Two, the lender is setting the stage to increase its share of the fast-growing EV financing pie. Three, the Piramal group is set to offload its stake in Shriram’s insurance businesses. Why this is a good thing, will become clearer in the next section.

Four, lenders received a boost from the regulator last week when the Reserve Bank of India (RBI) rolled back the increase in risk-weights for loans to NBFCs. This is expected to bring down the cost of funding for non-bank finance companies at a time when the stress in unsecured retail lending has been dragging down profits.

Following these developments, the stock of Shriram Finance has appreciated more than 8% in just three days.

Outperformance is not new

To be sure, the outperformance seen in the last few days is an exaggerated extension of the market-beating performance delivered since 2023, when Piramal Enterprises exited from Shriram Finance.

Established half a century ago, this Chennai-headquartered financial conglomerate is engaged in the full spectrum of financial services—investing, lending, insurance, and, more recently, asset reconstruction. Shriram Capital, which is jointly owned by Shriram Ownership Trust and South Africa-based Sanlam, is the holding company for the Shriram group.

However, its organizational structure used to be much more complicated. Back in 2013, Piramal Enterprises purchased stakes in several of Shriram’s group of companies with the objective of eventually merging the two businesses and applying for a banking license. After several failed attempts, which held back Shriram’s growth for almost a decade, the “tie-up” was given up in 2019, and Piramal has been exiting Shriram’s businesses one at a time since then.

Moreover, to simplify the organisational structure, towards the end of 2021, Shriram City Union Finance and Shriram Capital were merged into Shriram Finance (previously Shriram Transport Finance). In December 2024, the housing finance business was also sold off to Warburg Pincus.

Unlocking value

The basic idea behind the reorganization has been to offload its non-core businesses, while drawing synergies into its core business by bringing the group’s entire lending book under a single brand. The result? Shriram Finance is now the second largest NBFC in India, is well-diversified, and has more than 3,000 branches and ₹2.5 trillion in AUM.

The strategic focus on Shriram Finance has unlocked value for investors. Moreover, Shriram Finance is trading at a multiple of 2x its book value, while its peers, Bajaj Finance and Cholamandalam Investment and Finance, are much more expensive at 5x their book values.

