Dollar continued its reign as the strongest currency for yet another week, bolstered by solidifying expectations around gradual and measured rate cut cycle by Fed. The rate cut from ECB provided some additional tailwind for the greenback. However, momentum behind the Dollar’s rise remains tepid. Strong risk-on sentiment, coupled with sluggishness in U.S. Treasury yields, is capping further gains. Additionally, the potential for intervention from Japanese authorities has kept Dollar’s advances against Yen in check.

Sterling ranked as the second-best performer this week, supported by mixed economic data from the UK that leaves BoE’s policy outlook uncertain beyond the widely expected November rate cut. Notably, Pound resumed its uptrend against the weaker Euro, reaching its best level since mid-2022. Meanwhile, Swiss Franc ended the week at the bottom of the performance chart, with Euro not far behind.

Australian Dollar also struggled, despite a brief bounce following stronger-than-expected jobs data. The lack of concrete measures in China’s recent stimulus announcements continues to weigh on Aussie. Broader risk sentiment in the Asia-Pacific region, in China, Hong Kong, and Japan, is adding further pressure on the currency.

Record-Breaking Stocks, Yield Momentum Fades, Dollar Stalls at Key Resistance

U.S. equity markets continued their impressive ascent last week, with both DOW and S&P 500 closing at new record highs, marking six consecutive weeks of gains. This streak represents the longest series of weekly advances in 2024 for these major indices. Specifically, DOW gained 0.96% for the week, S&P 500 rose by 0.85%, and NASDAQ Composite added 0.80%. Investors are showing robust confidence, seemingly embracing the expectation that Fed will proceed with monetary policy easing only in a gradual and measured fashion.

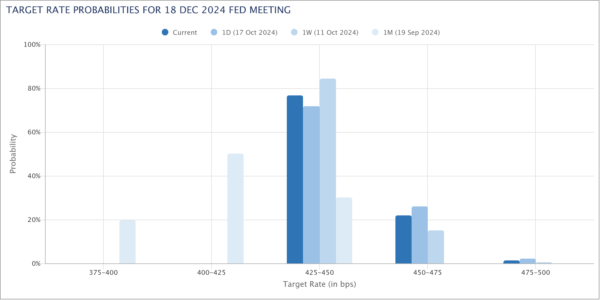

While the consensus still anticipates two additional 25bps rate cuts by Fed before the end of the year, recent comments from Fed officials suggest that a single rate cut may also be a plausible outcome. Markets are adjusting to these possibilities well as reflected in fed fund futures, which now prices in a 77% chance of a total of 50 bps of rate cuts by year-end, down from approximately 84% a week earlier.

While Dollar ended the week as the strongest performing currency, its momentum was somewhat constrained by risk-on environment, as well as loss of momentum in US Treasury yields. Technically, Dollar Index is capped by a significant medium-term resistance, which could continue to limit further appreciation in the near term.

As for DOW, near term outlook will remain bullish as long as 41831.74 support holds. Next target is 100% projection of 32327.20 to 3989.05 from 38000.96 at 45562.81. Also, while it’s still a bit far, we’d pencil in 100% projection of 1821365 to 36952.65 from 28660.94 as the next medium term target first.

10-year yield is starting to face strong resistance from 38.2% retracement of 4.997 to 3.603 at 4.135 and 55 W EMA (now at 4.074) zone. This is seen as an important hurdle that’s difficult for TNX to overcome. Firm break of 3.981 support should confirm rejection by the mentioned resistance zone and bring pullback to 55 D EMA (now at 3.935) and possibly below. However, decisive break of this zone will carry larger bullish implications, and open up the case for long term up trend resumption through 4.997.

Dollar index is also pressing 55 W EMA (now at 103.47). Break of 102.76 minor support will indicate initial rejection by 55 W EMA and bring pull back to 55 D EMA (now at 102.36) and possibly below. However, considering that DXY has just bounced of 55 M EMA (now at 99.85). Sustained break of 55 W EMA will raise the chance that whole corrective fall from 114.77 has completed, and bring stronger rally to 106.13/107.34 resistance zone.

