Ford Motor Company: Understanding the automaker’s history, legacy

Explore the rich history of Ford Motor Company, from its groundbreaking assembly line innovations to iconic cars like the Model T, Mustang, and F-150.

- The move is considered risky due to weak EV demand and competition in the European market, but also sensible as Ford needs to make significant moves to gain market share.

- Ford aims to capitalize on its leading position in the commercial vehicle market and leverage the growing demand for EVs with new models like the Ford Explorer, Ford Capri and Ford Puma Gen-E.

- Despite recent job cuts in Europe, Ford believes this investment will help turn around its business in the region and increase its long-term competitiveness.

In a gamble to grow its business in Europe, especially commercial vehicle sales, Ford Motor Co. will invest $4.8 billion in its struggling German operations over the next several years, a move analysts characterize as risky but sensible.

Ford announced Monday that it will inject the money to support the ongoing transformation of its business in Europe and increase long-term competitiveness. The money will fund a plan to turn around Ford’s German subsidiary, Ford-Werke GmbH.

The Dearborn-based automaker has already made significant investments in its German operations in recent years, including a $2 billion upgrade of its plant in Cologne to produce electric vehicles.

“By recapitalizing our German operations, we are supporting the transformation of our business in Europe and strengthening our ability to compete with a fresh product portfolio,” Ford vice chair and former CFO John Lawler said in a statement. “To build a sustainable business in Europe, we also need to continue to simplify our governance, reduce costs and drive efficiencies.”

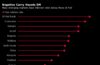

Wall Street analysts applauded the move, though they said that market is perilous at the moment. Germany cut off EV subsidies in December 2023, resulting in EV sales plunging 27.4% in 2024 from 2023. Similarly, Ford’s sales in Europe are down year over year.

“This is making a bet on the Europe market and a hedge against some tariff chaos Ford and others are dealing with,” said Dan Ives, managing director at Wedbush Securities. “There is also a view that Ford needs to make some big bets and this is the right time to bet on Germany and Europe. It’s risky, but makes sense. It’s a bet to gain share in the German market and also go after Tesla market share with Musk brand issues.”

Ford still ‘sees a path’ for turnaround

Tesla CEO Elon Musk has backed Germany’s far-right political party and with his ties to President Donald Trump, Tesla’s valuation has become tied to Musk’s politics. According to an article published Saturday by The Guardian, data released on Thursday showed that registrations of Tesla’s electric cars in Germany fell 76% to 1,429 last month.

While Ford might win some of those consumers, Europe is not firm ground for Ford. In November, Ford announced it would cut around 14% of its European workforce, blaming losses in recent years amid weak demand for EVs, poor government support for the shift to EVs and competition from subsidized Chinese rivals. Ford said the 4,000 job cuts would be primarily in Germany and the United Kingdom. Globally, the layoffs represent about 2.3% of Ford’s workforce of 174,000.

According to Ford spokesperson Dirk Ellenbeck, Ford sold 426,307 passenger vehicles in Europe last year, down from 513,481 for 2023.

In a statement Monday, Ford said this latest investment will help support sales growth in the region and it will help cover “the overborrowing position of Ford-Werke.” The investment, in part, allows Ford to retire a financial support letter that has been in place since 2006 and align Ford’s support of Ford-Werke with its other affiliates around the world.

Plus, it will fund a business plan to transform Ford’s European business over the next four years, said Ellenbeck. He added that the money will “expand our leading position in the commercial vehicle segment and increase Ford’s long-term competitiveness in Europe, particularly in the passenger vehicle segment.”

Morningstar autos analyst David Whiston said this investment signals Ford’s confidence in the European market, despite the struggles.

“They still see a path to turning things around and also don’t want to leave a large market,” Whiston said in an email. “(General Motors) was right to leave years ago. Even before the Chinese showed up there it was an overcrowded space and Volkswagan seemed like the only one to get scale among volume brands. Now it’s even more competitive there.”

Ford’s commercial vehicles and EVs

Whiston said Ford’s drive to stay in Europe rests on its commercial vehicle business, which could be highly lucrative for the automaker, adding, “the market doesn’t mind the cash use either, given the stock is up over 2% today.”In 2024, Ford expanded its European commercial vehicle segment, where it has been the top-selling commercial brand for 10 consecutive years, Ellenbeck said.

Ford also launched two new passenger EVs tailored to European customers: the Ford Explorer and Ford Capri, both built in Cologne, Germany.

Ford unveiled a third EV called the Puma Gen-E, which goes into production early this year in Romania and is expected to start at a price in the mid-$30,000 range.

Jamie L. LaReau is the senior autos writer who covers Ford Motor Co. for the Detroit Free Press. Contact Jamie at [email protected]. Follow her on Twitter @jlareauan. To sign up for our autos newsletter. Become a subscriber.