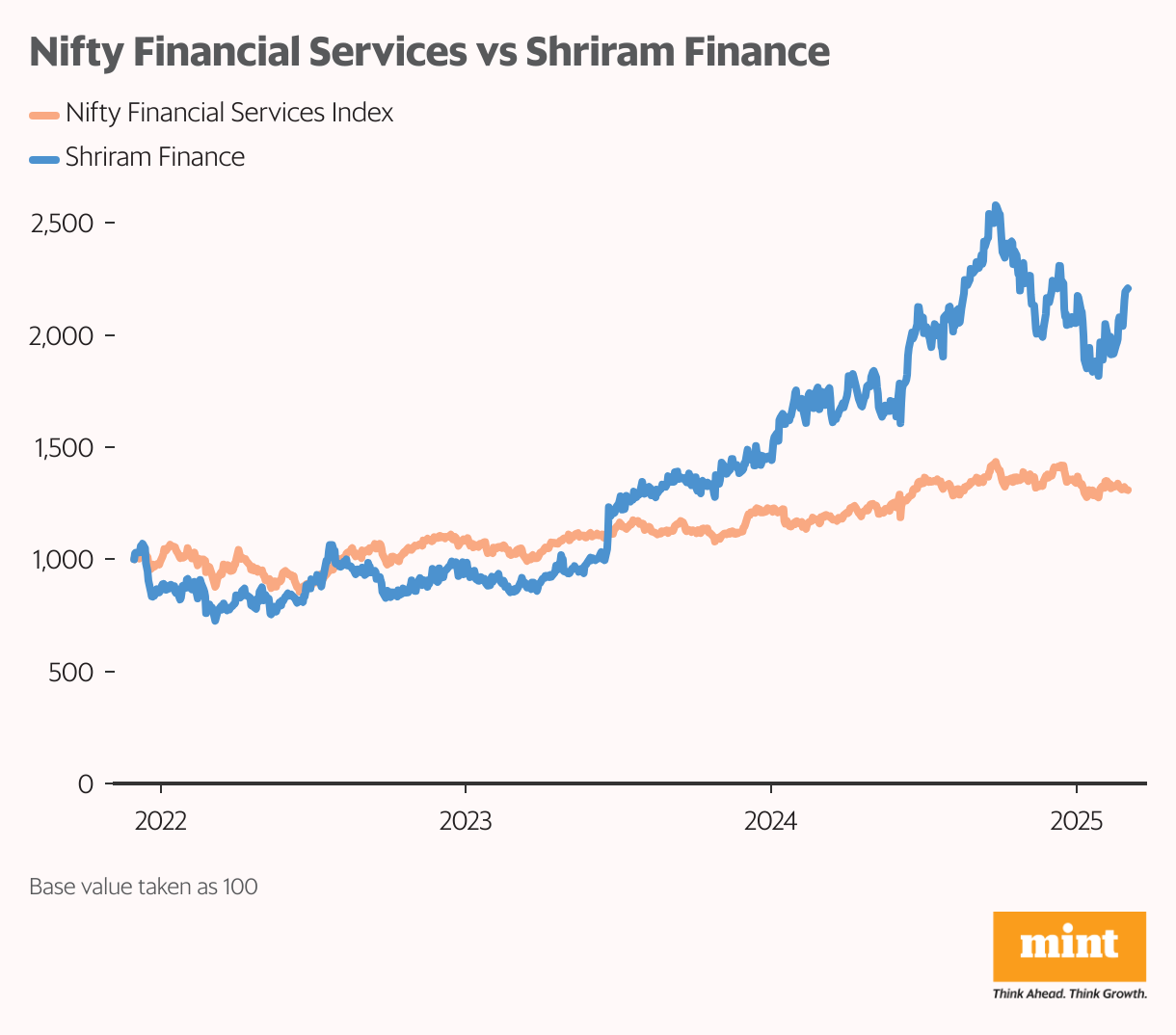

Reflective of this unlocked value and attractive valuation, Shriram Finance has been outperforming the broader Nifty Financial Services Index since early 2023. The outperformance widened after Shriram’s inclusion into the Nifty 50 index in March 2024.

Also Read: AU Small Finance Bank—weighed down by industry headwinds, but set for a turnaround

