These market leaders possess qualities that may make them a good fit for your portfolio.

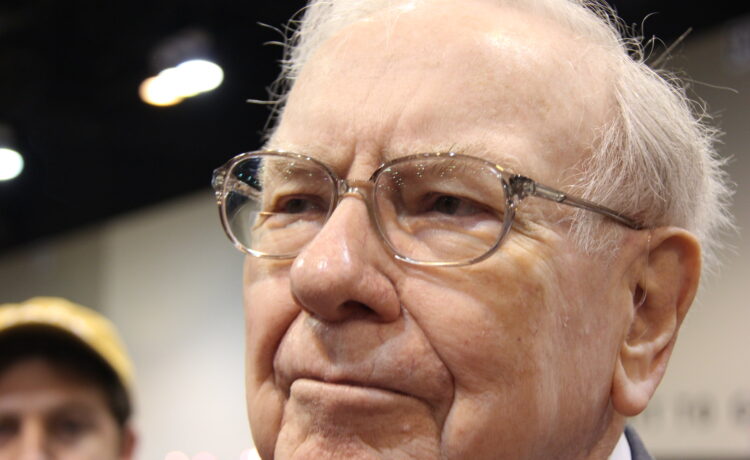

Warren Buffett has gained a loyal following of devoted fans through his years of beating the market. His company, Berkshire Hathaway (BRK.A) (BRK.B 0.07%), hasn’t just beaten the market, it’s outperformed it at outrageous levels, with an annualized return of 19.8% since Buffett took it over in 1965 versus 10.2% for the S&P 500.

Berkshire Hathaway owns a collection of about 60 companies that it operates, including names you know like Benjamin Moore paints and Duracell batteries. It also has a stake in about 45 stocks, including several of the most valuable companies in the world. Three of them have already reached trillion-dollar status, but Buffett’s holding on and expecting more. Let’s see why he owns them and whether or not you should, too.

1. On the never-sell list

Apple (AAPL -1.53%) is the largest holding in the Berkshire Hathaway portfolio, by far. It accounts for 29.6% of the total portfolio, or $92.5 billion. It’s the most valuable company in the world, with a market cap of about $3.5 trillion.

At the Berkshire Hathaway annual meeting in February, Buffett said Apple is an even better business than his mainstays Coca-cola and American Express and added it to the list of stocks he’d never sell.

Turns out, what Buffett actually meant was that he’d never sell it entirely, because not too long after that he sold quite a bit of Apple stock. It had accounted for about half of the portfolio before. Buffett clearly still sees a lot of value in owning Apple, and there are many reasons he might have sold it, such as a tax advantage for the company or to have some extra cash with high interest rates.

Buffett has praised Apple’s CEO, Tim Cook, many times. Excellent management is one of Buffett’s top factors when considering a stock to buy. But what’s likely the main reason Buffett loves Apple is its enduring competitive advantage. Simply put, Apple customers are fiercely loyal. They love the technology, which is differentiated, setting Apple apart from its peers. He posited that iPhone users wouldn’t give up their phones for $10,000, and fans are always upgrading to the newest models.

Something else Buffett has pointed out several times about Apple is its stock buyback program. For example, he “applauded” its share buybacks in his 2021 shareholder letter and noted how share buybacks led to an increase in stock ownership in the 2022 letter.

Apple stock looks expensive today trading at 35 times trailing-12-month earnings. That’s close to its all-time highs. It may be due for a near-term correction, but long-term investors can feel comfortable with a position in Apple stock.

2. On the accidental list

The next-largest company in the Berkshire Hathaway portfolio is Amazon (AMZN 1.00%), which has a market cap of $1.97 trillion. Amazon is only 0.6% of the portfolio, or $1.9 billion.

Buffett has famously said that he missed the boat on buying Amazon stock, waiting until 2019 to first buy shares. He explained to investors that he didn’t regret it, because tech stocks aren’t in his “circle of competence.” It would only be a mistake, he said, if he missed a great deal that was in his circle.

But it wasn’t even his idea to finally buy; one of his portfolio managers bought the stock for the company. Buffett said he didn’t want investors to think he had a “personality change,” getting into tech stocks.

However, he has said in the past that he admires Jeff Bezos, and in many ways, Amazon fits Buffett’s usual schema. It has a moat in its incredible brand and industry dominance in not one, but two distinct and growing industries. It’s trading at close to its lowest valuation in years, and it has several revenue streams.

Amazon has tons of future opportunity, and it’s a good fit for just about any individual investor portfolio.

3. The stock buyback strategy

One stock you won’t see in the portfolio is Berkshire Hathaway itself. Berkshire Hathaway is the ninth most valuable company in the world, and it hit a $1 trillion market cap earlier this month before falling back to $980 billion.

Buffett continues to invest in Berkshire Hathaway stock more than any other through stock buybacks. Just like Buffett praises Apple’s buybacks, he’s a firm practitioner himself. Share buybacks create value for shareholders and demonstrate management’s investment in its success.

The company spent $356 billion buying back stock in the second quarter, and more than $6 billion over the past 12 months. Sometimes it’s much more than that, but Buffett seems to be holding on to a good amount of cash right now.

Although one share of Berkshire Hathaway Class A stock, with a six-digit price tag, is out of reach for most investors, most investors can buy into Buffett’s wisdom through Class B shares.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. American Express is an advertising partner of The Ascent, a Motley Fool company. Jennifer Saibil has positions in American Express and Apple. The Motley Fool has positions in and recommends Amazon, Apple, and Berkshire Hathaway. The Motley Fool has a disclosure policy.