The biggest banks staged a broad Wall Street rebound in the third quarter, as corporate clients got more comfortable issuing new debt and pursuing mergers while some traders recorded one of their best quarters in years.

Goldman Sachs (GS) said Tuesday that its investment-banking fees were up 20% from the year-ago period. Bank of America reported its highest third-quarter trading revenue in more than a decade. And Citigroup‘s investment-banking fees were up 44%.

Executives at these banks are optimistic that the start of an interest rate-cutting cycle at the Federal Reserve — which last month reduced its benchmark rate by 50 basis points — will mean more deals in the near future.

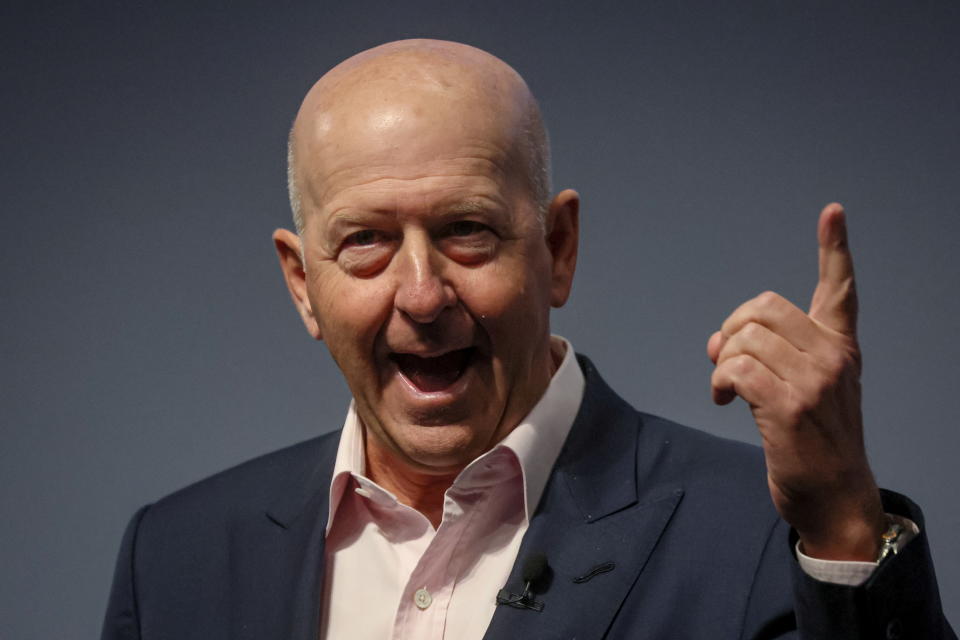

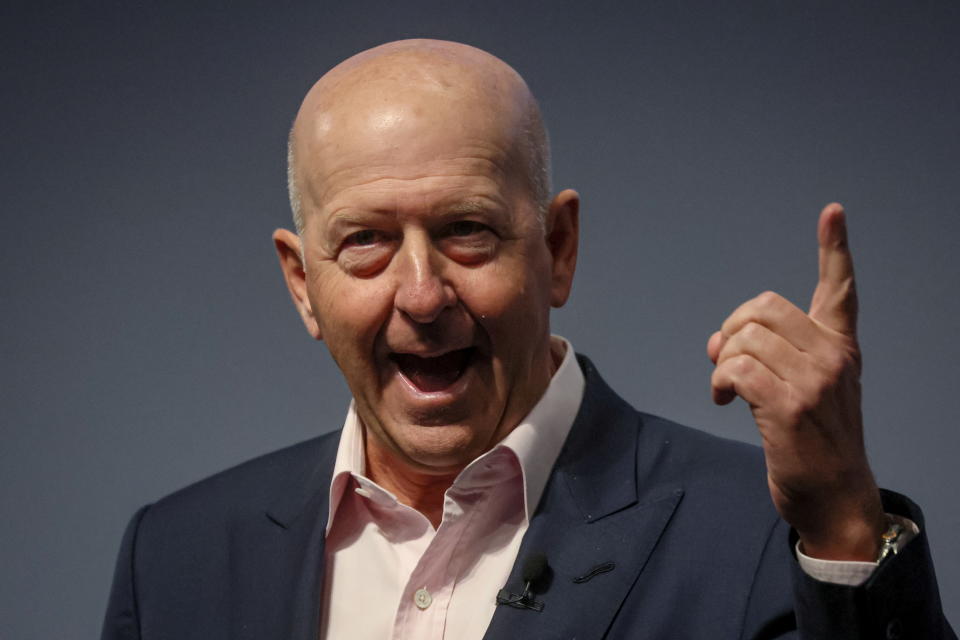

“My recent conversations with clients have been quite constructive,” Goldman CEO David Solomon told analysts Tuesday. “The beginning of the rate cut cycle has renewed optimism for a soft landing, which should spur increased economic activity.”

Citigroup CEO Jane Fraser said in a statement that “in a pivotal year, this quarter contains multiple proof points that we are moving in the right direction.”

Bank of America CEO Brian Moynihan touted “year-over-year growth in investment banking and asset management fees, as well as sales and trading revenue.”

Combined investment banking fees at Goldman, Bank of America (BAC), Citigroup and JPMorgan Chase (JPM), which reported its results last week, were $6.5 billion. That amounted to a 27% rise from a year earlier and 1% increase from the last quarter.

Combined trading revenue for those same Wall Street giants was $23.4 billion, a 6% increase from a year earlier and a 3% increase sequentially.

Another big Wall Street player, Morgan Stanley (MS), releases its third-quarter earnings Wednesday.

The results thus far offer the latest sign that a two-year-long dealmaking drought appears to be ending, helping banks to cushion uneven results in their consumer operations. Overall profits at Bank of America and Citigroup fell when compared to the year-earlier period.

Certainly there are some uncertainties that could upend that optimism, including unrest in the Middle East and the outcome of the 2024 US Presidential election in November.

