Above: File image. Francois Villeroy de Galhau, Governor Banque de France, Image: Deutsche Bundesbank, Nils Thies.

The Euro to Dollar exchange rate should theoretically be higher due to recent communications that cast doubt on the odds of an imminent European Central Bank rate cut.

However, the Euro-Dollar has fallen at a decent clip after members of the ECB’s Governing Council pushed back against the odds of interest rate cuts starting as soon as May.

“Dovish expectations for the major central banks suffered a setback on Tuesday after ECB Governing Council member Robert Holzmann cast doubt on the prospect of any rate cuts in 2024,” says Raffi Boyadjian, Lead Investment Analyst at XM.com.

Holzmann told the World Economic Forum in Davos that heightened geopolitical risks in the Middle East are posing a significant threat to inflation. Holzmann sounded downbeat on the likelihood of the disruptions to shipping in the Red Sea ending quickly, prompting him to warn that “we should not bank on the rate cut at all in 2024”.

The FX playbook says the retreat of ECB rate cut bets should support Euro exchange rates, all else equal.

‘All else equal’ is key here: not only are ECB rate cut bets fading, but they are falling everywhere else, denying the Euro any idiosyncratic support.

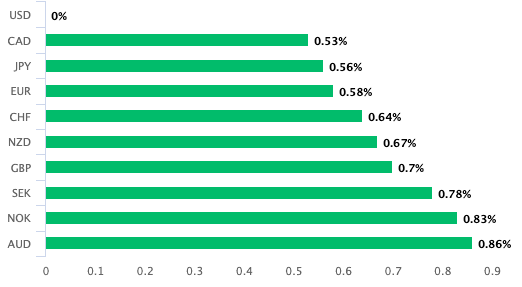

In fact, with markets having priced in over 150 basis points of cuts for the Federal Reserve in 2024, there is significantly more ‘pricing out’ of USD rate cut bets than there is for the EUR.

Above: USD is blazing ahead on Jan. 16.

Therefore, it makes sense Euro-Dollar is under pressure.

The Eurozone economy is also struggling under the weight of higher interest rates, with Germany being the only G7 country to contract in 2023.

From a macroeconomic perspective, any delays to rate cuts could delay the recovery in the Eurozone’s economy, thus weighing on the Euro.

“Other ECB officials also pushed back on the idea of a rate cut as early as spring, but were not quite as hawkish. The Bundesbank’s Nagel echoed remarks from the ECB’s chief economist Philip Lane over the weekend by arguing against cutting rates too soon,” says Boyadjian.

Bank of France’s Francois Villeroy de Galhau said, “we should be patient” as he declined to offer a timeline of when the ECB might begin to lower rates, pointing to some divisions within the Governing Council.

“It’s hard to ignore the coordinated move by the European Central Bank to cool investors’ aggressive rate cut bets,” says Boyadjian.