This was CNBC’s live blog covering European markets.

European markets closed lower on Wednesday as global traders brace themselves for a raft of fresh trade tariffs due to be announced by U.S. President Donald Trump’s administration.

After rebounding Tuesday, the regional Stoxx 600 index closed down 0.6%. Most sectors notched declines, though retail and utilities stocks posted slight gains.

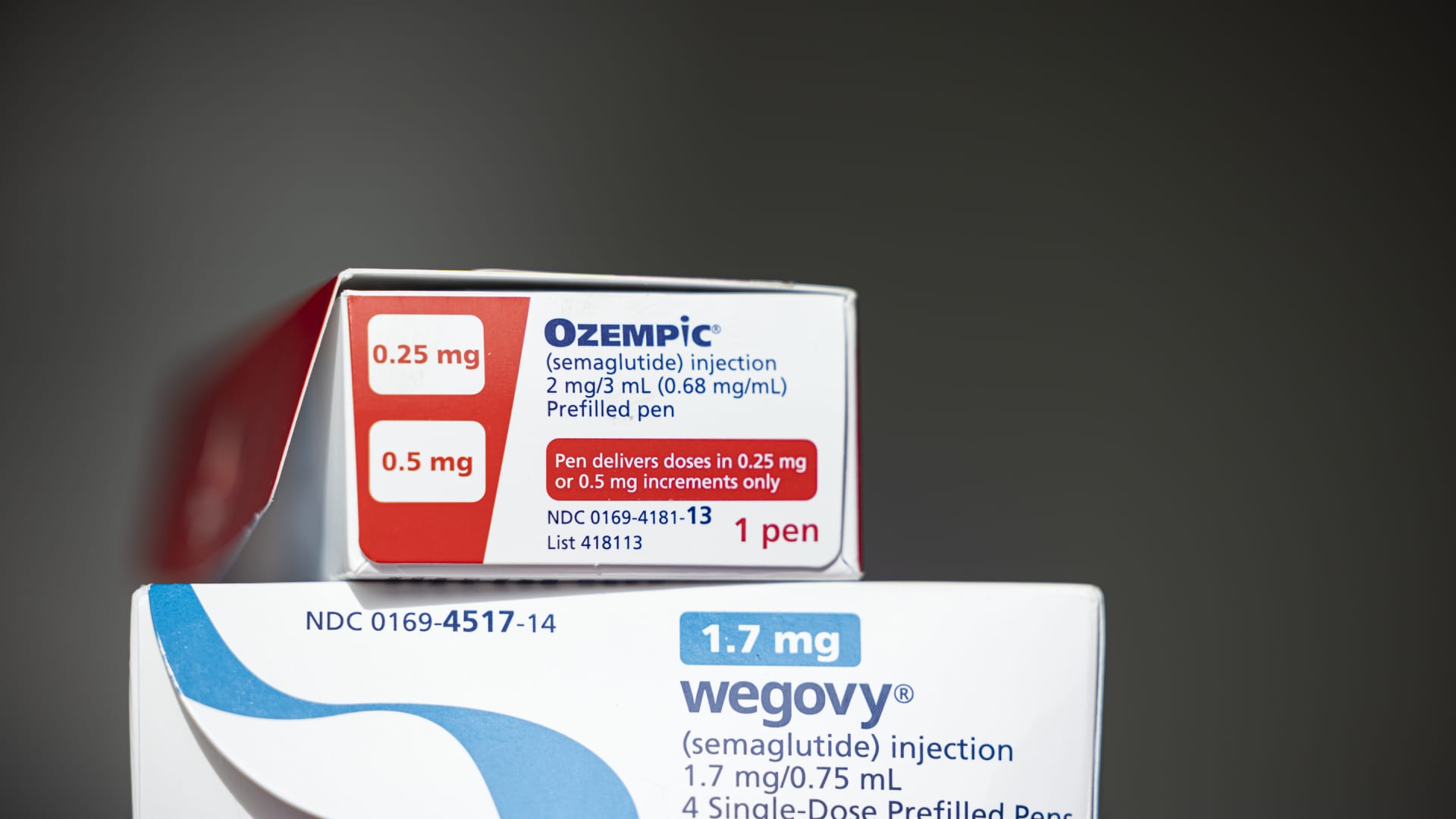

The Stoxx 600 healthcare index dropped nearly 2%, as hopes fade for any exemption from duties for the pharmaceutical sector. German pharma and biotech group Bayer was among the worst performers, down almost 4%.

