Dollar emerged as the unequivocal winner in the currency markets last week. Both Dollar Index and 10-year US Treasury Yield surged through their respect technically significant 55 W EMA resistance. It remains to be seen whether traders are positioning ahead of the US presidential election results, which are less than two weeks away. However, the pullback in stock markets indicates that investors are exercising caution instead. In any case, the upcoming fortnight will be pivotal for markets in determining medium-term trends.

Conversely, Japanese Yen suffered an extended selloff, ending the week as the worst-performing major currency. Verbal interventions by Japanese officials had limited effect, likely hindered by ongoing political uncertainty surrounding the snap election. This uncertainty also weighed heavily on Nikkei, which saw significant declines. Additionally, subdued performance in Hong Kong and Chinese stocks contributed to the regional weakness. Yen’s weakness was mirrored by New Zealand Dollar and Australian Dollar, both of which closed near the bottom of the performance chart.

Meanwhile, European occupied middle ground. Euro displayed resilience despite intensified discussions within ECB about accelerating monetary easing measures. Canadian Dollar was among the firmer currencies last week, alongside Swiss Franc. However, their strength was modest, and neither currency matched the dominance exhibited by the greenback.

Investor Caution Grows Ahead of US Payrolls and Presidential Election

Investors are turning increasingly cautious as the global markets prepare for a high-stakes two weeks ahead, marked by the upcoming US non-farm payroll report and a tightly contested US presidential election. Last week, both DOW and S&P 500 ended their recent winning streaks, closing with significant declines. Although NASDAQ managed a record intraday high on Friday, the gains didn’t hold through to the close, reflecting an underlying cautious tone. Meanwhile, 10-year Treasury yield to stood firm above 4.23% after strong rally, supporting Dollar, which closed as the best performing currency among majors.

The non-farm payroll report next week is expected to be pivotal for shaping the Fed’s anticipated easing cycle. Futures markets currently imply a 95.1% probability of a 25bps rate cut in November and a 74.6% chance of another 25bps reduction in December. However, these odds are likely to shift depending on the strength or weakness of the payroll report.

In addition, the US presidential election looms just under two weeks away, adding another layer of uncertainty to markets. The election remains tight, with Democratic candidate Kamala Harris and Republican candidate Donald Trump running neck-and-neck. The election’s outcome could bring significant shifts to fiscal policy, bond issuance, and even broader trade and foreign relations.

Given these unknowns, market responses are likely to be unpredictable. Rather than speculating on the election results or market reactions, it may be beneficial to focus on the technical picture.

S&P 500 should have formed a short term top at 5878.46 and some consolidations could be seen in the near term. Deeper retreat might be seen to 55 D EMA (now at 5679.09). But outlook will stay bullish as long as 5669.67 resistance turned support holds. The long term up trend would still be in favor to 6000 handle, or further to 61.8% projection of 4103.78 to 5669.67 from 5119.26 at 6086.98, at a later stage.

However, considering bearish divergence condition in both D MACD and RSI, firm break of 5669.67 will confirm medium term topping, and set up deeper correction back to channel support (now at 5445) or even further to 5119.26 structural support.

NASDAQ’s rise from 15708.53 is still seen as the second leg of the corrective pattern from 18671.06 high. Firm break of 17767.79 support should confirm rejection by 18671.06, and the start of the third leg back towards 15708.53 support.

Both 10-Year Yield and Dollar Index Surge Past 55 W EMA, More Bullish Momentum on the Horizon?

US 10-year yield surged sharply last through 55 W EMA last week to close at 4.232. The development further affirmed the bullish case that whole correction from 4.997 has completed with three waves down to 3.603. Near term outlook will remain bullish as long as 3.995 support holds. Next near term target is 61.8% retracement of 4.997 to 3.603 at 4.464.

From a pure technical point of view, it’s plausible that the up trend from 0.398 is ready to resume through 4.997 high. However, it’s premature to make definitive judgments without considering the still uncertain fundamental picture. The eventual path of yield depends on whether the next US administration would flood the markets with bond issuance for its expansive fiscal policies.