“The big unknown, or the big factor that’s out there remains, you know, more of the geopolitical issues, but also what happens with the US election, and we’ll kind of have to see how that plays out,” said Citigroup Chief Financial Officer Mark Mason.

Goldman finds itself in a much stronger position than it was a year ago when its CEO was grappling with a slump in dealmaking, the costly exit from consumer lending, and a series of high-profile departures from the firm.

Investment banking fees were $1.8 billion, up 20% from the year-ago period, as companies issued more debt and equity. Even its advisory fees were up slightly thanks to a revival in mergers and acquisitions.

Goldman’s trading revenue rose 2% year over year, driven primarily by a strong performance from its equities traders, while asset and wealth management revenue increased 16%.

Fixed-income trading did not do as well. Revenues from that unit were down.

Goldman’s stock is up this year more than any of its other big-bank rivals. It was roughly flat in Tuesday morning trading.

Bank of America also outperformed expectations for its Wall Street operations, as revenue from trading rose 12% and revenue from equity and debt issuance increased 16% and 37%, respectively.

The bank’s sales and trading revenue was up for its 10th consecutive quarter and reported its highest third quarter performance in more than a decade.

“For our clients, and whether that’s institutional or individual investors, things feel pretty, pretty reasonable,” Jim DeMare, president of Bank of America global markets business, told Yahoo Finance.

“The US economy has been surprisingly resistant, meaning a hard landing seems to be not a topic today and a soft landing with some kind of leaning towards a no-landing seems to be becoming popular,” he added.

Investment banking was definitely a bright spot for Citigroup, which helped the lender post a smaller-than-expected profit drop in the third quarter. Net income fell to $3.2 billion from $3.5 billion a year ago.

Like Goldman, it did well in equities trading but trading of bonds fell.

Its stock fell by more than 2% in Tuesday morning trading.

Read more: What the Fed rate cut means for bank accounts, CDs, loans, and credit cards

David Hollerith is a senior reporter for Yahoo Finance covering banking, crypto, and other areas in finance.

Click here for in-depth analysis of the latest stock market news and events moving stock prices.

Read the latest financial and business news from Yahoo Finance