Investors are concerned that the White House could be erring toward more punitive import duties after Trump said earlier this week that his “reciprocal tariffs” plan will target “all countries” when they are announced Wednesday, while the White House said that the tariffs “will be effective immediately.” An announcement is due after European markets close on Wednesday.

The Washington Post reported Tuesday that White House aides had drafted a proposal that would levy tariffs of roughly 20% on most imports. The paper, which cited three people familiar with the matter, noted that advisors cautioned that several options were still on the table, however, meaning the 20% tariffs may not materialize. CNBC reached out to the White House for comment and is awaiting a response.

Other trade duties are set to come into effect Wednesday, dubbed “Liberation Day” by the White House, including a 25% levy on “all cars that are not made in the United States.”

Asia-Pacific markets were mixed overnight, while U.S. stocks reversed course to trade higher on Wednesday.

Europe stocks close lower

European markets closed lower on Wednesday as global traders braced for fresh tariffs due to be announced by U.S. President Donald Trump’s administration.

The pan-European Stoxx 600 provisionally ended the session down 0.6%.

Germany’s DAX dropped 0.7%, France’s CAC 40 was lower by 0.2% and the U.K.’s FTSE 100 was down 0.3%.

— Sawdah Bhaimiya

Slovakia could be Europe’s biggest loser from Trump’s auto tariffs

A Kia Ceed Sportswagon plug-in hybrid electric vehicle (PHEV) in the quality control inspection area at the Kia Slovakia sro plant in Zilina, Slovakia, on Friday, Oct. 27, 2023.

Slovakia, the landlocked country east of Austria, could suffer the most from the new auto tariffs that Trump said will start to take effect Thursday.

“Germany’s car industry is in the eye of the storm and by far most exposed in terms of value, with major players like Volkswagen, BMW, Mercedes, and Porsche likely getting hit by tariffs,” economists Inga Fechner and Rico Luman of Dutch bank ING said in a recent research note.

“But Slovakia — home to several car plants — is most exposed in terms of total US export volume,” they said.

The nation of 5.4 million people produces more cars per capita than any other country in the world. And the “Detroit of Europe” relies heavily on U.S. trade, with autos comprising a major chunk of its U.S. exports.

— Kevin Breuninger and Sam Meredith

U.S.-Ireland relationship is ‘mutually beneficial,’ Irish minister says

Niamh Smyth, Ireland’s minister of state at the department of enterprise, trade and employment, discusses Trump’s tariffs and what they mean for Ireland and Europe.

U.S. Stocks open lower

U.S. Stocks opened lower for a third-straight day on Wednesday, with investors anxiously awaiting clarity on President Donald Trump’s tariffs.

The S&P 500 slipped 1%, while the Nasdaq Composite fell 1.4%. The Dow Jones Industrial Average pulled back 333 points, or 0.7%.

