(Bloomberg) — After two weeks of number-crunching, it now seems clear that investors in catastrophe bonds emerged from Hurricane Milton relatively unscathed.

Most Read from Bloomberg

In fact, holders of the bonds may be looking at returns of as much as 12%, according to Zurich-based asset manager and catastrophe-bond specialist Plenum Investments AG.

Before Milton struck just south of Tampa on Oct. 9 as a Category 3 hurricane, the market for catastrophe bonds had been bracing for losses as steep as 15%, dwarfing those triggered by Hurricane Ian two years earlier. In the event, losses from Milton will likely be closer to 1%, possibly even less.

“The underlying dynamic means that spreads stay at high levels,” said Dirk Schmelzer, managing partner at Plenum, which oversees more than $1.2 billion in insurance-linked securities and insurance debt, including about $900 million of catastrophe bonds.

And with this year’s hurricane season now unlikely to deliver more losses, the outlook is for “very attractive returns over the next 12 months,” he said during a webinar on Thursday. November hurricanes tend to hit in the lower latitudes and the chances of a major storm making landfall in the US “is next to zero,” Schmelzer said.

Catastrophe bonds, or cat bonds as they’re often called, are issued by insurers and reinsurers in order to hand some of their risk over to the capital markets. Investors in the bonds make money if a predefined disaster doesn’t occur, but can lose much of their capital if it does.

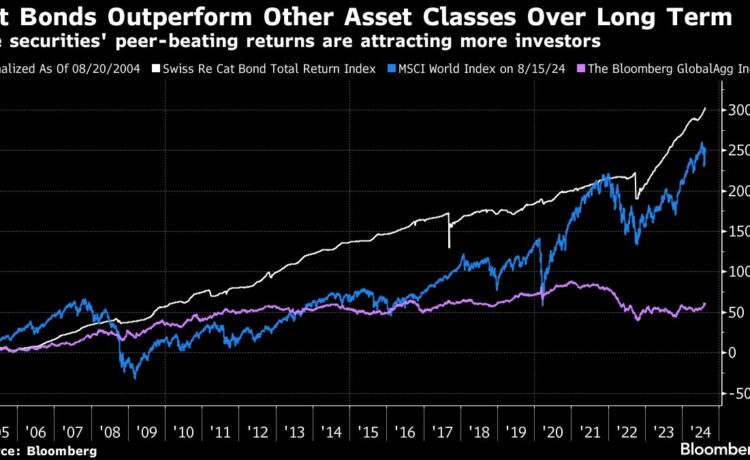

So far this year, the Swiss Re global cat-bond index is up more than 13%, as investors emerge largely unscathed after what meteorologists had warned would be one of the most active hurricane seasons in recent memory.

Market-beating returns are a recurring theme in the market for cat bonds. Last year, the instruments underpinned the most profitable hedge fund strategy of them all, namely insurance-linked securities, according to Preqin, which provides data on the alternative-asset management industry.

The parameters that determine cat-bond payouts are unlikely to become softer in the future, according to analysts monitoring the market. Morgan Stanley analysts said earlier this year that they expect cat bonds “to adjust the triggering criteria for a payout to cover only the most severe types of storms.”