Troubled chip giant Intel will invest more than $28 billion to construct two new chip factories in Ohio, to take fight to TSMC

Intel has reportedly announced an expansion of its Ohio manufacturing capabilities, pledging $28 billion to build two chip factories in that location.

Reuters reported that the $28 billion investment for two state-of-the-art chip factories in Licking County, Ohio, is part of its long-term initiative to build up its contract chip manufacturing business and better compete with Taiwan Semiconductor Manufacturing Co (TSMC).

Shares of the troubled chip firm rose nearly 4 percent in early trading on Friday to $23.22 as of Friday afternoon (UK time). Intel’s stock has slumped more than 55 percent this year, amid a wave of negative headlines.

Intel turnaround

It was back in March 2021 when CEO Pat Gelsinger had implemented Intel’s turnaround plan (IDM 2.0), which was designed to regain the company’s competitive edge, and help it focus on revitalising its manufacturing capabilities (including manufacturing chips for other companies), investing in advanced chip technologies, and expanding into new markets.

However industry observers warned it would take years to realise the plan to turn around Intel’s foundry business, and many expect TSMC to maintain its foundry lead in the coming years. There is also concern that to date Intel has been slow to line up high-profile customers.

That said, last month Intel and Amazon Web Services announced that they would coinvest in a custom chip for artificial intelligence (AI) computing, known as a fabric chip, in a major win for Intel’s manufacturing division.