— Brian Evans

Scope of tariffs is still up in the air: Report

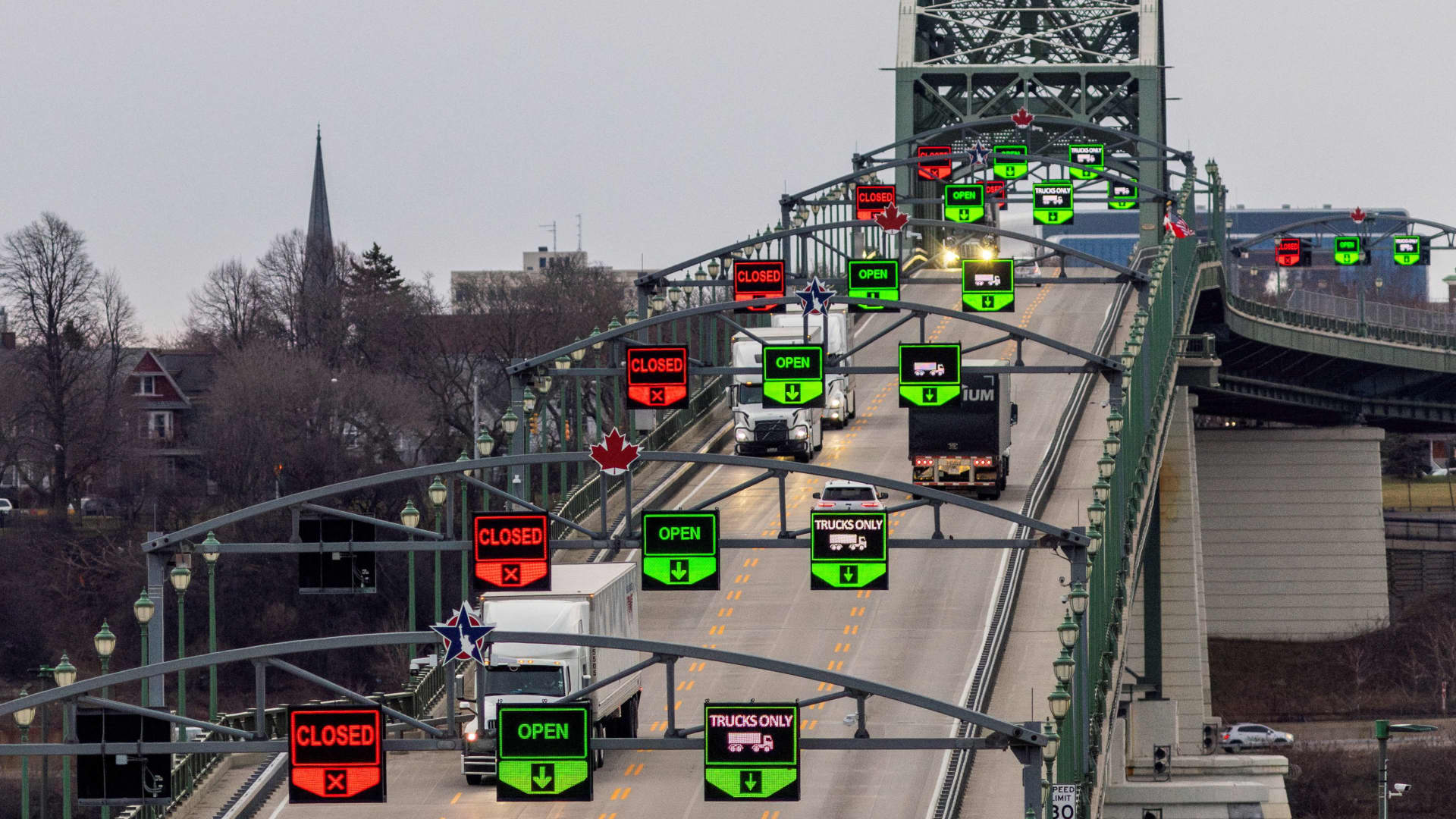

Vehicles cross the Peace Bridge connecting Canada and the United States amid the uncertainty of tariffs policy, at the Canada-U.S. border crossing in Fort Erie, Ontario, Canada April 2, 2025.

The scope of new tariffs has yet to be finalized by the White House, the Bloomberg news service reported.

“The White House has not reached a firm decision on their tariff plan,” Bloomberg reported, citing people familiar with the plan.

Several options are under consideration at the White House. One is a universal flat tariff rate applied to all trade partners, while another would tailor tariffs to each trade partner.

A third option prepared by the U.S. Trade Representative’s office would apply a flat rate to a select group of countries.

— Dan Mangan

Eutelsat rolls out internet service on business flights

A satellite dish in a ground network of satellites at Eutelsat’s Madeira office. Photographer: /Bloomberg via Getty Images

Shares of Eutelsat rose on Wednesday as the French satellite group said that its low Earth orbit (LEO) services for business flights are “live and operational.”

In a statement, Eutelsat said that it now has both LEO and geostationary orbit services in deployment with Air Canada via Intelsat, which signed a seven-year deal with the company last year to use its LEO satellite constellation.

Eutelsat’s LEO satellites are provided by Britain’s OneWeb, which merged with the company in 2023.

Eutelsat said it’s also working with in-flight broadband provider Gogo to equip Embraer’s Phenom 300 business jets with satellite connectivity.

It’s the latest example of how the satellite firm is looking to advance commercial use of its services and compete with Elon Musk’s Starlink venture.

Shares of Eutelsat have been volatile in recent weeks amid speculation over the firm potentially looking to replace Starlink’s services to Ukrainian forces battling Russian troops.

The company’s stock was up about 2% early Wednesday afternoon.

— Ryan Browne

UK market ‘continues to shrink in size,’ AJ Bell says

LSEG signage is seen on screens in the lobby of the London Stock Exchange in London, Britain, May 14, 2024.

In a note on Wednesday, Dan Coatsworth, investment analyst at AJ Bell, cast doubt on a resurgence of listings on London’s public markets.

