“We’re going to see deviations in (predictions of) easing paths being priced over time and that should lead to increased volatility,” Monex Europe senior market analyst Nick Rees said.

Sterling’s current value, he added, reflected expected UK economic growth but had ignored the risk of the BoE cutting rates faster than markets predict right now.

Traders predict UK rates will be higher than in the U.S. in a year’s time. The BoE cut rates by 25 basis points on Aug. 1 to 5% and money markets price in a further 40 bps of cuts by year-end. The European Central Bank is expected to ease by 65 bps to 3% over the same period.

CARRY ON BUYING?

Traders are wary of sudden sell-offs of higher-interest rate currencies after this month’s implosion of an estimated $250 billion in so-called carry trades, where speculators borrowed Japanese yen to buy higher-return assets.

“This is a pennies in front of a steamroller trade,” Capital Economics head of FX markets Jonas Goltermann said, referring to investments that can generate small steady profits but come with the risk of sudden, catastrophic losses.

Debt funded carry trades generally prosper when markets are calm and can rapidly run into trouble when markets turn volatile or interest rate expectations change.

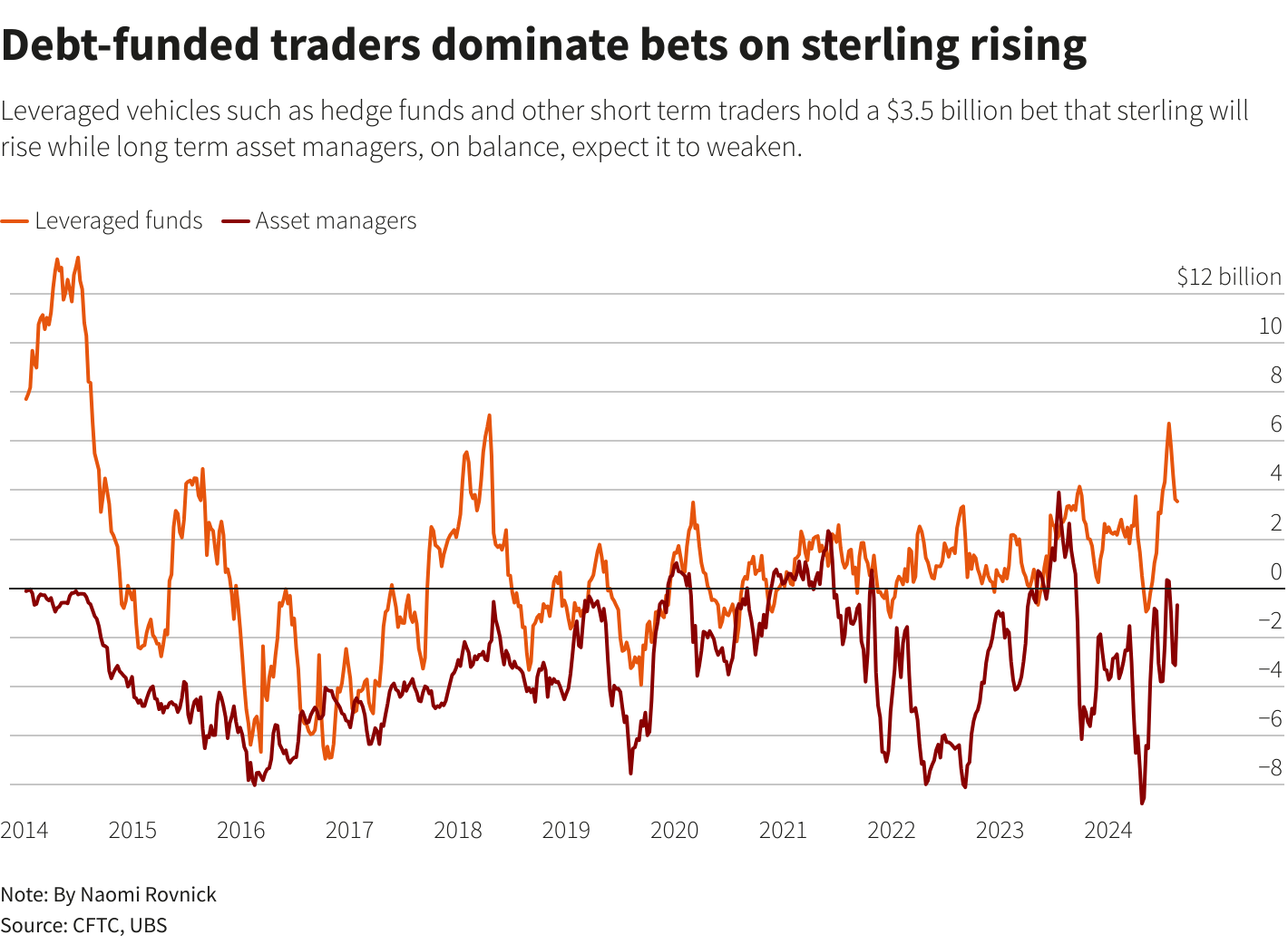

According to a UBS analysis of futures contracts, speculative traders using borrowed funds have dominated bets that sterling will appreciate against the dollar for more than a year, in a trade currently worth $3.5 billion.

