This is AI generated summarization, which may have errors. For context, always refer to the full article.

RCBC chief economist Michael Ricafort cites protectionist measures of US President Donald Trump as one of the possible reasons for the drop

MANILA, Philippines – Foreign direct investments (FDIs) dropped 19.8% to just $901 million in November 2024, latest figures from the Bangko Sentral ng Pilipinas (BSP) showed.

This brought the cumulative net inflow of FDIs from January to November 2024 to $8.5 billion, 4.4% higher than the $8.2-billion inflow during the same period in 2023.

Nearly half of FDIs during the period came from Japan (49%), followed by the United States (24%) and Singapore (17%).

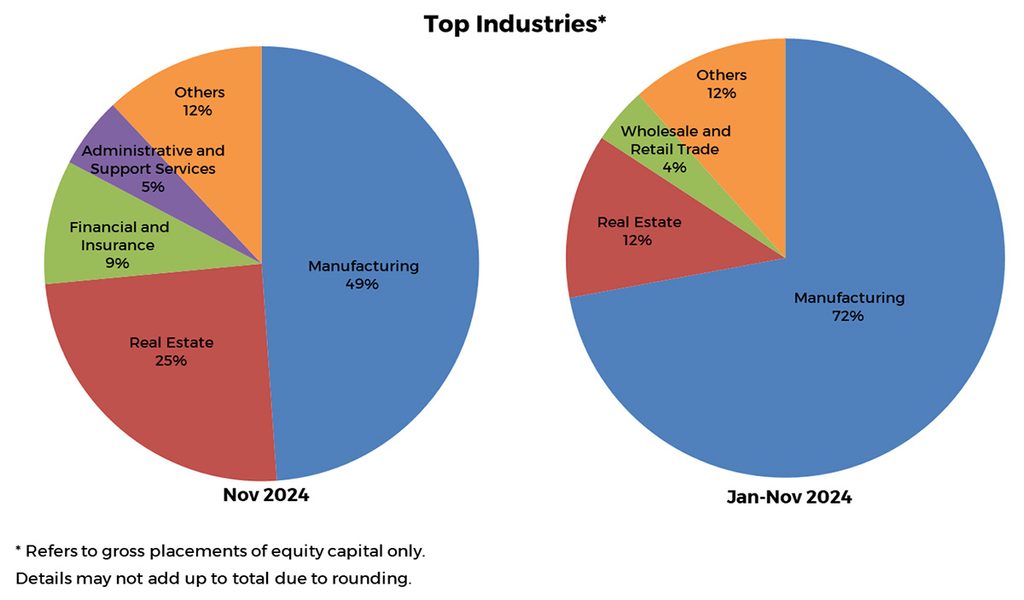

The manufacturing sector received 49% of FDIs in November, with real estate (25%) and financial and insurance (9%) trailing behind.

Nonresidents’ net investments in debt instruments shrank 17.9% to just $791 million in November 2024. These investments include intercompany borrowing and lending between foreign investors and their Philippine units and affiliates.

Meanwhile, nonresidents’ reinvestment of their earnings remained steady at $74 million.

Rizal Commercial Banking Corporation (RCBC) chief economist Michael Ricafort cited protectionist measures of US President Donald Trump, which may have encouraged American firms to keep their investments within the US instead.

Trump made his historic comeback to the White House in the November presidential race.

Other factors that Ricafort believes contributed to the drop in FDIs include the storms that hit the country in early November and geopolitical tensions between China and the Philippines over the West Philippine Sea.

“Foreign investors/locators also awaited the CREATE MORE [Act], which was already signed into law on November 11, 2024, as some foreign investors were on a wait-and-see mode prior to that; but this would now make foreign investors more decisive on whether or not to locate in the country,” Ricafort added in an email.

CREATE MORE stands for Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy. Ricafort is optimistic that the passage of this law will encourage more foreigners to invest in the Philippines instead of in regional competitors.

However, the RCBC chief economist also noted that FDIs could still drop if Trump’s protectionist policies continue to discourage American firms from investing outside of the US.

Trump earlier paused his threat of higher tariffs on Mexico and Canada after these countries, which share borders with the US, agreed to bolster law enforcement efforts. – Rappler.com

![[Ask the Tax Whiz] FAQs on the CREATE MORE Act](https://financefundsupdate.com/wp-content/uploads/2025/02/Screenshot_20241115-084647_Gallery.jpg)