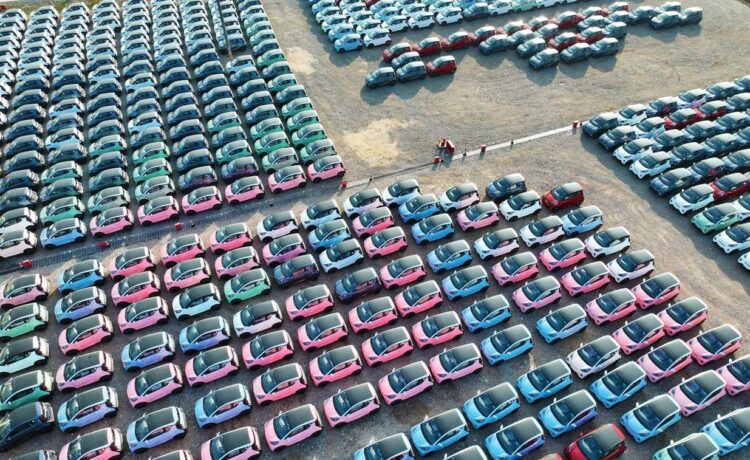

Chery small electric cars in China (Photo by Wang Yushi/VCG via Getty Images)

If European manufacturers don’t produce mass-market electric vehicles soon they will fail to meet tough quotas for EV sales or leave the field open to cheap and cheerful little Chinese battery-powered vehicles.

Experts say there is little likelihood of any European equivalents of the BYD Seagull or Wuling Bingo city cars appearing anytime soon. The only hope for the European Union and U.K. auto industries is a relaxation of the rules sending internal combustion engines to an early grave. (SAIC owns about half of Wuling and General Motors 34%).

Green lobby group Transport & Environment begs to differ, saying European technological advances will lead to more affordable EVs.

European governments insist EVs must win at least 80% of all sales by 2030. In 2024 in Britain similarly, the quota is 22% rising steadily through 2030 to 80% and on to 100% by 2035. In the EU, a formula based on weight and carbon dioxide emissions will force a similar ratio of sales increases and penalties for failure. It has relaxed the rules in 2035 to allow a limited number of ICE vehicles powered by synthetic fuel.

U.S. rules are slightly easier, with the EPA proposing 67% of sales by 2032 are EVs. California and U.S. states, which take its lead, want to ban the sale of new ICE cars by 2035, although allowing a limited number of plug-in hybrid electric vehicles.

The European plan assumes truly affordable EVs are available in huge numbers. The trouble is European manufacturers have been asleep at the switch. EVs for average wage earners are unavailable.

European manufacturers talk about “affordable” new cars starting at around €25,000 ($27,400) after tax, but average wage earners might well scoff at the thought. Until recently little ICE cars like the Ford Ka, Citroen C1, Peugeot 108, SEAT Mii, and Renault Twingo were available from around €12,000 ($13,150). But EU regulations aimed at crippling ICE sales have raised entry-level prices closer to €20,000 ($21,900). Most EV prices start at around €30,000 ($32,900) and average more like €50,000 ($54,800).

BYD Seagull small electric car. (Photo by VCG/VCG via Getty Images)

Little EVs like the BYD Seagull sell for well under $10,000 in China and could be sold in theory in Europe for close to that figure. These little EVs would have a range of about 100 miles and a top speed close to 60 mph. They can accomplish perhaps 90% of regular motoring requirements. Most EVs now have poor long-distance utility.

Electric vehicle sales in Europe have ridden the crest of a wave of well-heeled early adopters and corporate sales driven by government subsidies. However, just as the easy sales are petering out, European Union rules demand they jump by a factor of more than four by 2030.

These targets are crucial to the future of the European automotive industry because there are huge penalties for failure. For every sale of an ICE vehicle over the limit in Britain, there’s a fine of £15,000 ($16,450). According to a report by Autovista24, Ford, Toyota and Nissan are the most exposed in the U.K. AutoVista said a complicated formula allows the uncompliant to buy EV rights from the likes of all-electric Tesla while they bolster battery power.

Investment researcher Jefferies said in December EV sales in Europe will rise to 8.9 million in 2030 from 2.1 million in 2023, although this is a cut from its previous month’s forecast of 9.3 million. Investment bank UBS’s December report forecast 2030 sales of 9.6 million. However, expect this to be revised down in the wake of the shakeout in the last quarter of 2023, when Ford, GM, VW and Mercedes had to reevaluate their electric car plans, which, particularly in the U.S., had led to large stocks of unsold vehicles.