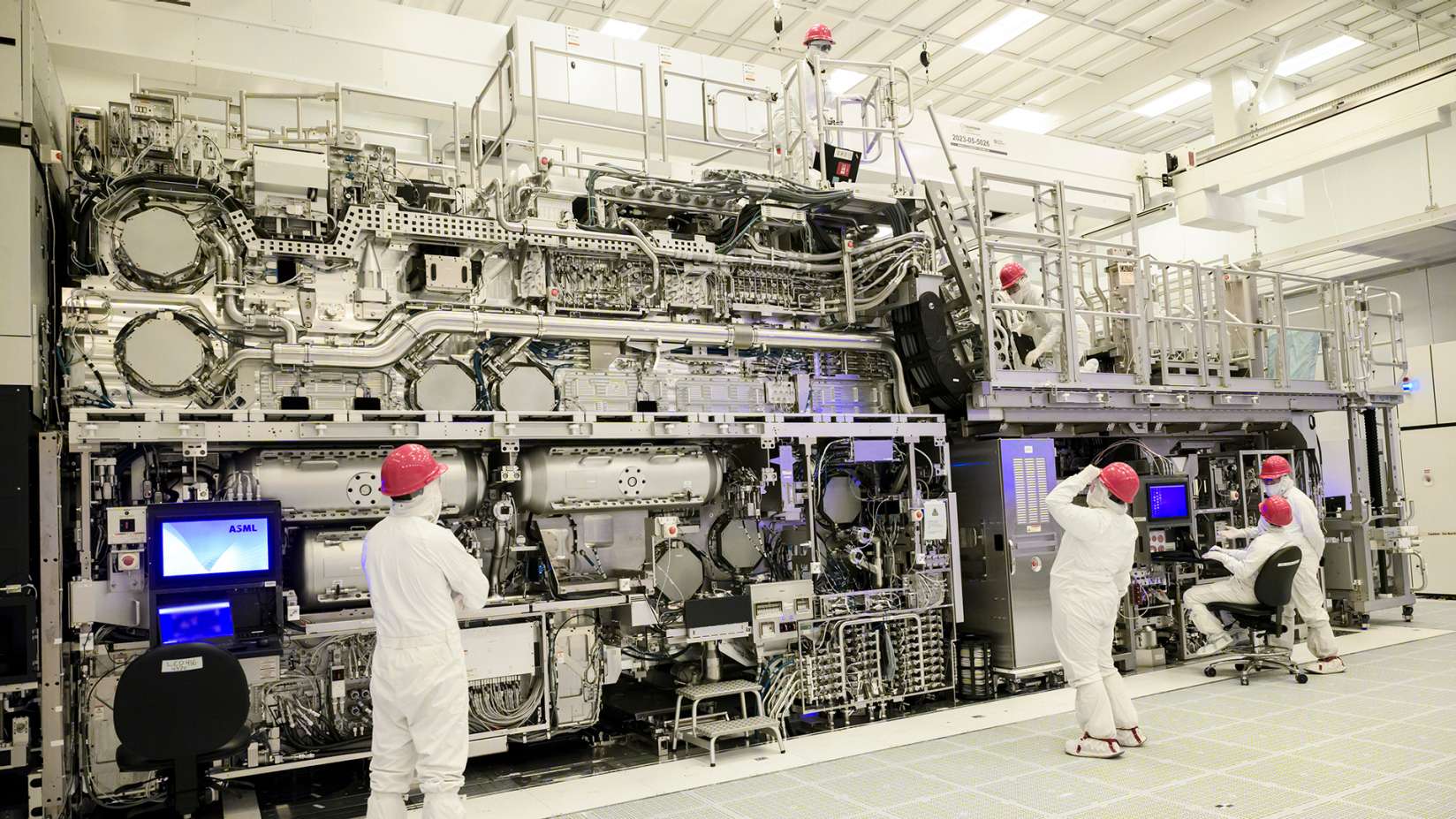

The deal is part of a “multiyear, multibillion-dollar framework” and will use Intel’s 18A manufacturing process, the most advanced process available to outside clients.

Ohio expansion

Santa Clara, California-based Intel reportedly said on Friday the initial phase of the Ohio project is expected to create 3,000 Intel jobs (as well as 7,000 construction jobs), and the investment marks the largest single private sector commitment in Ohio’s history.

To support the development of these new facilities, Intel has also reportedly pledged an additional $100 million to collaborate with educational institutions, building a talent pipeline and backing regional research projects.

Concern about Intel’s slow progress in its turnaround was brought to a head in August this year, when Pat Gelsinger shocked the markets by reporting a Q2 net loss, as well as the axing of 15,000 jobs.

Gelsinger also confirmed that “costs are too high, our margins are too low”, and this, coupled with weak forecasts and the suspension of dividend payments to investors – triggered the largest single day drop in Intel’s stock price in 50 years, after it plummeted 26 percent on 2 August. This caused Intel’s market value to sink more than $32 billion in a single day.

Angry Intel shareholders then sued the firm, alleging the chipmaker fraudulently concealed problems that led it to post weak Q2 results, slash jobs and suspend its dividend payment.

Soon after that Intel sold its stake in UK chip designer ARM Holdings, and then chip industry veteran Lip-Bu Tan resigned “effective immediately” from Intel’s board of directors, amid reports of differences with CEO Gelsinger over what Tan considered Intel’s bloated workforce, risk-averse culture, and lagging AI strategy.

Tan’s exit reportedly left a vacuum of chip-industry technical and business acumen on Intel’s board, which is said to be mostly populated by leaders in academia and finance, and former senior executives from the medical, tech and aerospace industries.

Then it was reported that Intel was exploring its strategic options, allowing the board to consider a full range of options, including splitting off and selling the businesses.

Last month, Intel announced a significant strategic restructuring when Gelsinger confirmed that Intel will spin off Intel Foundry as an “independent subsidiary inside of Intel.”

Gelsinger then confirmed some bad news for Europe, saying that Intel will pause its pause its chip factory projects in Poland and Magdeburg, Germany for two years, while pushing ahead with expansion in Arizona, New Mexico, Oregon and Ohio.

However a rare piece of good news for Intel came this week when the Europe’s top court, the Court of Justice, ended a legal battle that has been ongoing since 2009, by upholding a lower courts decision to overturn the European Commission’s €1.06 billion (£883m or $1.14 bn) antitrust fine.