Mainstream asset managers hold a $700 million net short position, the same data showed, suggesting that these longer term investors have a negative view on sterling overall.

RATE BETS

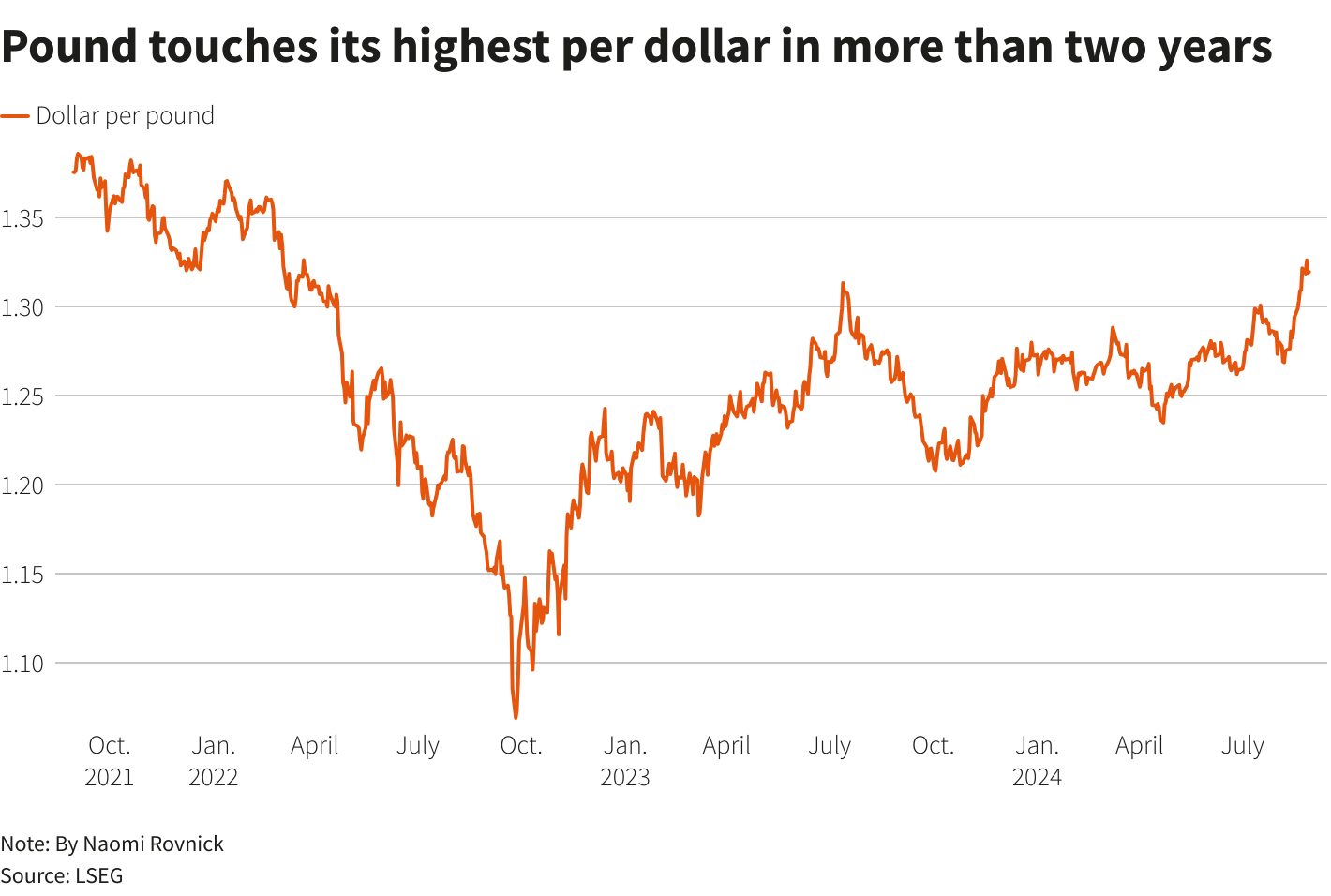

Sterling is almost 3% higher against the euro year-to-date and the best performing major currency against the dollar with a rise of 4%.

Still, the new government’s first Budget in October poses risks of spending cuts or tax rises that may keep Britain’s high national debt under control but could hurt growth.

“All the good news for the pound is now in the price, and seemingly none of the bad news,” Goltermann said.

Rob Wood, chief UK economist at Pantheon Macroeconomics, said the BoE keeping rates high could suppress the economy in the years ahead, potentially knocking the pound.

EDGY

UBS’s Head of G10 FX Strategy Shahab Jalinoos said foreign exchange markets remained tense after the early August yen shock and could become more so as November’s U.S. presidential election approaches.

Carry trades tend to prosper when markets are calm, making the pound vulnerable to future bouts of volatility, he said.

“But the positioning is not so enormous as to preclude the possibility of sterling recovering once the dust settles again.”

The pound’s performance against the dollar was probably also exaggerated by thin summer trading conditions, Monex’s Rees said.

If this perceived risk fades, sterling could weaken “pretty easily” to 86 pence per euro from around 84 pence currently, he said.

Sign up here.

Reporting by Naomi Rovnick; editing by Dhara Ranasinghe and Toby Chopra

Our Standards: The Thomson Reuters Trust Principles.