“The UK market’s big IPO comeback is conspicuously absent,” he said. “There were only four floats in the first quarter of 2025 versus 15 takeover situations, meaning the UK market continues to shrink in size.”

AJ Bell noted, that in the first quarter of this year, four companies went public in London: Achilles Investment Company, One Health, RC Fornax and Wellnex Life.

“The names that did join the UK market this year were all tiny, the biggest being activist investment trust Achilles Investment Company with a mere £54 million ($69.9 million) valuation,” Coatsworth said.

— Chloe Taylor

Trump’s tariffs to be ‘negative’ across the world, ECB’s Lagarde says

U.S. President Donald Trump’s tariffs are likely to be “negative” across the world, European Central Bank chief Christine Lagarde said Wednesday.

“The density and the durability of the impact will vary depending on the scope, on the products targeted, on how long it lasts, on whether or not there are negotiations,” she said during an interview on Ireland’s Newstalk radio, Reuters reported.

Lagarde explained that as the escalation of tariffs is “harmful” for all sides, they can prompt negotiations and therefore lead to some barriers being removed eventually.

The ECB president also said that predictability was “in short supply,” according to Reuters, noting that it was still unclear what the deal with the U.S. could be for the rest of the world.

Lagarde has in recent weeks and months repeatedly suggested that the economic outlook is uncertain, and that the Trump administration’s measures, as well as any response from trading partners, would likely weigh on economic growth.

— Sophie Kiderlin

Brighton Pier Group shares plunge more than 59% after delisting proposal

A rider and scooter pass the Brighton Palace Pier on the seafront on April 14, 2024 in Brighton, England.

Shares of Brighton Pier Group plummeted 59% by 10:40 a.m. U.K. time, after the company proposed delisting its stock.

The group — which owns multiple businesses across Britain, including Brighton Palace Pier on the U.K.’s south coast, minigolf sites and bars — announced Wednesday that it wanted to remove its shares from London’s FTSE AIM index at a rate of 25 pence ($0.32) per share to go private.

It has traded as a public company since 2013.