Growth in non-CV book

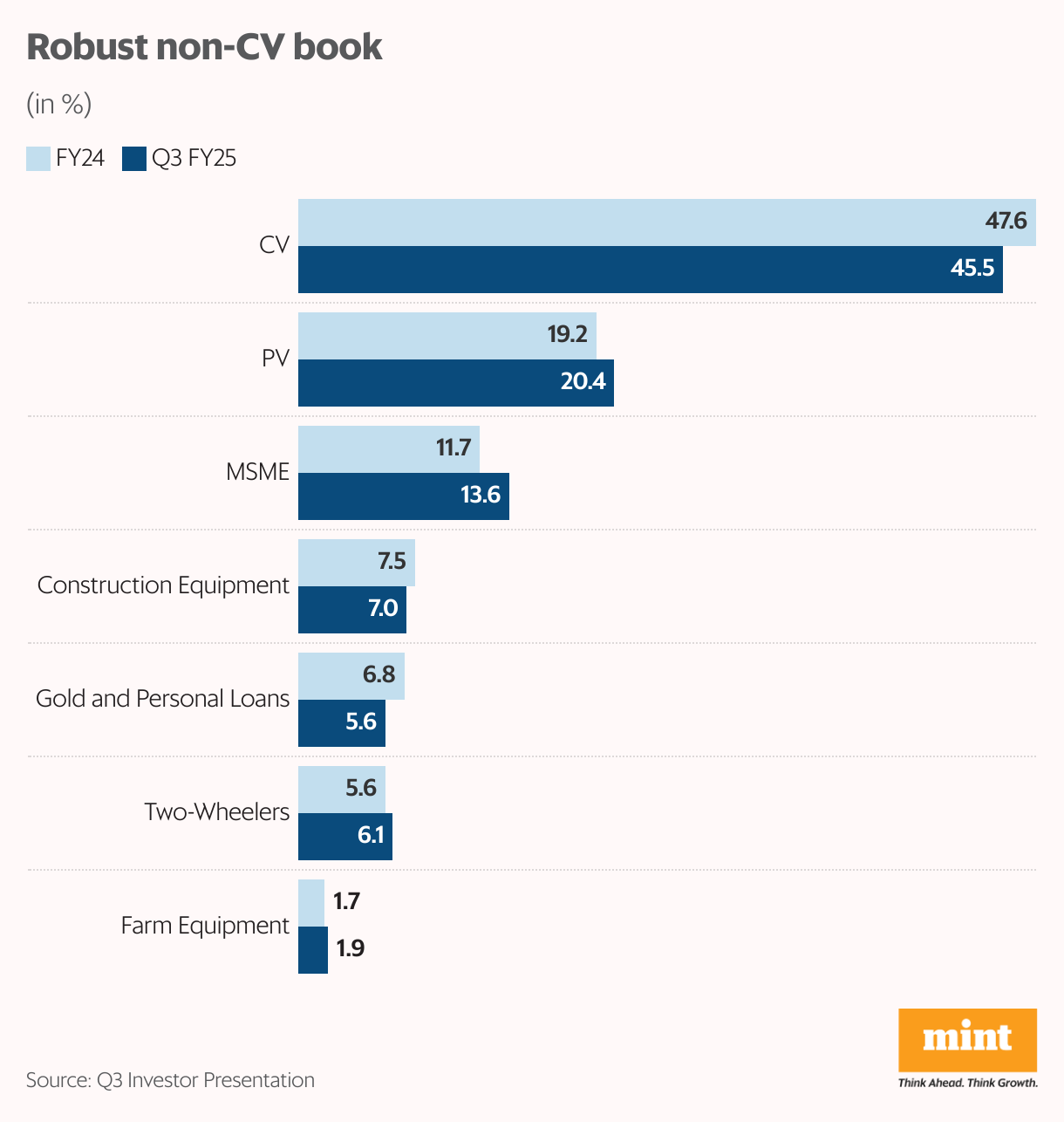

While Shriram Finance started as a pure commercial vehicle (CV) financier, it has actively diversified its loan book into other segments. Against overall AUM growth of 19% year-on-year, its CV book has grown by a modest 13%.

Meanwhile, its non-CV book, particularly, passenger vehicles (PVs), two-wheelers and MSMEs have grown much faster at 25-50% year-on-year. This has more than covered up for the decline in gold and personal loan segments following the regulator’s crackdown on the indiscriminate lending in personal loans and its guidance to reduce gold LTV (loan-to-value) ratio to 60-65%.

Shriram’s CV book now constitutes 45.5% of its total book, down from 52% in FY23, thereby reducing its vulnerability to economic cycles.

Also Read: EV financing no longer risky, says Shriram Finance’s executive vice chairman Umesh Revankar