DAX at Record But Faces Resistance, EUR/GBP Targets Crucial Support After Breakout

ECB unanimously lowered deposit rate by 25bps to 3.25%, aligning with widespread expectations. The key takeaway from President Christine Lagarde’s statement was the acknowledgment that the disinflationary process is “well on track.” The inflation outlook has been hit by “downside surprises” in economic activity, signaling that the ECB’s path to further easing may continue.

While Lagarde did not provide explicit guidance on future policy moves, it’s evident that policymakers are increasingly surprised and concerned by the deterioration in economic indicators since their previous meeting. A further rate cut in December appears to be on the table, and only a significant improvement in incoming data might deter ECB from proceeding. The pace at which ECB intends to lower interest rates to a neutral level, however, remains uncertain and will likely depend on the new economic projections scheduled for release in December.

ECB’s accelerated easing measures seem timely for European investors, as reflected by the DAX index reaching new record highs last week. However, DAX is now approaching a critical resistance zone around the psychological level of 20k, which may pose a significant hurdle that’s proved difficult to break unless the European economic outlook improves significantly under the ECB’s support.

Technically, DAX is now close to 100% projection of 8255.65 (2020 low) to 16290.19 (2021 high) from 11862.84 (2022 low) at 19897.38, which is close to 20k psychological level. Break of 18911.72 support will indicate initial rejection by this resistance zone, and bring break deeper pullback towards 17024.82 support.

Nevertheless, firm break of 20k will be a sign of strong underlying momentum. Next near term target will be 100% projection of 14630.21 to 18892.92 from 17024.82 at 21287.52.

Euro concluded the week on a weaker footing, notably breaking lower against Sterling. The UK’s economic data painted a mixed picture last week. CPI dropped more than anticipated to 1.7% in September, the lowest level since April 2021. This significant decline strengthens the argument for BoE to resume policy easing with a 25 basis point rate cut in November. However, robust employment figures and strong retail sales suggest that consumer demand may not be cooling sufficiently to ensure continued disinflation. While another BoE rate cut in December remains a possibility, it is by no means certain, which is helping to keep the Pound relatively buoyant.

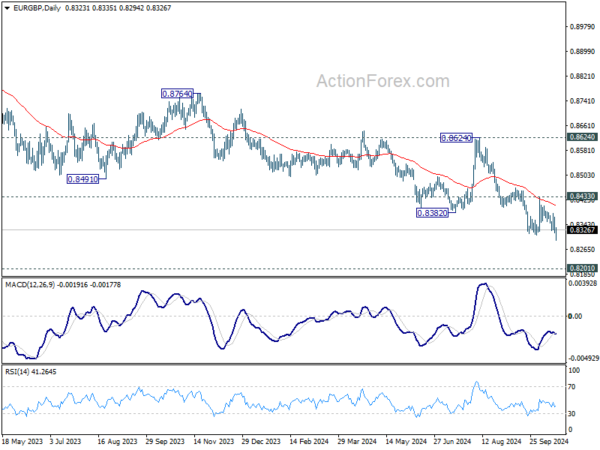

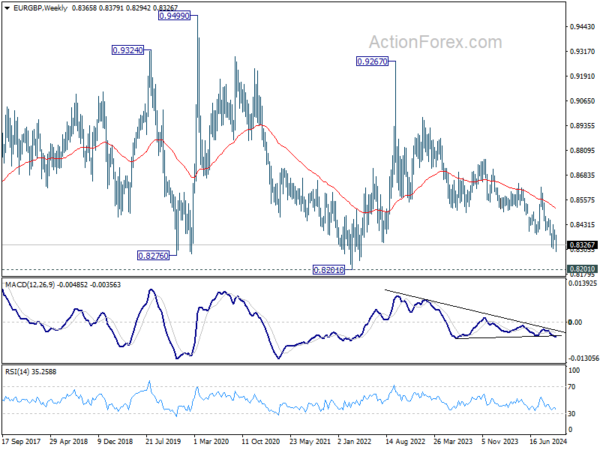

Technically, while EUR/GBP’s down trend resumed last week it’s now heading towards an important support at 0.8201 (2022 low). Strong support is expected there to contain downside and bring rebound, at least on first attempt. Break of 0.8433 resistance should turn the cross into sideway trading first. But medium term outlook will remain bearish as long as 0.8624 resistance holds.

