(Bloomberg) — European stocks and US futures were little changed as traders digested hotter-than-anticipated inflation in the US and readied for the earnings season to take off.

Most Read from Bloomberg

The Stoxx 600 index and contracts for the S&P 500 traded flat at the open, capping a week when US stocks hit yet another record high. Europe’s Stoxx 600 dipped. France’s 10-year bond yield fell after the government announced a budget that focused heavily on spending cuts and taxes to tackle a public debt pile.

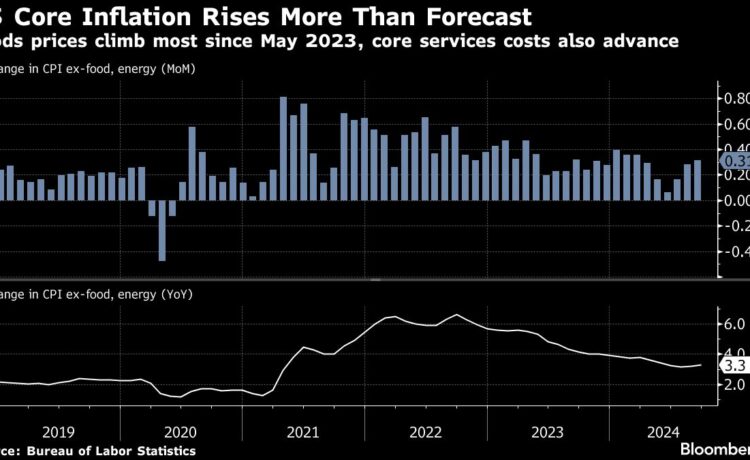

The higher-than-expected inflation print for September and rising unemployment benefits underscored the challenge facing the Federal Reserve, indicating stalling progress in the fight to bring prices to target. Investors will now be watching US September producer-price numbers on Friday for further indications about the Fed’s easing path.

“The Fed said the last mile getting toward their inflation target is going to be tough, and that is what we are seeing,” said David Donabedian at CIBC Private Wealth US. “But we still expect the Fed to cut rates by a quarter point in November, and likely a similar cut at the December meeting.”

Swaps market pricing indicating a potential Fed rate cut next month was little changed, with traders pricing in a roughly 80% chance that the Fed will cut by 25 basis point in November. That compared with a fully priced-in move prior to last week’s strong US jobs data.

Fed policymakers John Williams, Austan Goolsbee and Thomas Barkin were unfazed by the higher-than-forecast consumer price index, suggesting officials can continue lowering rates.

Investors are also gearing up for third-quarter earnings later Friday from JPMorgan Chase & Co., Wells Fargo & Co and Bank of New York Mellon Corp.

JPMorgan’s outlook for net interest income will be a major focus, after company executives tried to temper expectations for the key revenue source. As for Wells Fargo, investors may look for updates on its asset cap.

In China, the CSI 300 Index dropped 2.4% in afternoon trade as caution grows ahead of a key weekend briefing that may shed more light on Beijing’s fiscal stimulus. Investors and analysts expect Beijing to deploy as much as 2 trillion yuan ($283 billion) in fresh fiscal stimulus as authorities seek to boost growth and restore confidence.

Oil edged lower, trimming some of its gains from Thursday when West Texas Intermediate futures climbed 3.6% as traders awaited Israel’s response to Iran’s missile attack.

Key events this week:

-

JPMorgan, Wells Fargo kick off earnings season for the big Wall Street banks, Friday

-

US PPI, University of Michigan consumer sentiment, Friday

-

Fed’s Lorie Logan, Austan Goolsbee and Michelle Bowman speak, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 fell 0.2% as of 8:12 a.m. London time

-

S&P 500 futures were little changed

-

Nasdaq 100 futures were little changed

-

Futures on the Dow Jones Industrial Average were little changed

-

The MSCI Asia Pacific Index was little changed

-

The MSCI Emerging Markets Index rose 0.2%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0937

-

The Japanese yen fell 0.1% to 148.74 per dollar

-

The offshore yuan was little changed at 7.0802 per dollar

-

The British pound was little changed at $1.3050

Cryptocurrencies

-

Bitcoin rose 1.9% to $60,847.48

-

Ether rose 2% to $2,412.98

Bonds

-

The yield on 10-year Treasuries advanced one basis point to 4.07%

-

Germany’s 10-year yield was little changed at 2.26%

-

Britain’s 10-year yield declined one basis point to 4.20%

Commodities

-

Brent crude fell 1.2% to $78.42 a barrel

-

Spot gold rose 0.4% to $2,640.10 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Winnie Hsu, Natalia Kniazhevich and Richard Henderson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.