This is AI generated summarization, which may have errors. For context, always refer to the full article.

The Bases Conversion and Development Authority has already signed 75 residential and commercial lease agreements, signaling the private sector’s trust in the transformation of Camp John Hay into a premier ecotourism and investment hub

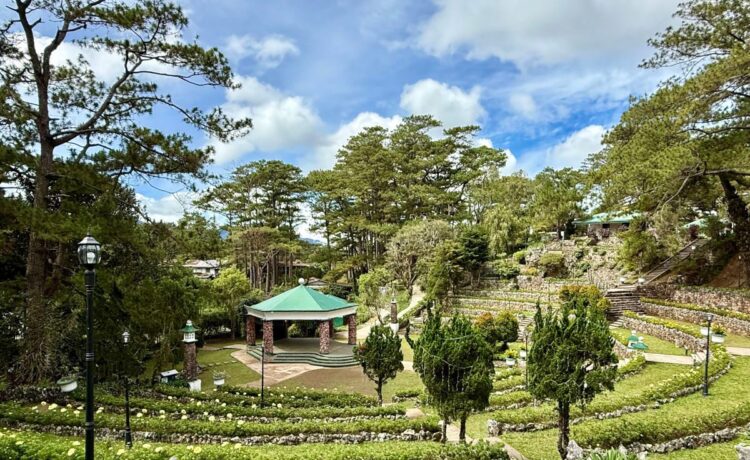

BAGUIO CITY, Philippines – Just two months after the Bases Conversion and Development Authority (BCDA) regained control of Camp John Hay, investments in the estate have surged past ₱1 billion, underscoring strong investor confidence in the government’s vision for the historic mountain destination.

According to Joshua M. Bingcang, BCDA President and CEO, the agency has already signed 75 residential and commercial lease agreements, signaling the private sector’s trust in the estate’s transformation into a premier ecotourism and investment hub.

Historic, but contentious

Once a rest and recreation facility for the United States Armed Forces, Camp John Hay was turned over to the Philippine government in 1991. The 625-hectare estate was later placed under the jurisdiction of BCDA, which leased a 247-hectare portion to CJH Development Corporation (CJHDevCo) in 1996 for redevelopment into a world-class tourism and commercial zone.

However, years of legal disputes between BCDA and CJHDevCo over unpaid lease obligations and contract violations led to arbitration. In 2015, the Arbitral Tribunal ordered CJHDevCo to vacate the leased property and return it to BCDA, while requiring BCDA to refund ₱1.42 billion in lease payments to CJHDevCo.

The legal battle dragged on until October 2024, when the Supreme Court upheld the arbitral ruling, clearing the way for BCDA to fully recover Camp John Hay. By January 2025, BCDA took over operations, paving the way for new investments.

Strong market response

The bulk of the newly signed agreements — 70 residential leases — were secured with both local and foreign investors, including Korean nationals. Meanwhile, the remaining five contracts involve commercial leases with established industry players and small- and medium-sized enterprises.

Some of the key investors in Camp John Hay’s new phase of development include:

- Metro Pacific Investments Corporation (MPIC) subsidiary Landco Pacific Corporation, the interim manager of John Hay Hotels;

- Stern Real Estate Development Corporation, which now operates Le Monet Hotel;

- Amare La Cucina, a renowned homegrown restaurant brand;

- Golfplus Management Inc. (GMI) and DuckWorld Philippines, the consortium managing John Hay Golf;

- Top Taste Trading Inc., a specialty café and restaurant operator.

Economic and environmental commitments

BCDA emphasized that these new investments will generate local employment opportunities and contribute significantly to the state’s revenue, while ensuring the preservation of Camp John Hay’s natural landscape.

“As we bring in economic opportunities that will benefit everyone, we want to assure the local community that we will protect and preserve the vast forested area and open spaces of Camp John Hay,” said Bingcang.

To align with this commitment, BCDA is conducting a comprehensive review of the master plan for the John Hay Special Economic Zone (JHSEZ), ensuring compliance with the United Nations’ 17 Sustainable Development Goals (SDGs). Among the planned initiatives are:

- Enhanced pedestrian and jogging trails,

- Installation of solar-powered streetlights, and

- The development of a smart transport system in coordination with the Baguio City Government.

A new chapter

Since BCDA’s takeover, visitors have noted visible improvements in amenities and services, a result of BCDA’s partnerships with Landco Pacific Corporation for hotel operations and GMI-DuckWorld PH for the golf course’s management.

Looking ahead, BCDA expects more lease agreements to be finalized in the coming weeks, reinforcing Camp John Hay’s role as a sustainable ecotourism and business hub in Northern Luzon.

“Numbers don’t lie,” said Bingcang. “Breaching the billion-peso mark in just two months proves that Camp John Hay is thriving and that investors are seeing its potential under BCDA’s management.”