Yen Slide Halted by Verbal Intervention and Political Risks: Will It Bounce Back?

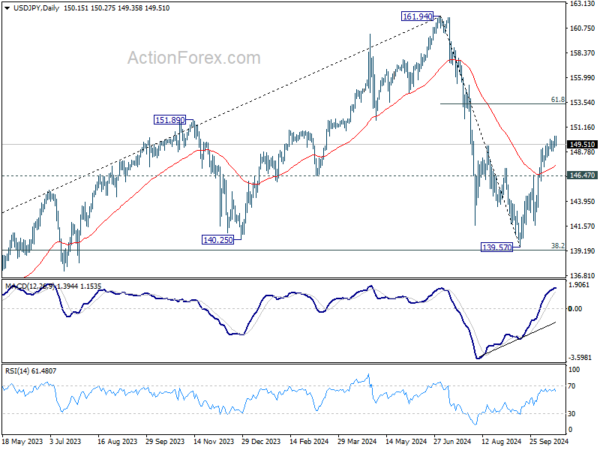

In Japan, Yen briefly slipped past the critical 150 level against Dollar, but it quickly regained ground as verbal interventions from Japanese officials made traders wary of pushing the currency lower. At this same time, this stabilization of Yen comes amid a broader shift in investor sentiment, as Nikkei Index experiences a selloff fueled by growing political uncertainty ahead of the snap general election scheduled for October 27.

Recent polls suggest that the ruling Liberal Democratic Party may struggle to secure the 233 seats needed for an outright majority in the 465-seat lower house. According to a Nikkei newspaper report, the LDP’s grip on power—held since 2012 after a brief period in opposition—could be at risk. Further adding to the political unease, a separate survey by Jiji Press revealed that support for new Prime Minister Shigeru Ishiba’s cabinet has fallen to just 28%, marking the lowest approval rating for a new government since records began in 2000. This sharp decline raises serious doubt about the stability of Ishiba’s leadership.

Technically, Nikkei’s rise from 31156.11 is seen as the second leg of the corrective pattern from 42426.77 high. Target of 61.8% projection of 31156.11 to 39080.64 from 40257.34 has already be reached.

Notably, Tuesday’s trading session formed an “Abandoned Baby” candlestick pattern, a rare and potent bearish reversal signal. Break of 37651.07 support will argue that whole rebound from 311156.11 has completed, and turn outlook bearish for 35254.43 and below.

Extended selloff in Nikkei could drag USD/JPY lower. Break of 146.47 resistance turned support will indicate that the rebound from 139.57 has completed, and turn near term outlook bearish for retesting this low.

