No doubt USD investors will be kept on their feet by Trump in the coming weeks. Credit: Currencies Direct

Euro

EUR/GBP: Down from £0.84 to £0.82

EUR/USD: Unchanged at $1.04

The euro has traded in a wide range over the past month. Starting with a slump at the end of January as another European Central Bank (ECB) interest rate cut coincided with stagnant Eurozone GDP growth.

Early February extended the EUR selloff amid tariff threats from US President Donald Trump. Before the euro was able to claw back a good portion of its gains thanks to a weakening US dollar and the prospect of a peace deal in Ukraine.

However, the euro then came under pressure again as the exclusion of European representatives from US-Russia discussions on ending the war in Ukraine raised concerns about Europe’s influence in the peace process.

Looking ahead, the euro likely faces more bumps in the road as the fallout from Germany’s federal election, the Ukrainian peace process and erratic US trade policy are all likely to infuse volatility into the single currency.

Pound

GBP/EUR: Up from €1.18 to €1.20

GBP/USD: Up from $1.23 to $1.26

Trade in the pound has been erratic over the past month. In late January, Sterling strengthened due to improved UK economic optimism and Chancellor Rachel Reeves’ growth-oriented speech.

However, these gains were swiftly reversed after the Bank of England (BoE) delivered a dovish interest rate cut and halved its 2025 growth forecast.

An unexpected uptick in UK GDP brought fresh relief, before GBP investors largely shrugged off stronger-than-expected UK inflation and wage growth figures, on the expectation the BoE will still cut rates again in May.

Turning to March, the main focus for GBP investors will likely be the Chancellor’s Spring Statement. Expect any tax hikes or spending cuts to sap Sterling sentiment.

US Dollar

USD/GBP: Down from £0.81 to £0.79

USD/EUR: Unchanged at €0.95

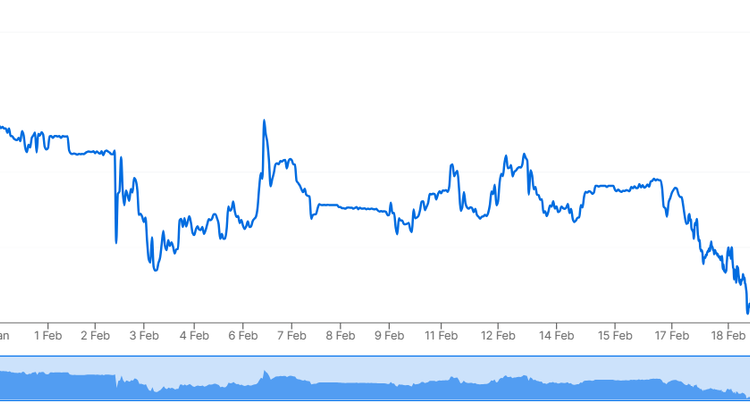

The US dollar has faced significant volatility in the first four weeks of Donald Trump’s second term in office.

This has been primarily driven by the President’s scattergun approach to his tariff announcements, with USD investors left reeling by his inconsistent position on trade.

On the more positive front for the US dollar was the Federal Reserve’s decision to pause its cutting cycle and a hotter-than-expected US inflation print.

No doubt USD investors will be kept on their feet by Trump in the coming weeks. With the President’s erratic policy announcements likely to infuse further volatility into the US dollar.

Currencies Direct have helped over 500,000 customers save on their currency transfers since 1996. Just pop into your local Currencies Direct branch or give us a call to find out more about how you can save money on your currency transfers.

Sponsored