Shares of Amazon (AMZN 1.30%) were up 44% in 2024, handily outpacing the 23% return for the S&P 500. And as far as I’m concerned, this outperformance was easy to anticipate for investors who knew what to look for.

Over the last 20 years, Amazon stock has dropped 25% or more many times. But it has never posted a year-over-year drop in quarterly revenue. Therefore, Amazon’s stock price isn’t strongly correlated with its sales, which have always gone up, whereas the stock price has its ups and downs.

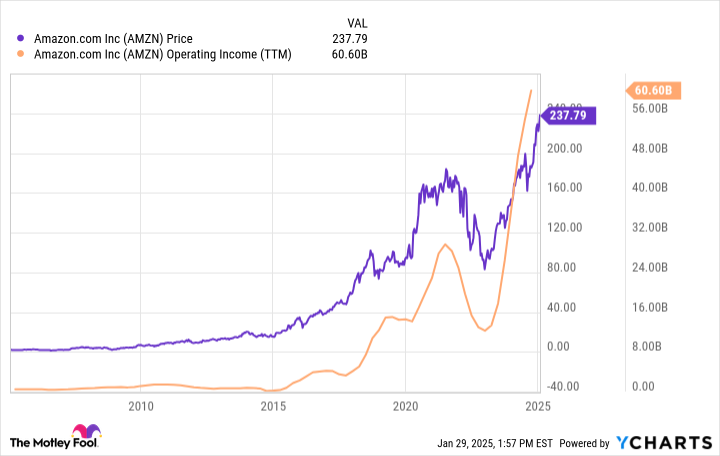

For Amazon, operating income has long had a stronger correlation with its stock price. Directionally speaking, when the company’s operating income rises, the stock price tends to follow, as the chart below illustrates.

AMZN data by YCharts; TTM = trailing 12 months.

In reality, this is what makes stocks go up over the long term, generally speaking. Companies with high cash-flow potential are worth more than companies with little cash-flow potential.

Amazon clearly was poised for robust profitability before 2024 even began. Two of the company’s highest-margin revenue streams are from its cloud computing platform Amazon Web Services (AWS) and from digital advertising. Both of these businesses were booming at the end of 2023, pointing to a strong year ahead.

Through the first three reported quarters of 2024, Amazon has earned operating income of $47 billion. And it expects at least $16 billion more in the upcoming fourth quarter (which it’s scheduled to report on Feb. 6). This represents a significant increase from its operating income of $37 billion in 2023.

Not only is it an increase from 2023, but the company’s projected $63 billion in operating income would also represent an all-time annual high. For this reason, Amazon stock is unsurprisingly at an all-time high as well.

But what should investors expect in 2025 for the company’s operating income and its share price?

How high can profits go for Amazon?

Investors are still awaiting 2024 fourth quarter results. But coming out of the third quarter, Amazon’s fastest-growing business segments (among the major ones) were AWS, subscription services, and digital advertising. Revenue for these gained 19%, 11%, and 19%, respectively.

All three of these are high-margin revenue streams, and all are growing by double digits. And there are reasons to believe this can continue in 2025.

For starters, a boom in interest with artificial intelligence (AI) is one of the factors that’s driving accelerated growth for AWS. Enterprises are turning to cloud computing platforms to leverage AI quickly, and this isn’t a trend that looks like it will slow in the coming year.

Turning to subscription services, growth in Amazon Prime memberships is also accelerating. Management says that the economy has people looking for bargains, which helps sell them on a Prime membership.

Lastly, growth in digital advertising has been quite beneficial. For one example, consider that the company lost more than $10 billion in international markets from the start of 2022 through the end of 2023. But through the first three quarters of 2024, the international business has more than $2 billion in operating income, thanks to the boost from digital advertising.

These are big trends with room to run in the coming year. It’s why I believe that Amazon will go on to set new records with its operating income. And if this is true, then I also expect its stock to hit new all-time highs in 2025.

A closing word of warning

I’m sure that this all sounds wonderful, but there are at least two things that could keep Amazon stock from reaching higher highs in 2025.

First, it’s possible that profits could take a step back. As of this writing, things seem to be going well. But things change.

For instance, the economy could stumble, causing businesses to pull back on their spending for AWS, at least temporarily. This could also cause advertisers to pause some spending. This would hurt growth for operating income.

Moreover, management thinks long term. Therefore, it could opt to spend more in 2025 to build its business to capture a future opportunity. This could also hit profits in the near term.

This leads me to my second point: A single year is a poor time frame to judge a business or measure investment success. With the latter point, investment sentiment drives stock performance over short time periods, and that’s prone to quick changes and overreactions.

This is why it’s better to be thinking about the next five years or more when investing in Amazon stock — sometimes it takes that long for an investment to pay off. That said, I do believe that the company’s profits will continue to grow in the long term. Therefore, I believe it’s only a matter of time before the stock further climbs and rewards shareholders.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.