AUD/USD Weekly Report

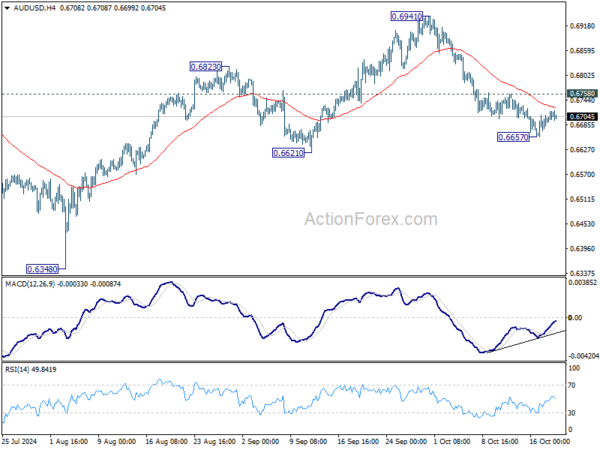

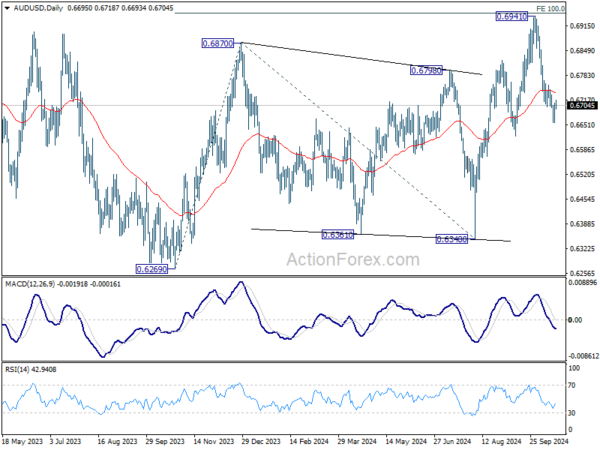

AUD/USD edged lower to 0.6657 last week but recovered since then. Initial bias stays neutral this week for some more consolidations. Further decline is expected as long as 0.6758 resistance holds. Below 06657 will target 0.6621 first. Firm break there will confirm bearish reversal. However, break of 0.6758 will suggest that pullback from 0.6941 has completed and turn bias back to the upside.

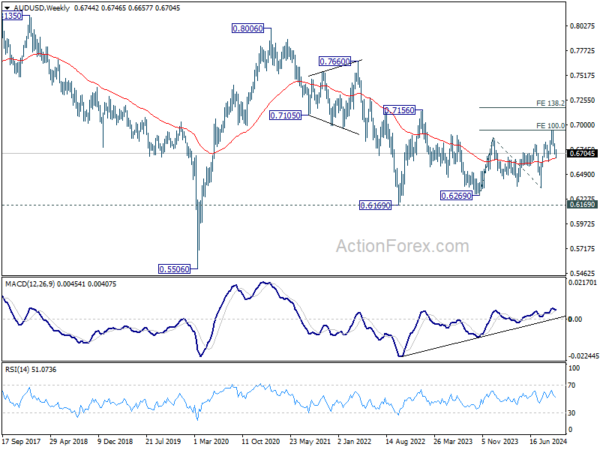

In the bigger picture, overall, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern, with rise from 0.6269 as the third leg. Firm break of 100% projection of 0.6269 to 0.6870 from 0.6340 at 0.6941 will target 138.2% projection at 0.7179. However, break of 0.6621 support will argue that rise from 0.6269 has completed and bring deeper fall back to 0.6269/6348 support zone.

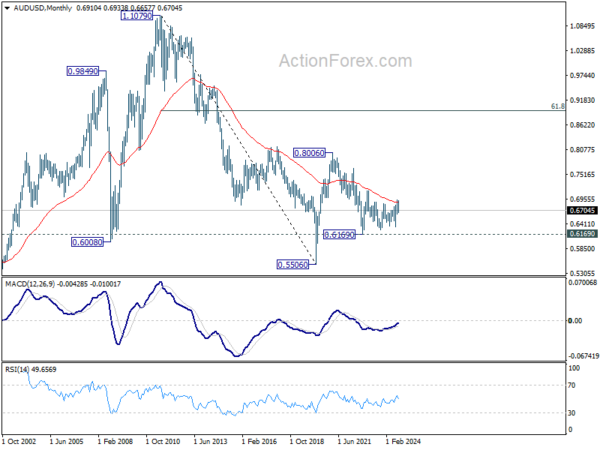

In the long term picture, the down trend from 1.1079 (2011 high) should have completed at 0.5506 (2020 low) already. It’s unsure yet whether price actions from 0.5506 are developing into a corrective pattern, or trend reversal. But in either case, fall from 0.8006 is seen as the second leg of the pattern. Firm of 0.7156 resistance will argue that the third leg has already started towards 0.8006.