What’s going on here?

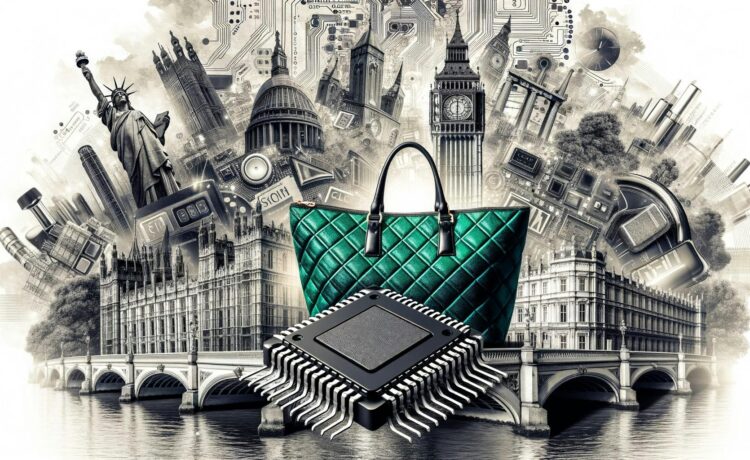

European shares are under pressure, with the STOXX 600 index dipping 0.3% as the tech and luxury sectors struggle ahead of the European Central Bank’s policy announcement.

What does this mean?

Tech giant ASML saw its stock drop 4% after delivering a disappointing 2025 sales forecast, rattling global confidence in chip-related stocks and dragging tech shares down by 1.2%. Meanwhile, luxury powerhouse LVMH fell 7% following a drop in third-quarter sales and weakened consumer confidence in China. This decline spread to other luxury brands like Kering, Hermes, and Richemont, which saw sales decrease between 2.1% and 5.3%. The personal and household goods sector overall contracted by 2%, with brands like Burberry and Swatch experiencing declines as well. On a positive note, the FTSE index increased by 0.6%, driven by a sharp decrease in UK inflation, suggesting potential interest rate cuts. However, carmaker Stellantis encountered a 2% decline after forecasting a 20% drop in third-quarter shipments, and Adidas shares slipped 3% following an earnings report. Investors are now eyeing a possible 25 basis point rate cut from the European Central Bank as a potential market stimulus.

Why should I care?

For markets: Chips and threads under pressure.

The tech and luxury sectors are weighing down European markets, with ASML’s sales forecast unsettling tech stocks worldwide and LVMH’s struggles highlighting vulnerabilities in the luxury segment. As consumer confidence falters in China, these industries could face continued headwinds, prompting investor caution.

The bigger picture: Central banks and consumer shifts.

Interest rates and inflation are playing critical roles, leaving markets poised for significant shifts based on central bank decisions. The anticipated rate cut could boost optimism and liquidity in stocks, but ongoing issues in tech and luxury highlight the complexities in global economic recovery.