— Chloe Taylor

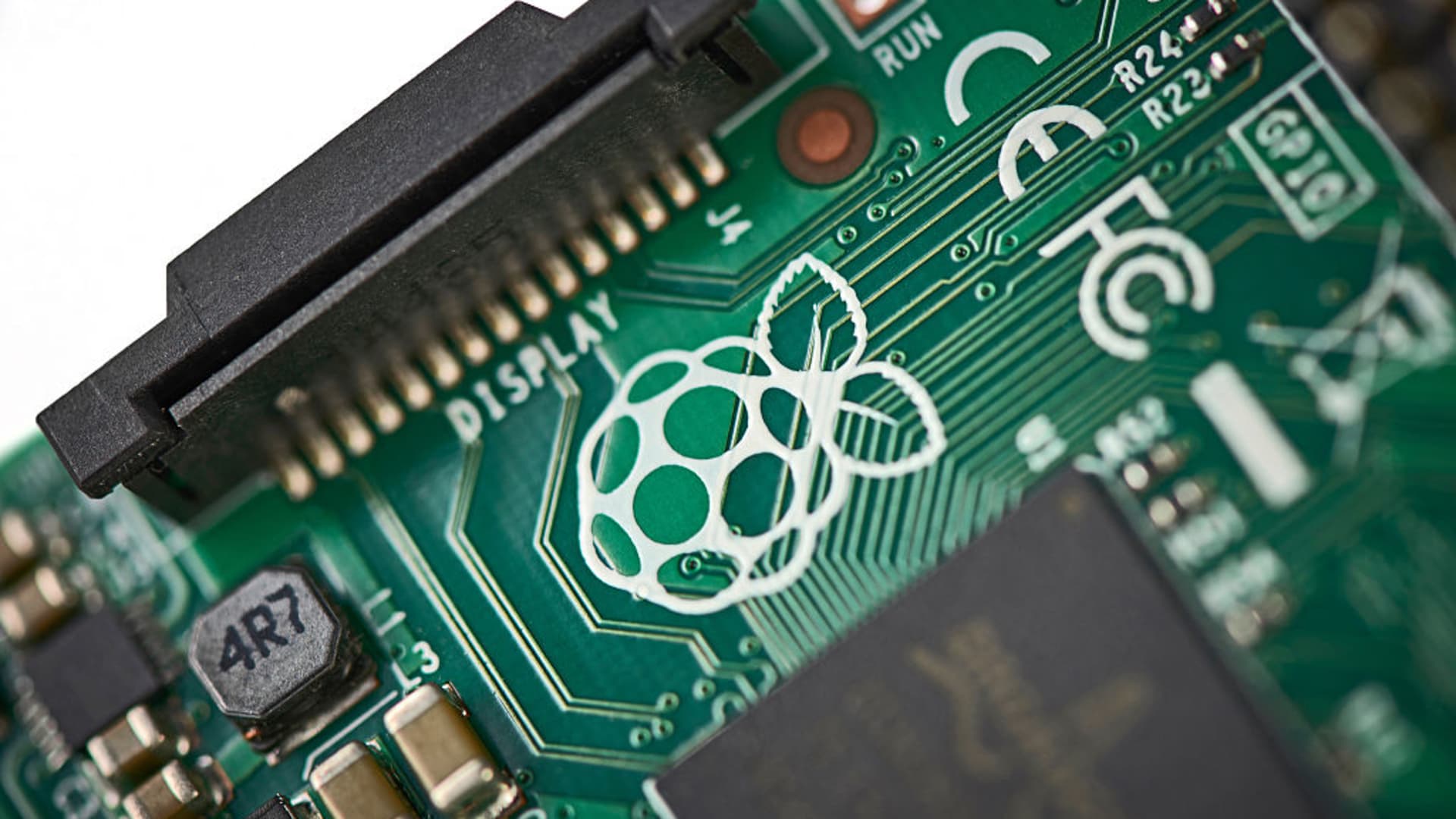

Sony-backed Raspberry Pi posts 57% profit plunge

A Raspberry Pi 2 Model B single-board computer.

British computing startup Raspberry Pi reported a 57% drop in profit for the fiscal year 2024, in the company’s first earnings report since its London listing.

Pre-tax profits at the firm sank to $16.3 million — less than half the $38.2 million of profit it reported a year earlier. Full-year revenue also slipped, dropping about 2% year-over-year to $259.5 million.

Raspberry Pi is best known for manufacturing tiny single-board computers. It was established by CEO Eben Upton with the aim of making computing more accessible to young people.

Raspberry Pi’s computers can be used to power a whole range of uses. While they initially gained traction with hobbyists, today the firm is targeting large industrial players with its products.

The company went public in June 2024, in an initial public offering that raised £166 million ($214.6 million). Shares of the company — which have rallied over 80% from their IPO price — were up about 9% Wednesday.

— Ryan Browne

Tariffs will be a ‘game-changer’ for some pharmaceutical companies: Sydbank

Jacob Pedersen, head of equity research at Sydbank, told CNBC’s “Squawk Box Europe” on Wednesday that a trade war could dampen the ability of pharmaceutical companies to invest and earn money in the future, noting that tariffs were a new challenge for the sector.

— Chloe Taylor

Investors are turning bearish on the U.S. dollar as Trump tariffs loom

Foreign currencies advertised in a window in Times Square, one of New York’s and the nation’s top tourist attractions, on March 28, 2025.

The rollout of U.S. President Donald Trump’s tariffs regime is dampening sentiment on the dollar and prompting investors to look elsewhere for their foreign exchange trades, strategists told CNBC.

Market watchers said they see potential upside for the euro, the British pound and Australia and New Zealand’s currencies.

— Chloe Taylor

Danger for markets is that tariff uncertainty drags on: RBC Brewin Dolphin

Uncertainty may keep having a “spook effect” on markets even after U.S. President Donald Trump’s highly anticipated tariff announcement on Wednesday, Zoe Gillespie, chartered wealth manager at RBC Brewin Dolphin, told CNBC’s “Squawk Box Europe” on Wednesday.

“The danger is we don’t get much clarity for a long period of time … that could delay any peak bottom signals,” she said.

Gillespie said it was unlikely that full details on tariffs would be announced Wednesday, with other unknowns including whether trade partners such as the European Union would announce retaliatory tariffs, and the impact on inflation and interest rates.

“It’s been really difficult because you’re trying to prepare for something you don’t really know the detail of… for sectors it’s whether there is a degree of supply chains globally, or whether at this stage you’re looking at more domestic-focused companies that are less reliant on that. The service sector is another unknown as well,” she said.

— Jenni Reid

Credit Agricole scores European Central Bank permission to hike Banco BPM stake up to 19.9%

A branch of the French Credit Agricole bank is seen in Warsaw, Poland.

The European Central Bank has authorized Credit Agricole to raise its stake in Italian lender Banco BPM up to 19.9%, the French bank said Wednesday.