But funding costs have eroded margins

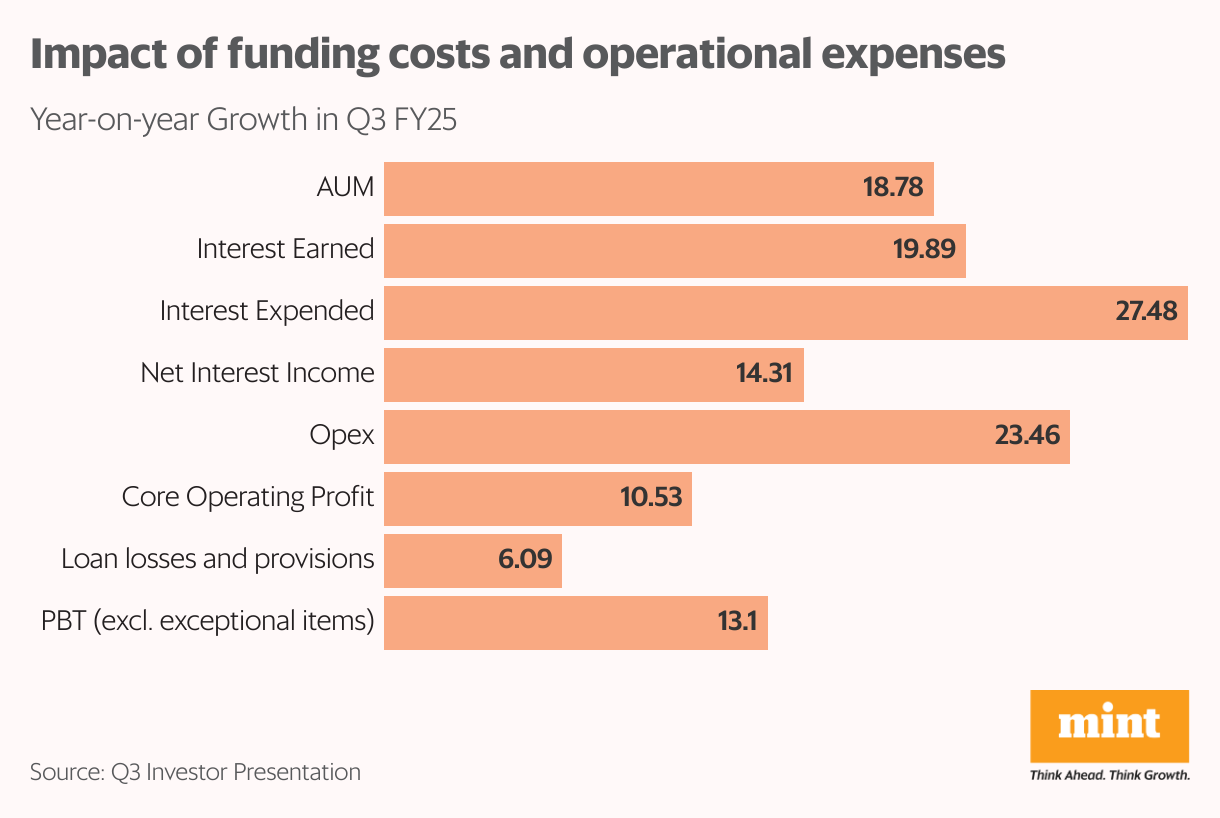

The diversification into high-yielding non-CV loans like MSME and personal loans has improved the book yield in Q3 FY25, resulting in 19.9% year-on-year growth in interest-income. That’s higher than the 18.8% growth in AUM seen during the period.

