(Bloomberg) — A global bond selloff accelerated in Asia on Thursday, pushing Japanese benchmark yields to the highest in more than a decade after heavy selling in German bunds spread across fixed income markets. Asian stocks were buoyed by a delay to some US tariffs on Mexico and Canada.

Most Read from Bloomberg

Japan’s 10-year yield touched 1.5% for the first time since June 2009, as the country manages rising inflation and higher borrowing costs. Treasuries fell, pushing the US 10-year yield higher for a third day to trade around 4.3%. Bund futures extended Wednesday’s decline while European equity-index futures rose about 1% ahead of the European Central Bank’s policy meeting.

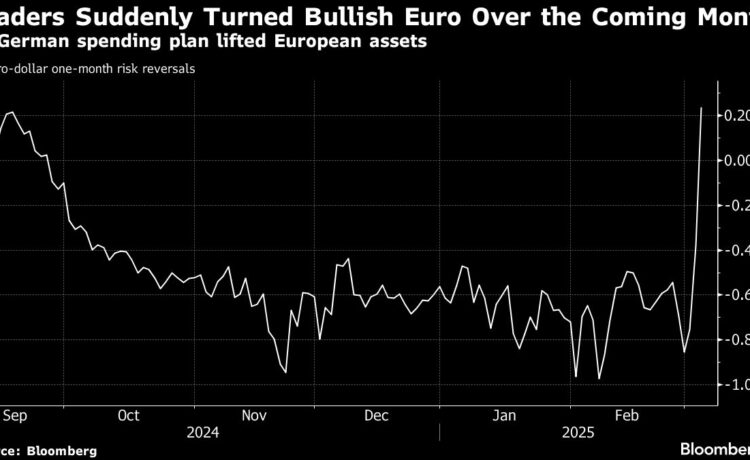

The moves show how geopolitical volatility over the past few weeks that includes fraying US support for Ukraine and whipsawing news on tariffs has impacted financial markets as traders gauge the impact on growth and inflation. Also weighing on the fixed-income markets is Germany’s historic plan to ramp up spending with Chancellor-in-waiting Friedrich Merz declaring his country would do “whatever it takes” to defend itself.

“The last time the bond market took note of a pledge to do ‘whatever it takes’ it came as relief,” Citi strategists led by Jamie Searle wrote, citing ECB President Mario Draghi’s pledge in 2012 to save the euro. This time, however, it “comes as a warning to bond valuations.”

The selloff was sparked by a sudden drop in German bonds that sent 10-year bund yields as much as 31 basis points higher Wednesday, the most since 1990. The euro had its best three-day rally since 2015 ahead of the ECB’s policy decision meeting on Thursday. Analysts polled by Bloomberg almost unanimously predict a quarter-point cut by the monetary authority. US data expected Thursday includes initial jobless claims ahead of Friday’s monthly payrolls figures.

Get the Markets Daily newsletter to learn what’s moving stocks, bonds, currencies and commodities

Listen to the Bloomberg Daybreak Europe podcast on Apple, Spotify or anywhere you listen.

Bund futures extended Wednesday’s decline, with markets paring wagers on further rate cuts by the ECB as expectations build around the scale of borrowing required to finance spending plans to counter the threat of Russian aggression.