Stay informed with free updates

Simply sign up to the Currencies myFT Digest — delivered directly to your inbox.

In December the Swiss National Bank cut interest rates by a larger-than-expected 50 basis points to 0.5 per cent, and warned that if data continued to weaken then it would be open to taking them negative once more.

Here’s what SNB’s president Martin Schlegel told Bloomberg TV at the time:

Nobody likes negative interest rates — also at the Swiss National Bank, we do not like negative interest rates. Of course we would also be ready to implement negative interest rates again if necessary. But with the cut that we did today, the probability of negative interest rates has been lowered.

In other words, rates might have to be yanked below zero once more, but the SNB hoped that by delivering a jumbo cut in December that it wouldn’t have to.

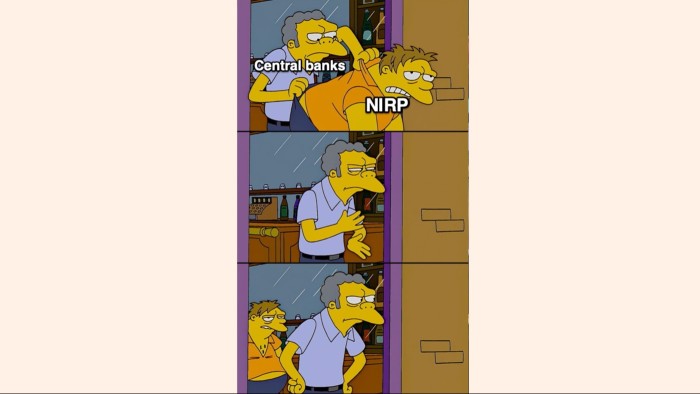

Unfortunately, inflation has continued to be soft in Switzerland, leading analysts and investors to pencil in another rate cut at the SNB’s meeting on March 20. And Rabobank now reckons that the negative interest rate policy is probably coming back before the end of the year.

Alphaville’s emphasis below:

A lot can happen in six weeks, but at this point it seems fairly likely that the central bank will announce another cut in rates. This would follow the jumbo 50 bps move at the last meeting in December. The SNB only meets once a quarter. This alone increases the chances of a move next month. Arguably, it also raises the chances that policymakers could decide on another jumbo move since the next policy meeting will not be until June. That said, the SNB’s policy rate is already at 0.50%. Given the benign inflation backdrop in Switzerland and the lacklustre pace of growth there is the possibility that SNB interest rates turn negative again later this year.

OK, yes, sure, this is just the SNB, and Switzerland is a weird place. It has possibly earned itself a place in the old joke of how here are just four kinds of economies; developed, emerging, Japan and Argentina. Just because it reintroduces NIRP it doesn’t mean that other countries will do the same.

Moreover, the SNB has other tools in its armoury, such as outright currency interventions to weaken the Swiss franc. Morgan Stanley reckons that Switzerland’s central bank will continue to defend the euro-Swiss franc floor at 0.93. And futures contracts indicate that most investors are positioning themselves for Swiss franc weakness.

However, aggressive SNB interventions might be a bit dicey given how the new US administration could go on the warpath against countries overtly weakening their currencies against the dollar. That means that NIRP is the more likely tool if the SNB feels compelled to act.

As Schlegel also stressed to Bloomberg in December:

One very important lesson is that negative interest rates worked. When we introduced negative interest rates in 2015 it was to lower the attractiveness of the Swiss franc, and this worked. [It was] the main takeaway [from that period].

🍿🍿🍿