Dollar Index also broke through 55 W EMA decisively last week. Further rally is now expected as long as 55 D EMA (now at 102.66) holds. Next target is 106.13 resistance.

Meanwhile, it should be emphasized again that Dollar Index has just drawn strong support from rising 55 M EMA (now at 99.86). Current development is raising the chance that whole correction from 114.77 has already completed, at 99.57 or 100.15. Further break of 106.13/107.34 resistance will solidify this bullish case, and target 114.77 again in the medium term.

While the upcoming NFP would have huge impact on Dollar the in the near term, the medium term path would hinge on the election result, and the impact on risk sentiment as well as treasury yields.

Yen Decouples from Nikkei Amid Japan’s Political Uncertainty

Yen has unexpectedly decoupled from the Nikkei index over the past week. Despite Yen weakening beyond the significant 150 level against Dollar, Nikkei 225 has suffered notable declines, unable to capitalize on the traditionally positive effect a weaker Yen has on export-oriented stocks. The primary driver behind this divergence is the heightened political uncertainty stemming from the snap election in Japan. Meanwhile, attempts by Japanese authorities to arrest Yen’s decline through weak verbal interventions have been largely ineffective.

Technically, Nikkei is approaching a critical support level at 37651.07 following the two-week decline. Firm break there should confirm that entire rebound from 31156.11 has completed with three waves up to 40257.34. In this, deeper fall should be seen back to 35253.34 first, as the third leg of the corrective pattern from 42426.77 commences.

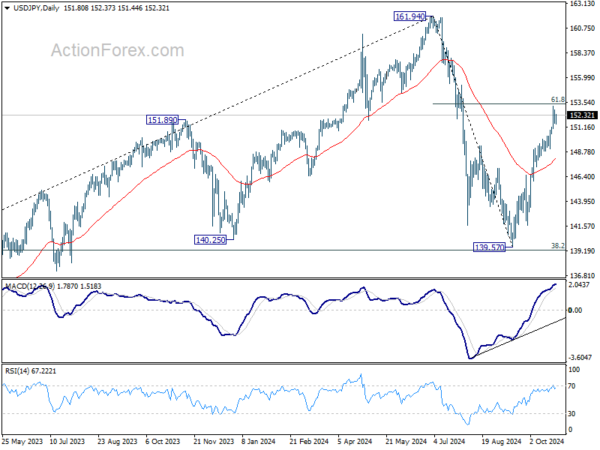

The key question is whether USD/JPY will recouple with Nikkei’s movement if the index continues to slide. For now, further rise in USD/JPY would remain in favor as long as 55 D EMA (now at 148.16) holds. Decisive break of 61.8% retracement of 161.94 to 139.57 at 153.39 will extend the rally from 139.57, as the second leg of the corrective pattern from 161.94, to retest 161.94 high.

Euro Finds Support from PMI After Intense ECB Debates

It was an active week of commentary from ECB policymakers, with discussions centered on three key issues: whether to implement a 25 bps or 50 bps rate cut in December, the risk of inflation undershooting, and the need of lowering interest rates below neutral level. While dovish members pushing for more aggressive cuts are vocal, they currently remain a minority within the Governing Council.

While the debates put come pressure on Euro, the currency managed to stabilize, aided by the latest PMI data from Eurozone. The PMIs presented at worst a mixed but not wholly negative picture. While France showed signs of economic deterioration, Germany’s data indicated improvement. An uptick in manufacturing activity helped offset a downtick in the services sector. Crucially, persistent inflation and wage growth are likely to keep ECB’s hawkish members cautious about rapid easing, suggesting that a significant rate cut may not be imminent.

In the currency markets, Euro weakened against Dollar, influenced by Dollar’s strength and expectations of divergent monetary policies. However, the selloff against British Pound has slowed, and Euro remains range-bound against Swiss Franc. Notably, EUR/AUD is showing signs of strength as the rebound from 1.6002 gains momentum.

