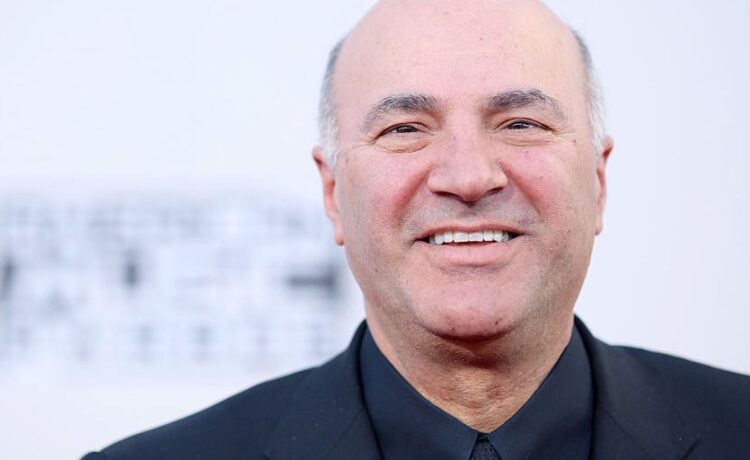

- “Shark Tank” star Kevin O’Leary told Fox Business on Thursday that he would never buy a bitcoin ETF.

- Paying fees is “completely unnecessary,” he said, noting that he already owns the token.

- But he welcomed the ETFs’ approval as a meaningful step in improving US crypto regulation.

Spot bitcoin ETFs may be a milestone for the US crypto industry, but “Shark Tank” star Kevin O’Leary doesn’t see much point in joining the frenzy.

That’s because the ETF issuers are charging fees, though some are offering temporary waivers.

“If you’re a purist and you’re just holding bitcoin for the long term as a digital gold as I am, I would never buy an ETF,” he told Fox Business on Thursday. “Why would I pay these fees? It’s completely unnecessary, and they add no value to me.”

Meanwhile, he sees little chance that all 11 of the bitcoin ETFs approved by the SEC on Wednesday will “survive.”

Instead, he expects two or three to emerge from the pack, echoing a prediction made by Galaxy Digital CEO Mike Novogratz.

“I would bet that behemoths like Fidelity and BlackRock end up on top because they have massive sales forces,” O’Leary said.

Despite his personal skepticism about investing in the new ETFs, he still considers their regulatory approval as a meaningful step in advancing the crypto industry.

O’Leary hopes that the ETFs could also spur lawmakers to look at digital payments systems, such as the dollar-linked stablecoin USDC.

“Now, we have this momentous occasion, which is great. But we’re way early, we’re in the first inning,” he said.

Meanwhile, O’Leary said in a separate CoinDesk interview that bitcoin has the potential to triple in price by 2030, hitting $150,000-$250,000.

But he said Cathie Wood’s bull case for bitcoin to reach $1.5 million by 2030 would only happen if there’s an economic catastrophe.

“For bitcoin to appreciate that quickly to that price would mean that the US economy had somehow faltered in my view,” he said. “So no, I don’t agree with that price point.”