| Company | Value | Change | %Change |

|---|

In the same quarter last year, the company had reported a net profit of ₹116 crore.

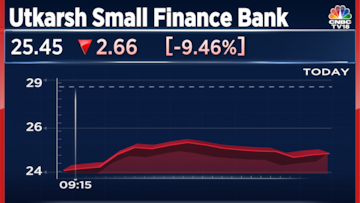

The stock opened Monday’s trade session 13.51% lower at ₹24.31 apiece. It then extended losses and fell 14.97% to its all-time low of ₹23.90 per share.

In the third quarter, the company had reported a net interest income fell by 0.5% at ₹480 crore from the previous year’s ₹482 crore.

The company’s gross non-performing assets stood at 6.17% against 3.88% in the September quarter. The net NPA was at 2.5% from 0.89% in the previous quarter.

The lender reported a 16.2% growth in its gross loan portfolio from last year, reaching ₹19,057 crore. The share of secured loans in the total portfolio increased to 41%, compared to 38% as of September 30, 2024, and 34% as of March 31, 2024.

Govind Singh, MD and CEO of Utkarsh Small Finance Bank said, “Operating environment remained difficult for micro-banking lending in Q3, FY25 on account of credit supply tightening for underlying micro-banking borrowers following guard rail norms, the impact of which is visible in higher provisioning in Q3, FY25. Though guard rail advisory has impacted disbursements also however it is a structurally positive step for the sector, the benefit of which will be seen soon.

The stock was trading 9.64% at ₹25.4 per share at 9.45 pm on Monday, February 17. The stock has fallen 54.61% in the past year.

Also Read: Zen Technologies shares hit 20% lower circuit as broader market sell-off continues