BY Bobby Kunda and Stephen Howes

At the start of last year, we analysed trends in the value of the kina (the PNG currency). We noted that although, as per government policy, the kina had fallen against the US dollar, it had hardly moved at all when assessed against a trade-weighted bundle of currencies, as measured using a Trade-Weighted Index (TWI).

Specifically, we showed that, whereas the kina fell against the US dollar by 5.5% over 2023, against the TWI basket of currencies it only fell by 1.6%. What has happened since then?

In 2024, it was in fact a similar story. The depreciation against the US dollar was 6.8% (between December 2023 and December 2024), whereas the depreciation against the TWI basket was only 0.9%. The trends have been very different this year, however. Between December 2024 and June 2025, the kina has only depreciated 2.5% against the US dollar, but 8.1% against the TWI basket.

This is because the US dollar has weakened over the course of the year. As NBC news recently reported, over the half-year to June the US dollar “has declined more than 10% compared with a basket of currencies from the US’ major trading partners — something it has not done since 1973″. NBC attributes this to Trump’s tariffs and a worsening fiscal outlook for the United States. (Note there has been some reversal of this trend with the US dollar strengthening in July.)

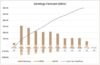

The figure below brings together all the results discussed above, and shows both the Kina/USD exchange rate and the value of TWI — that is, the kina’s value against a basket of trading partner currencies — from January 2023 to June 2025 (values shown are the exchange rates on the last day of each month).

The Kina/USD line (the blue one) is very smooth, with a very consistent depreciation since the PNG central bank’s policy of deliberately weakening the kina to end foreign exchange shortages began in April 2023. There was a slight slowdown in September 2023 and then a resumption of depreciation against the dollar in 2024. Since January 2024, the Kina/USD line is virtually a straight one.

The orange line, representing the TWI, couldn’t be more different. While also on a downward trend, it has plunged three times, and appreciated three times as well. It is all over the place.

This is not an accident. The value of the kina is set by the Bank of Papua New Guinea (BPNG) in terms of the US dollar. The value of the kina as expressed in the TWI depends on the value of the USD against other currencies, such as the Australian dollar, something BPNG has absolutely no control over.

In our last article we suggested BPNG shift away from setting the value of the kina in terms of the US dollar and towards defining the kina with reference to the TWI. Recent developments have only strengthened this argument. With US economic policy increasingly unpredictable, it makes less and less sense for PNG to tie the kina to this one currency. In fact, from 1977 till PNG floated the currency in 1994, the kina was pegged against a basket of currencies. Now that the kina is once again being managed rather than floating, it would make sense to return to this policy. After all, PNG trades in a variety of currencies, not just the US dollar. It should manage the kina in recognition of that fact.

One encouraging sign is that, in its May Monetary Policy Committee report, BPNG actually noted the depreciation of the kina as measured by the TWI, saying that there had been “a broad-based weakening of the kina”. There is no mention that this was an accidental outcome: BPNG weakened the kina slightly against the US dollar, and the US dollar happened to weaken against all other currencies. Nevertheless, it is good to see the central bank note and welcome this development. A logical next step would be to target the kina against the TWI basket of currencies as a matter of policy, rather than leaving it to chance.

An important intermediate step would be to publish TWI data on a timely basis. When we published our first article, back at the start of 2024, BPNG’s TWI data was more than six months out of date. Currently, BPNG statistics are showing TWI data up to March 2025, hardly any better. (For the most recent months, we use our own estimate of the TWI, which experience has shown to be very close to the official BPNG TWI figures.)

If we are thinking about how the kina impacts the PNG economy, we need to look at its value against the currencies of all of PNG’s trading partners, not just one of them. The experience of the last few years clearly supports the notion of pegging the kina against a basket of currencies and in that sense “de-dollarising” the kina.

Disclosure: This research was undertaken with the support of the ANU-UPNG Partnership, an initiative of the PNG-Australia Partnership, funded by the Department of Foreign Affairs and Trade. The views are those of the authors only.

This article appeared first on Devpolicy Blog (devpolicy.org), from the Development Policy Centre at The Australian National University.

Bobby Kunda is an economics lecturer at the University of Papua New Guinea.

Stephen Howes is Director of the Development Policy Centre and Professor of Economics at the Crawford School of Public Policy at The Australian National University.