ABOUT 74 per cent of Asia-Pacific companies have incorporated environmental, social and governance (ESG) metrics into their executives’ remuneration in 2024, with companies in the energy, materials and financial services sectors having the highest prevalence of ESG metrics, according to a recent report by advisory company WTW.

This is slightly lower than the global average of 81 per cent.

However, the Asia-Pacific region was the only one that saw an improvement (of two percentage points) from the previous year, compared with North America (77 per cent) and Europe (94 per cent) which did not see any change.

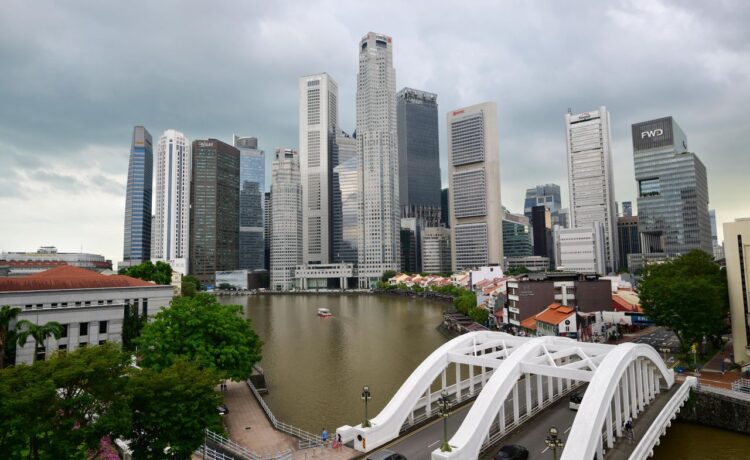

Among the seven Asia-Pacific markets the report analysed, Australian companies had the highest number linking ESG metrics to executive pay, at 92 per cent. This was followed by Singapore at 82 per cent, and then Japan at 74 per cent.

The other four markets were China, Hong Kong, India and Malaysia. The report had analysed the 50 largest companies in each of them.

It found that while 64 per cent of companies included at least one ESG metric in their short-term incentive plans, only a small number of companies (30 per cent) implemented such metrics in their long-term incentive plans.

A NEWSLETTER FOR YOU

Friday, 12.30 pm

ESG Insights

An exclusive weekly report on the latest environmental, social and governance issues.

This is materially lower than European companies, which incorporate long-term carbon emission goals in their long-term incentive plans.

Social metrics remain the most popular ESG metric category used globally, with 62 per cent of Asia-Pacific companies including them in their executive pay plans.

Diversity and inclusion measures were incorporated by 59 per cent of companies.

As for environmental metrics, only 42 per cent of companies in Asia-Pacific had such metrics – a sharp drop compared to 85 per cent of companies in Europe.

About 30 per cent of Asia-Pacific companies included greenhouse gas or carbon emission measures including Scope 3 emissions, which refers to indirect emissions arising from a company’s supply chain.

“The disclosure and prevalence of ESG metrics used by companies in Asia-Pacific continue to vary and are influenced by the level of disclosure requirements and institutional investors’ expectations in each market,” said Shai Ganu, managing director and global practice leader for executive compensation and board advisory at WTW.

“While markets such as Australia, Japan and Singapore continue to have high prevalence of ESG measures in executive incentives, we haven’t seen significant change over the past year. Going forward, geopolitical shifts may prompt slowdown in adoption of climate and diversity, equity and inclusion measures, particularly in North America. Nevertheless, Asian companies will do well as they continue to drive the right behaviours by ensuring alignment between ESG strategy and executive incentives,” he added.