issues. In my opinion, this can be construed as a positive referendum on economic conditions.

issues. In my opinion, this can be construed as a positive referendum on economic conditions.

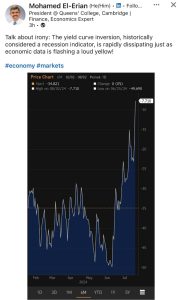

Anecdotally, over the years we have always heard that the bond market rarely gets it wrong. For this reason, we seem to pay much attention to the inversion of the yield curve as it pertains to being a predictor of an impending recession.

A brief primer on the inversion of the yield curve. This is the comparison of yields between two-year treasury issues and 10-year treasury issues. Remember, there is an inverse relationship between price and yield when it comes to bonds. The higher the price, the lower the yield. If you believe that a recession is on the horizon, then you are more inclined to sell two-year issues, resulting in lower prices, and higher yields. In such circumstances, issues of 10-year treasury debt are in greater demand, and therefore prices rise, and yields decline.

The result is a higher yield for the two-year issue, and a lower yield for the ten-year issue, thus giving you the inversion of the yield curve that we heard so much about.

Every recession that has ever been recorded was preceded by an inverted yield curve. This is why inversions get so much attention. Every time the yield curve has inverted however, we have not always had a recession. As a high-level rule of thumb, the longer the inversion, and the deeper the inversion, the worse the recession could possibly be.

At its deepest, the recent inversion of the yield curve stood at 108 basis points. As of Friday, the 2nd of August, the inversion stood at just under eight basis points.

In my opinion, this is a huge reversal, and you can see the degree by which it has occurred since the middle of June. There is only one way that the yield curve can reverse an inversion. There is more buying on the two-year issues, and more selling on the ten-year issues, thus leveling the yield curve inversion.

In my opinion, this is a huge reversal, and you can see the degree by which it has occurred since the middle of June. There is only one way that the yield curve can reverse an inversion. There is more buying on the two-year issues, and more selling on the ten-year issues, thus leveling the yield curve inversion.

In my opinion, this is clearly a bullish indicator, and suggesting that there is increasingly less concern about the possibility of a recession in the near term. Otherwise, why would there be such discernible buying in the two-year issues?

Have we had weaker than expected employment data? Yes, we have. Is the ISM Manufacturing index once again below 50? Yes, it is. Are weekly jobless claims stubbornly above 200,000 again? Yes, they are. Each of these points of data can be explained by seasonal weakness coming during the slowest quarter of the year, while coupled with weather anomalies.

Might we truly be on the precipice of a long and deep recession? Clearly, I can’t guarantee that were not, but as far as the data is concerned, I see no evidence of that. To me, this is like hearing your local weather forecaster suggesting that you should break out the winter coats, because we could potentially have 6 inches of snow, on 5th of August, in Alabama.

Again, welcome to my fun house of mirrors. You must look more deeply than just the surface to really get to the truth, and right now, that requires quite a bit of effort.

Lately, we’ve heard about something called “carry trade”. Carry trade at a high level is just a leverage and arbitrage trade. Bear in mind that we’re talking about institutional investors doing this with billions of dollars. This isn’t a strategy that the average individual could employ. I think this graphic depicts the concept pretty well.

We’re able to borrow dollars at a low rate of interest. Let’s say two percent. Those dollars are then used to buy Yen, where we’re paid a high interest rate. Let’s say that’s eight percent. The six percent difference is then used to purchase equities. The arbitrage between the two currencies is used to purchase equities, and recently, most of these purchases have been equities that have come to be known as The Magnificent Seven.

Well, if suddenly markets begin worrying about weakening economic conditions, and furthermore, accommodation by the Federal Reserve is more about an emergency reaction to stave off that recession instead of simply being a shift in policy, then you also begin to worry that the favorable metrics that supported the carry trade could diminish or reverse. If that happens, then you need to unwind the carry trade long positions.

Again, I think this is a mechanical and technical event that precipitated from the economic concerns that we just discussed. Interestingly enough, the carry trade concern that contributed to market volatility on the 5th of August, had nearly evaporated entirely by the end of that week. Again, welcome to my fun house of mirrors where things aren’t always as they seem. Markets can worry about whatever they want to, at any time. It’s not always rational, and when it’s not, it can create opportunities for those with the intestinal fortitude to leverage such times to their benefit.

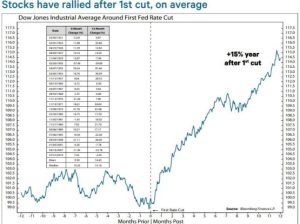

I have 103 years-worth of data that suggests that markets average again of 15% over the 12 months following the first easing, from a cycle of restriction.

I have 103 years-worth of data that suggests that markets average again of 15% over the 12 months following the first easing, from a cycle of restriction.

I have no idea if the Fed was merely hinting at the possibility of a rate cut in September. What I do know is that it hasn’t happened yet, so it remains in the windshield. Remember that the windshield is 35 times larger than the rearview mirror for reason. Where we are going is what is most important, and we haven’t received the first rate cut yet, and I can’t discount what 103 years-worth of previous anecdotal evidence tells us about what might happen next following that first rate cut.