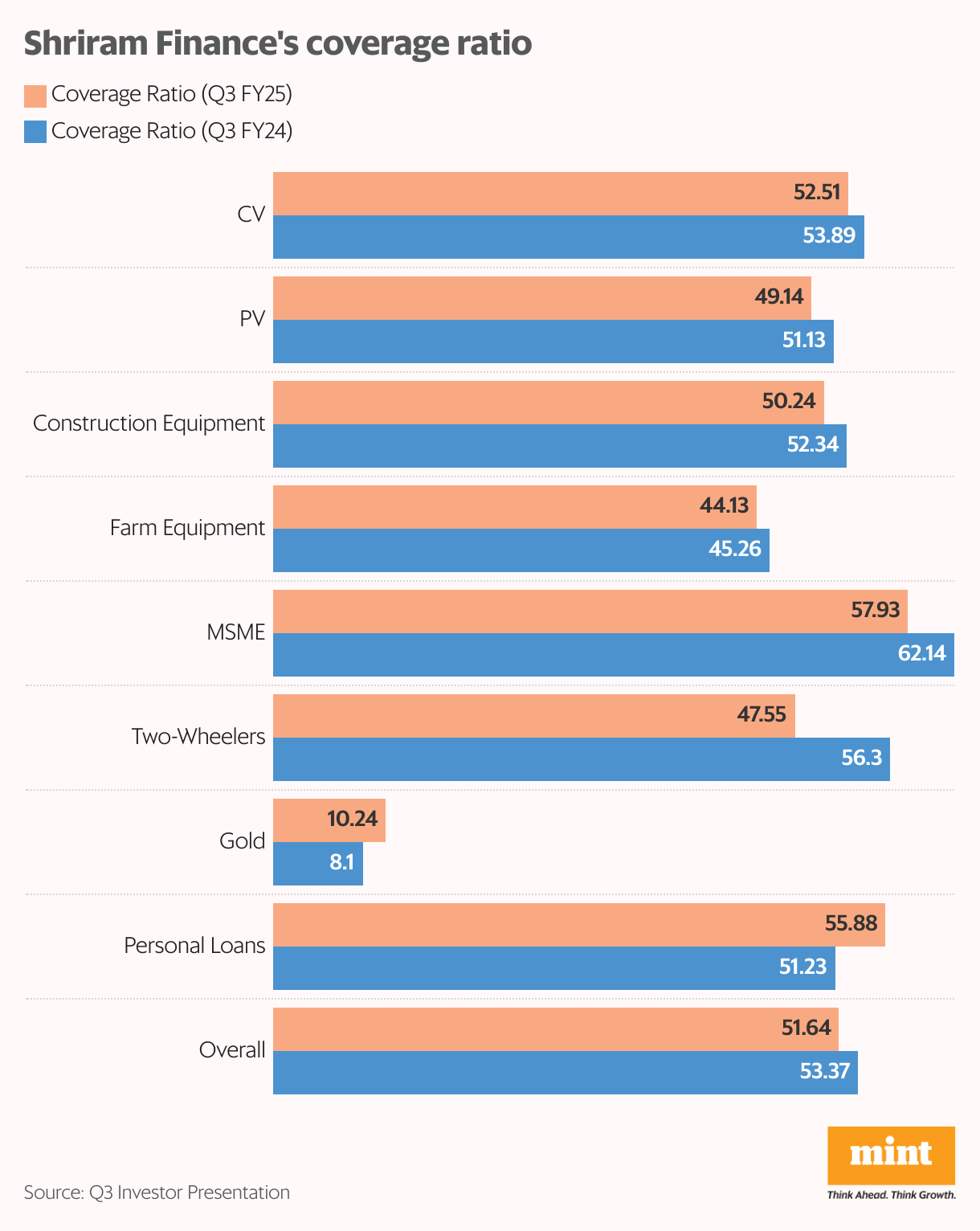

While diversification had helped expand its net-interest-margin (NIM) from 6.62% in FY22 to 8.37% in FY23 and 8.84% in FY24, owing to the recent stress in retail lending, Shriram Finance has had to increase provisioning towards gold and personal loans. But thanks to the currently small (and reducing) share of these loans in its book at 5.6% and reduced coverage in all other segments, its overall stage 3 coverage ratio has fallen. Gross NPA for the quarter came in at 5.38%, lower than 5.66% in the year-ago period. As a result, the loan losses and provisioning costs grew by only 6.1% year-over-year, thereby supporting the bottom line.

That said, due to high rates, increasing competition, and recent regulatory headwinds, funding costs have increased by 27.5% year-on-year. This has led to NIM compression from 8.99% in Q3 FY24 to 8.48% in the latest reported quarter. Combined with a 23.5% growth in operational expenditure, we are left with a relatively mellow 13.1% year-over-year growth in PBT, excluding exceptional items.