Technically, EUR/AUD’s fall from 1.7180 could have completed with three waves down to 1.6002, after defending 1.5996 key support. Further rise is now in favor to 38.2% of 1.7180 to 1.6002 at 1.6452. Sustained break there should confirm near term bullish reversal, and target 61.8% retracement at 1.6730 and above.

USD/CAD Weekly Outlook

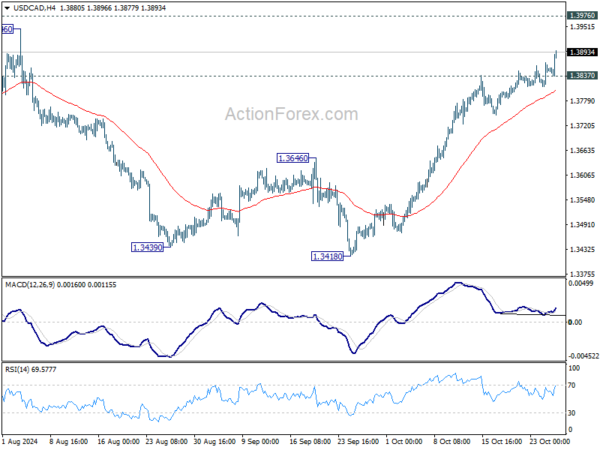

USD/CAD’s rally from 1.3418 continued last week and there is no clear sign of topping yet. Initial bias stays on the upside this week for 1.3946/76 resistance zone. On the downside, below 1.3837 minor support will turn intraday bias and bring consolidations first.

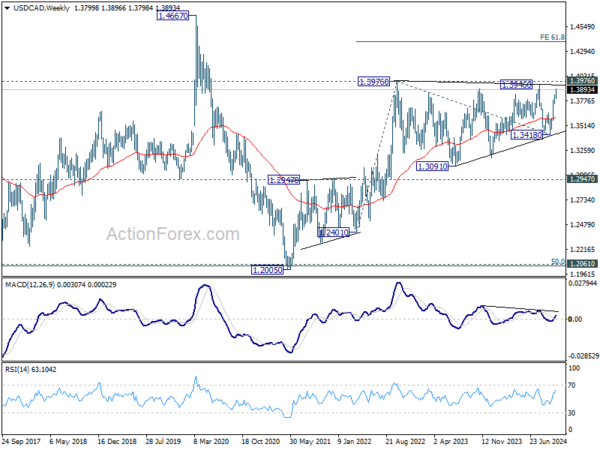

In the bigger picture, sideway consolidation pattern from 1.3976 (2022 high) might still extend further. While another decline cannot be ruled out, strong support should emerge above 1.2947 resistance turned support to bring rebound. Rise from 1.2005 (2021 low) is still in favor to resume at a later stage. Decisive break of 1.3976 will target 61.8% projection of 1.2401 to 1.3976 from 1.3418 at 1.4391.

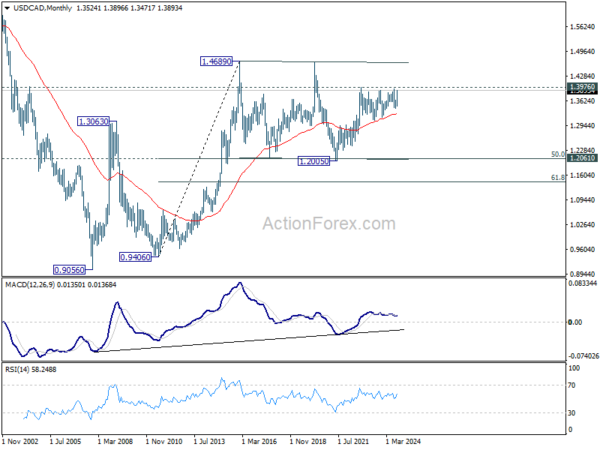

In the longer term picture, price actions from 1.4689 (2016 high) are seen as a consolidation pattern, which might have completed at 1.2005. That is, up trend from 0.9506 (2007 low) is expected to resume at a later stage. This will remain the favored case as long as 1.2947 resistance turned support holds.