-

Customer Lending Growth: GBP8.1 billion increase to GBP367 billion.

-

Climate and Sustainable Funding: GBP23.5 billion provided, totaling GBP85.4 billion since July 2021.

-

Customer Deposits: Increased by GBP8.3 billion to GBP427 billion.

-

Assets Under Management: Increased by GBP5.7 billion to GBP46.5 billion.

-

Income: GBP10.8 billion for the first nine months.

-

Operating Profit: GBP4.7 billion.

-

Attributable Profit: GBP3.3 billion.

-

Return on Tangible Equity: 17%.

-

CET1 Ratio: 13.9%.

-

Earnings Per Share: 38p, up 12% year on year.

-

Income Excluding Notable Items (Q3): GBP3.8 billion, up 5.1%.

-

Operating Expenses (Q3): GBP1.8 billion, 9% lower.

-

Impairment Charge (Q3): GBP245 million.

-

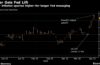

Net Interest Margin: Increased 8 basis points to 218 basis points.

-

Gross Loans to Customers: Increased by GBP8.6 billion to GBP367.2 billion.

-

Deposits (Q3): Increased by GBP2.2 billion to GBP427 billion.

-

Loan Impairment Rate: Expected below 15 basis points for the full year.

-

Tangible Net Asset Value Per Share: Increased to 316p.

-

Full Year Income Guidance: Expected to be around GBP14.4 billion.

Release Date: October 25, 2024

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

-

NatWest Group PLC (NYSE:NWG) upgraded its full-year income and returns guidance, reflecting strong financial performance and strategic progress.

-

Customer lending grew by GBP8.1 billion, with significant contributions from commercial and institutional sectors, including social housing.

-

The company achieved GBP23.5 billion in climate and sustainable funding, nearing its GBP100 billion target by 2025.

-

Customer deposits increased by GBP8.3 billion, with growth across all business segments.

-

Return on tangible equity improved to 17%, supported by strong earnings and active risk management.

-

Operating expenses were 9% lower, but the company anticipates higher costs in Q4 due to severance and property costs.

-

An impairment charge of GBP245 million was recorded, reflecting economic uncertainty and a single name charge.

-

The CET1 ratio is expected to face RWA inflation of around GBP8 billion by January 2026 due to regulatory changes.

-

Non-interest income growth may face seasonality and normalization in Q4, impacting overall income.

-

The company expects further base rate cuts, which could affect net interest income and margins.

Q: Can you provide more details on the impact of the base rate cut on margins and deposit spreads? A: The base rate cut has impacted the customer rate, but we’ve also seen benefits from instant access preferences. The impact of the rate cut is not fully reflected in the quarter due to timing. Typically, it takes about a month for retail bank rate cuts to affect customers, and a bit longer for commercial. The funding and other line increased by 4 basis points, supported by treasury management and deposit growth.