The ECB’s permission is a prerequisite for stakeholders to increase their position in a lender within the European Union past certain thresholds.

Credit Agricole on Wednesday disclosed it has gained a 9.9% stake in Banco BPM through derivatives since the fourth quarter of last year. It plans to exercise physical delivery of Banco BPM shares underlying that position and bring its holding to 19.8% of the Italian lender’s share capital.

“Crédit Agricole S.A. does not intend to launch a public offer for the capital of Banco BPM,” the French bank said. Banco BPM has already drawn the takeover sights of Italian rival UniCredit, which earlier on Wednesday revealed Italian regulators had authorized its offer document.

— Ruxandra Iordache

Europe stocks open lower

European stock markets opened lower Wednesday, with the Stoxx 600 index down 0.36% at 8:04 a.m. in London.

France’s CAC 40 and Germany’s DAX were both down around 0.35%, while the U.K.’s FTSE 100 fell 0.18%.

— Jenni Reid

Investors will be assessing scale of upside on tariffs, economist says

The Trump administration has guided that it will impose “maximum” reciprocal tariffs on trading partners on April 2, but the scale of the upside scenario is still to be gauged, Florian Ielpo, head of macro at Lombard Odier, told CNBC on Wednesday.

Ielpo said that according to his calculations, markets were pricing an effective tariff rate of between 6% and 10%, accounting for elements like import levels and exemptions.

“Markets are ready for that, they’ve been discounting the immediate effect of that — not the long-term, forward effect of that because it’s very difficult to know,” Ielpo said.

“The worst-case scenario is probably something in the region of 17%, which would be the largest increase in tariff duties we would have seen in 125 years of tariff data. For that, the Vix [Volatility Index] is clearly not high enough.”

“The key message for markets is rather than looking at sectors, [look at] the overall level of tariffs and the scale of magnitude with which they will be applied,” he added.

— Jenni Reid

Italian regulator approves UniCredit’s offer document for Banco BPM bid

The Commerzbank AG headquarters, in the financial district of Frankfurt, Germany, on Thursday, Sept. 12, 2024.

Italian securities regulator Consob on Wednesday approved the document of UniCredit‘s takeover bid for Italian domestic peer Banco BPM, UniCredit said in a release.

The offer, which has been greenlit for a tender period between April 28 and June 23, entitles holders of each Banco BPM share to 0.175 newly issued UniCredit ordinary shares with regular dividend rights.

On the footsteps of building and increasing a surprise stake in Commerzbank late last year, UniCredit unexpectedly launched a $10.5 billion takeover offer for Banco BPM in November. Banco BPM at the time responded that the bid did not reflect its profitability and potential for further value creation.

— Ruxandra Iordache

Europe’s pharma industry braces for tariffs

Containers of Ozempic and Wegovy seen at Children’s Hospital in Aurora, CO, Nov. 18, 2024.

Europe’s pharmaceutical sector is bracing for the potential impact of U.S. tariffs as hopes of an industry-wide exemption by U.S. President Donald Trump fade.

The pharmaceutical industry has until now been exempt from trade levies, but Trump confirmed last week that he would soon impose tariffs on the sector.

Drugmakers are now lobbying the president for a phased approach to duties on imports to the U.S., Reuters reported Tuesday, citing four sources familiar with the discussions. The sources said the levies may not be announced Wednesday but were likely inevitable.

— Karen Gilchrist

European markets: Here are the opening calls

European markets are expected to open lower Wednesday as global traders prepare for U.S. President Donald Trump’s trade tariffs.

The U.K.’s FTSE 100 index is expected to open 24 points lower at 8,558, Germany’s DAX down 38 points at 22,501, France’s CAC 4 points lower at 7,872 and Italy’s FTSE MIB 74 points lower at 37,977, according to data from IG.

There are no major data releases Wednesday. Earnings are set to come from Raspberry Pi.

— Holly Ellyatt

White House considering roughly 20% tariff on most imports, report says

White House aides have drafted a proposal that would levy tariffs of roughly 20% on most imports, The Washington Post reported Tuesday.

The report cited three people familiar with the matter. It also said White House advisors cautioned that several options are still on the table, meaning the 20% tariffs may not come to pass. Another plan being considered is the country-by-country “reciprocal” approach, according to the Post.

The report comes a day before April 2, when President Donald Trump is set to announce his larger plans for global trade. The date has loomed over Wall Street, where stocks have been struggling in part due to uncertainty around rapidly changing global trade policy.

— Jesse Pound