British-based automotive analyst Charles Tennant wonders whether EU and U.K. quotas are attainable.

“While wealthy first adopters and U.K. company car users, who are enjoying significant tax advantages of driving an EV, have been lapping up EV’s, the same cannot be said for the mass market customers who are being left behind in the race to an electrified automotive future,” Tennant said.

“Legislators should encourage a trend towards smaller urban city EV cars with research and investment tax breaks for manufacturers and purchase price rebates for customers whilst progressively increasing the taxation of petrol (gasoline) and diesel fuel. Merely setting targets for EV sales is clearly only one half of the equation,” Tennant said in an email exchange.

Tennant said the slowdown in EV sales was thought to be just about high prices, range anxiety and battery life. But other stumbling blocks have emerged as insurance costs have spiked, repair services have struggled while poor residual values undermine leasing finances.

The Dacia Spring is probably the cheapest EV in Europe with prices starting at about $23,000 after … [+]

“That is why legislators (in the U.K. and EU) need a serious rethink to steer the industry in another direction to enthuse mass market customers in considering an EV ahead of any total ban for ICE cars,” Tennant said.

Frank Schwope, Automotive Industry lecturer at the University of Applied Sciences FHM Hannover, agrees there should be some dilution in the government timetable towards 2035.

“Political decisions in Europe in favor of the combustion engine are conceivable in order to protect the European car industry,” said Schwope, a former investment banker at NordLB.

“In the next few years, a wave of more than 20 Chinese manufacturers will come to Europe, of which 5-10 will stay. Market shares of 10-15% for Chinese car manufacturers in Europe are realistic. Calls for protectionist measures will become louder. We can only hope that politicians decline because then the Chinese will also take protectionist measures. In the end, everyone would lose out, especially consumers,” Schwope said.

Brussels-based green lobby group Transport & Environment doubted cheap Chinese city cars would be very competitive once EU safety requirements were met and the 10% tariff added.

Julia Poliscanova, T&E’s Senior Director of Vehicles and Supply Chains, said cheaper batteries, mass production techniques and innovative battery chemistries in Europe would help develop more affordable EVs here.

“Citroen, Renault and VW all announced even lower-priced BEV models for 2025. The issue is not that producing cheap BEVs in Europe is impossible, but that European carmakers purposefully exit the small segment in favor of higher profit large cars,” Poliscanova said.

“I hope for their own survival sake they change the strategy, as prioritizing compact BEVs in Europe is the best way to avoid the flood of small Chinese EVs. Overall, a €20,000-€25,000 priced BEV in Europe in 2025 is an affordable option. Most new fossil cars cost as much. And no one can predict the innovations or cost reductions that are feasible by 2030, but the ICE history tells us the price will only go down,” Poliscanova said.

Last week, VW reportedly delayed the introduction of its “affordable” €25,000 ID.2 from 2025 until May 2026. It’s unlikely that average wage earners in Europe will find €25,000 affordable.

In Germany, Europe’s biggest market, an abrupt termination of EV subsidies has shocked manufacturers.

Wuling Bingo electric subcompact. (Photo by VCG/VCG via Getty Images)

“Electric cars are being put on the hard shoulder in Germany,” said Professor Ferdinand Dudenhoeffer, director of the Center for Automotive Research in Bochum.

“According to our projections, 200,000 fewer fully electric new will be sold in Germany in 2024. BEV’s market share could then be around 10% in Germany,” Dudenhoeffer said.

Dudenhoeffer said a second shock could be punitive tariffs on Chinese imports, if the EU decides there were unlawful subsidies. That would mean EV prices in Europe would remain high and demand weaken.

“Politics in Europe will be responsible for the European and German car industry falling behind China and Tesla. It seems that the politicians in Europe will become the biggest danger for the future of our car industry,” Dudenhoeffer said.

British analyst Tennant thought political inaction would be dangerous for Europe.

“If (legislators fail to persuade manufacturers to make small city cars and help consumers buy them) an existential threat may devastate the European legacy industry as alternative EV propositions from Asia arrive here in their droves at a product performance and price point that consumers will accept,” Tennant said.