What’s the hottest cryptocurrency on the planet right now? A strong case can be made for XRP (Ripple) (XRP 0.83%). In recent months, XRP has delivered gains that trounced all of the best-known cryptocurrencies, including Bitcoin (BTC 2.77%), Ethereum (ETH 2.45%), and Dogecoin (DOGE 1.74%).

Many crypto fans could be kicking themselves for not jumping on the XRP bandwagon sooner. But just how hard should those self-inflicted kicks be? Here’s how much money you’d have now if you’d invested $1,000 in XRP 10 years ago.

A brief history of XRP

If you bought XRP 10 years ago, you still wouldn’t have been entirely on the ground floor. The XRP Ledger was launched more than three years earlier, in June 2012.

XRP’s roots go back even earlier. Engineers David Schwartz, Jed McCaleb, and Arthur Britton started down the path that ultimately led to the cryptocurrency in 2011. They liked Bitcoin but knew its limitations. Their vision for XRP was to improve Bitcoin and build a more optimal platform for payments.

Shortly after XRP’s 2012 launch, the three men and Chris Larsen founded NewCoin to advance the cryptocurrency. The company’s name was soon changed to OpenCoin. In 2013, OpenCoin was renamed Ripple Labs.

Another major milestone for XRP came in September 2020 with the formation of the XRPL Foundation. This independent nonprofit organization was established to foster adoption and speed up the development of the XRP Ledger.

An astronomical return

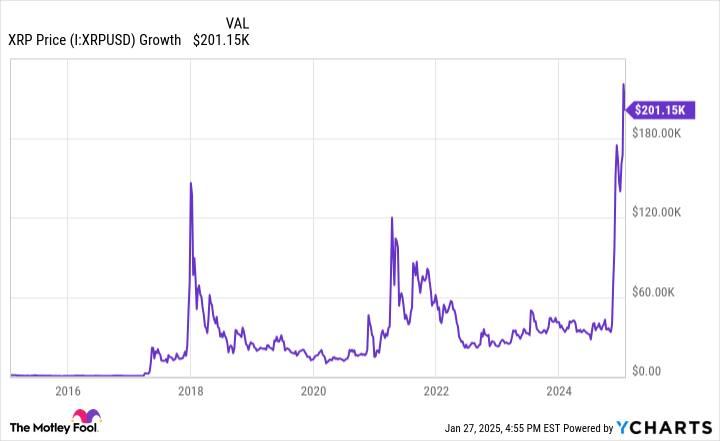

Let’s suppose you became really interested in cryptocurrencies in early 2015. Bitcoin had just delivered a dismal performance the previous year, sinking 46%. So you decided to place a bet 10 years ago on what was still a relative newcomer to the crypto world and bought $1,000 worth of XRP.

You might have soon regretted that decision. By the end of 2015, XRP’s price was down 63%. However, let’s assume that you weren’t too rattled by the steep decline and didn’t sell.

In mid-March 2017, your investment would have still been deeply in the red. But things were about to change dramatically for the better. XRP skyrocketed, turning a big cumulative loss into a gain of nearly 50% in a matter of days. At the end of 2017, you would have sat atop a jaw-dropping return of 13,570%.

It would have been very tempting to take profits at that point. You might have even wished you had, with XRP falling sharply throughout 2018 and 2019 as a crypto winter ensued. However, 2021 was another banner year for the cryptocurrency followed by big up and down moves over the next two years.

XRP again took off breathtakingly in late 2024, with its momentum continuing into early 2025. How much would your initial investment of $1,000 be worth today if you had held on for the entire 10 years? You might want to sit down first. The total comes to over $201,000.

Incredibly, XRP has generated a 10-year gain of over 20,000%. As impressive as this astronomical return is, though, you would have been better off buying Bitcoin after its sell-off in 2014. A $1,000 investment in the granddaddy of cryptocurrencies would be worth more than $434,000.

Could XRP still be a 200-bagger?

As the old saying goes, hindsight is 20/20. But could XRP still be a 200-bagger going forward? Don’t hold your breath.

XRP’s market cap currently approaches $174 billion. If it increased by 200 times, the cryptocurrency would be worth $34.8 trillion. That’s roughly twice the current market caps of the so-called “Magnificent Seven” stocks combined.

Probably the better question to ponder is whether XRP is likely to deliver market-beating returns over the next few years. The answer is a definite maybe, in my opinion.

Like all cryptocurrencies, XRP is worth what the investment community thinks it’s worth. Even with its tremendous gains over the last 10 years, it’s not unreasonable to envision investors valuing XRP much more highly five years from now. Who knows? XRP could even still be the hottest cryptocurrency on the planet in 2030. We’ll see.

Keith Speights has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin, Ethereum, and XRP. The Motley Fool has a disclosure policy.