Industry tailwinds

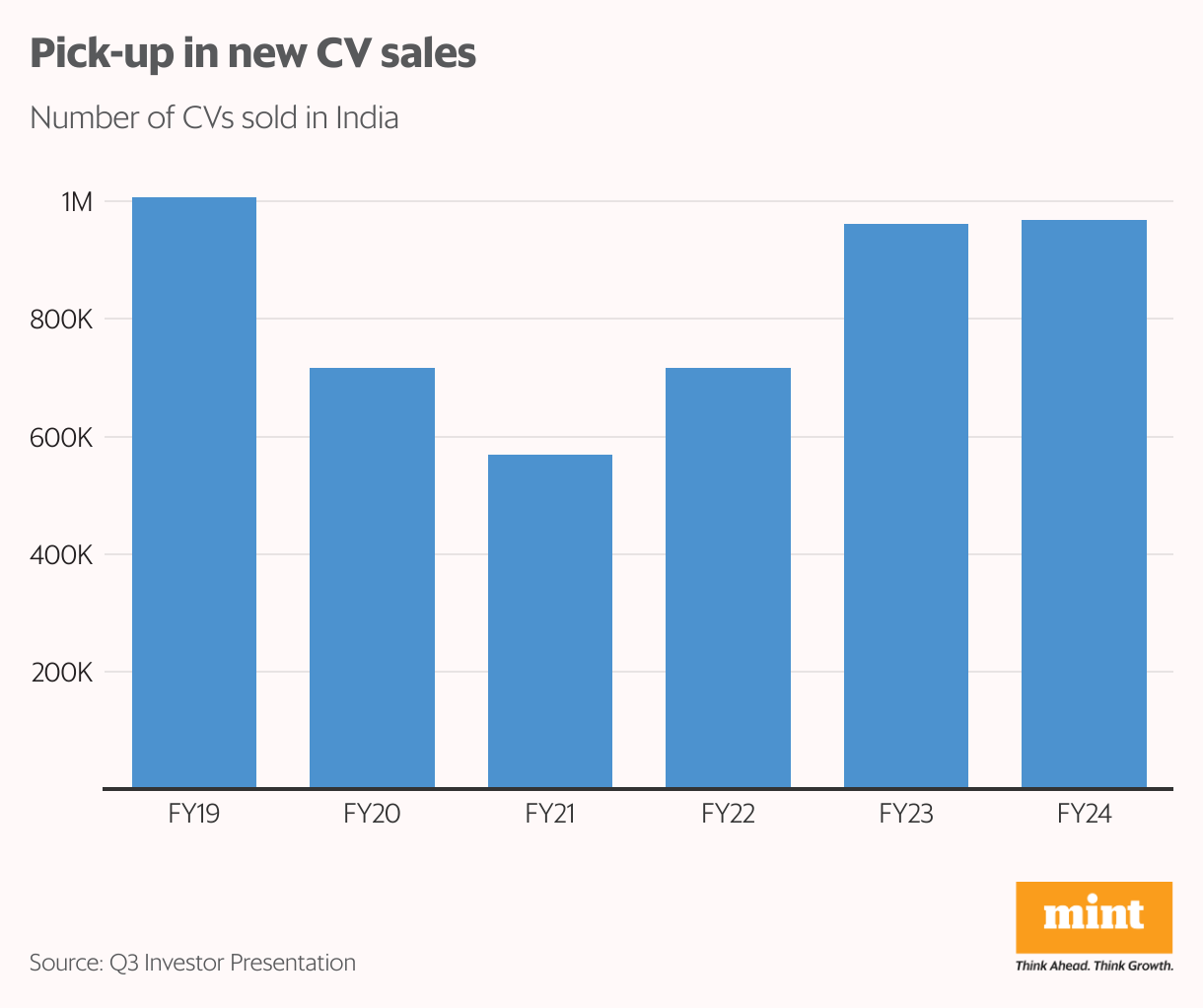

India’s economy just returned to the high-growth lane with 6.2% growth in Q3 FY25. Freight capacity is slated to grow 1.25 times faster than the economy. Furthermore, stringent regulatory norms around emissions and retiring older trucks are set to drive replacement demand. Sales of new CVs have picked up since FY21 to almost catch up with pre-pandemic levels.

Shriram Finance is primarily into used CV financing, with the used vehicle book constituting almost 70% of the lender’s total book. After the strong growth in new CV sales in recent years, used CV financing is expected to pick up pace. Moreover, 55-60% of the market for used truck financing is unorganized. This leaves room for growth of organized lenders such as Shriram, with their competitive lending rates. Of course, a slowdown in infrastructure-growth remains a risk.

Also Read: In our sector, trust and credentials are key: Shriram Finance’s Venkatraman

Regulatory drivers

RBI’s crackdown on loans to NBFCs had made credit costlier for NBFCs. But Shriram Finance commands a superior credit-rating. Also, compared to typical NBFCs which derive almost 50% of their funding from banks, Shriram has access to diversified sources of funding with bank-credit accounting for less than a quarter of its debt. So, it has been better placed to withstand the stress. And with the RBI’s recent reversal of higher risk-weights, bank-credit has become a more viable funding option.

The RBI started easing monetary policy in February after holding rates high for two years. Considering that NBFCs don’t have access to sticky low-cost CASA deposits, lower interest rates are expected to benefit NBFCs more than banks. Moreover, vehicle financing in India is typically done through fixed-rate loans. So, NBFCs focused on vehicle financing, such as Shriram Finance, are expected to witness a larger improvement in profitability as their funding costs moderate while their asset yields remain stable.

For more such analyses, read Profit Pulse.

Ananya Roy is the founder of Credibull Capital, a SEBI-registered investment adviser. X: @ananyaroycfa

Disclosure: The author does not hold any shares of the companies discussed. The views expressed are for informational purposes only and should not be considered investment advice. Readers are encouraged to conduct their own research and consult a financial professional before making any investment decisions.