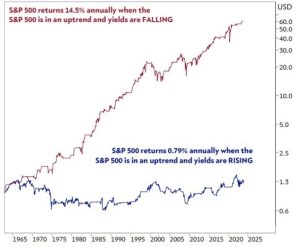

Furthermore, going back to 1965, I know that markets have averaged impressive gains during environments when bond yields were falling. Again, as referenced by the yield curve, that seems to be happening now. Frankly, it has been happening since October 2023.

Furthermore, going back to 1965, I know that markets have averaged impressive gains during environments when bond yields were falling. Again, as referenced by the yield curve, that seems to be happening now. Frankly, it has been happening since October 2023.

So why exactly are falling bond yields generally beneficial to the prices of equities? As interest rates and bond yields decline, the equity market looks to be an increasingly compelling place to seek growth and forward momentum.

Indeed, as late as July, there seem to be over $6 trillion that had been drawn to the sidelines as bond yields peaked. As referenced by the previous two graphics, those yields may be falling at the  present time, and if history is any indicator, the market could become increasingly attractive at these valuations to the cash that has built on the sidelines during the Covid crisis, and the economic aftermath that followed.

present time, and if history is any indicator, the market could become increasingly attractive at these valuations to the cash that has built on the sidelines during the Covid crisis, and the economic aftermath that followed.

When you couple this with other economic metrics, such as the University of Michigan’s consumer confidence survey, ISM manufacturing and services data, and industrial production, in my mind, a picture of economic summer begins to emerge.

Has consumer confidence risen this year? Yes, it has. Until just recently, the University of Michigan’s consumer sentiment survey stood at a level that we had not seen since prior to the Covid pandemic. This has translated into better-than-expected patterns of consumption behavior.

People who feel increasingly confident about their ability to consume, generally demonstrate increasingly better patterns of consumption. As data indicates over the first and second quarters of this year, that is happening.

It was just in mid-July, just four weeks ago, that the market was up 742 points on the day when we received this much better-than-expected indication of consumption patterns.

Why is this important, and why did the market respond so positively on 16th of July when we received this report? Because consumption is 70% of gross domestic product. To me, there seems to be a great disconnect between these most recent indications of consumption behavior, from just three weeks ago, and the current concern just three weeks later, that we may be on the precipice of a long and deep recession. Those two conclusions just don’t seem to exist in the same ZIP Code. I’m not sure how you can be wet and dry, at the same time.

In my opinion we continue to emerge into a warmer, early economic summer period of time, from the economic winter through which we have been over the last four years. Remember, this will happen over the course of fits and starts. Nothing ever evolves in a straight line. Along the way, we will have the metaphorical blackberry economic winter, where we have a cold snap in the middle of emerging into a warmer season.

Lastly, please bear in mind that all of this is happening under the specter of an election year. The sensationalism and the hyperbole are palpable. I find it interesting that when potential voters are asked for their opinions regarding the economy, and inflation, they are returning much more dire answers when it comes to the candidate for whom they will cast a vote.

However, when the University of Michigan calls and asks, do you have a job, can you get a job, do you believe that the job that you have will pay a higher income over the next 12 months, do you have a greater capacity to purchase today than you did 12 months ago, and similar questions, we are getting much more positive answers.

You absolutely must insulate yourself from the noise, and wade through the sensationalism and the hyperbole to get down to the data. Data is what it is. There is no distortion. You just have to approach the analysis of data with a stoic disposition, and without foregone conclusions. Then data can talk to you. When it does, you must then have the intestinal fortitude to listen, and do what it is telling you to do.

So, in conclusion, in my opinion I do not believe that we are on the precipice of a long and deep recession. I believe that the Federal Reserve has done exactly what they said they were going to do, since March 2022. This is particularly true since November 2022 when they adopted a more docile and data-driven approach to monetary policy.

I believe that the market is replete with attractive valuations, and now would be the time to critically evaluate the implementation of your financial plan with an eye toward where you will be one year from now, and five years from now, rather than five minutes from now. We must resist the temptation to join the stampede of lemmings. Rise above that, as we move from one economic season to the next.

(*) David R. Guttery, RFC, RFS, CAM, is a financial advisor, and has been in practice for 33 years, and is the President of Keystone Financial Group in Trussville. David offers products and services using the following business names: Keystone Financial Group – insurance and financial services | Ameritas Investment Company, LLC (AIC), Member FINRA / SIPC – securities and investments | Ameritas Advisory Services – investment advisory services. AIC and AAS are not affiliated with Keystone Financial Group. Information provided is gathered from sources believed to be reliable; however, we cannot guarantee their accuracy. This information should not be interpreted as a recommendation to buy or sell any security. Past performance is not an indicator of future results. Examples are for illustrative purposes only and should not be considered representative of any investment. Investments involve risks, including loss of principal.