The greenback is strengthening again after a bumpy 2023, as Wall Street accepts that interest rate cuts are coming later than previously expected.

The US Dollar Index, which tracks the dollar against the British pound, euro, Swiss franc, Japanese yen, Canadian dollar and Swedish krona, is up 2.8% for the year as of Friday morning.

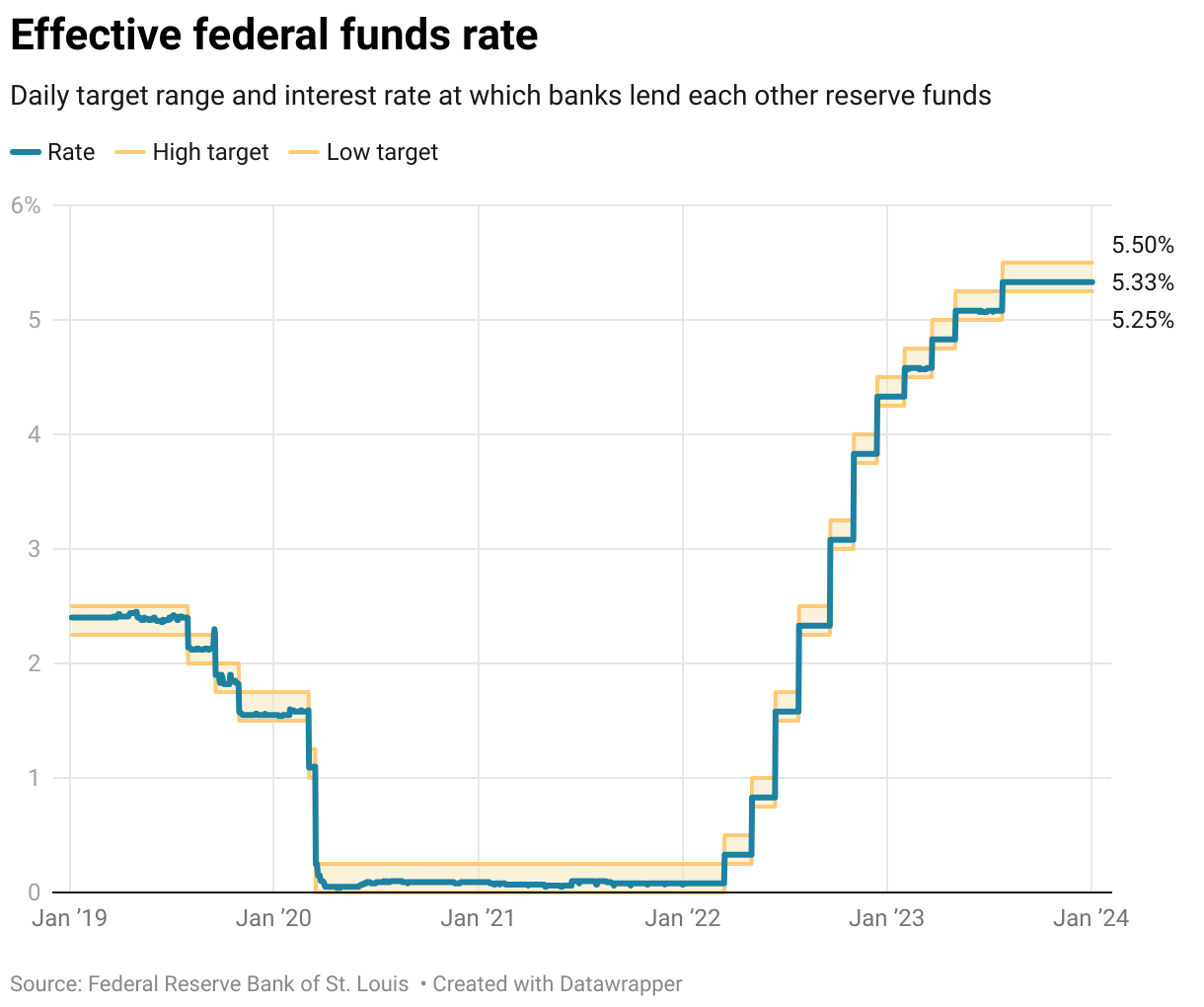

The US currency slid last November and ended the year lower against that basket of currencies as investors grew optimistic that the Federal Reserve would soon cut interest rates. But Fed Chair Jerome Powell said in January that interest rate cuts are unlikely to begin in March, as investors widely believed would happen.

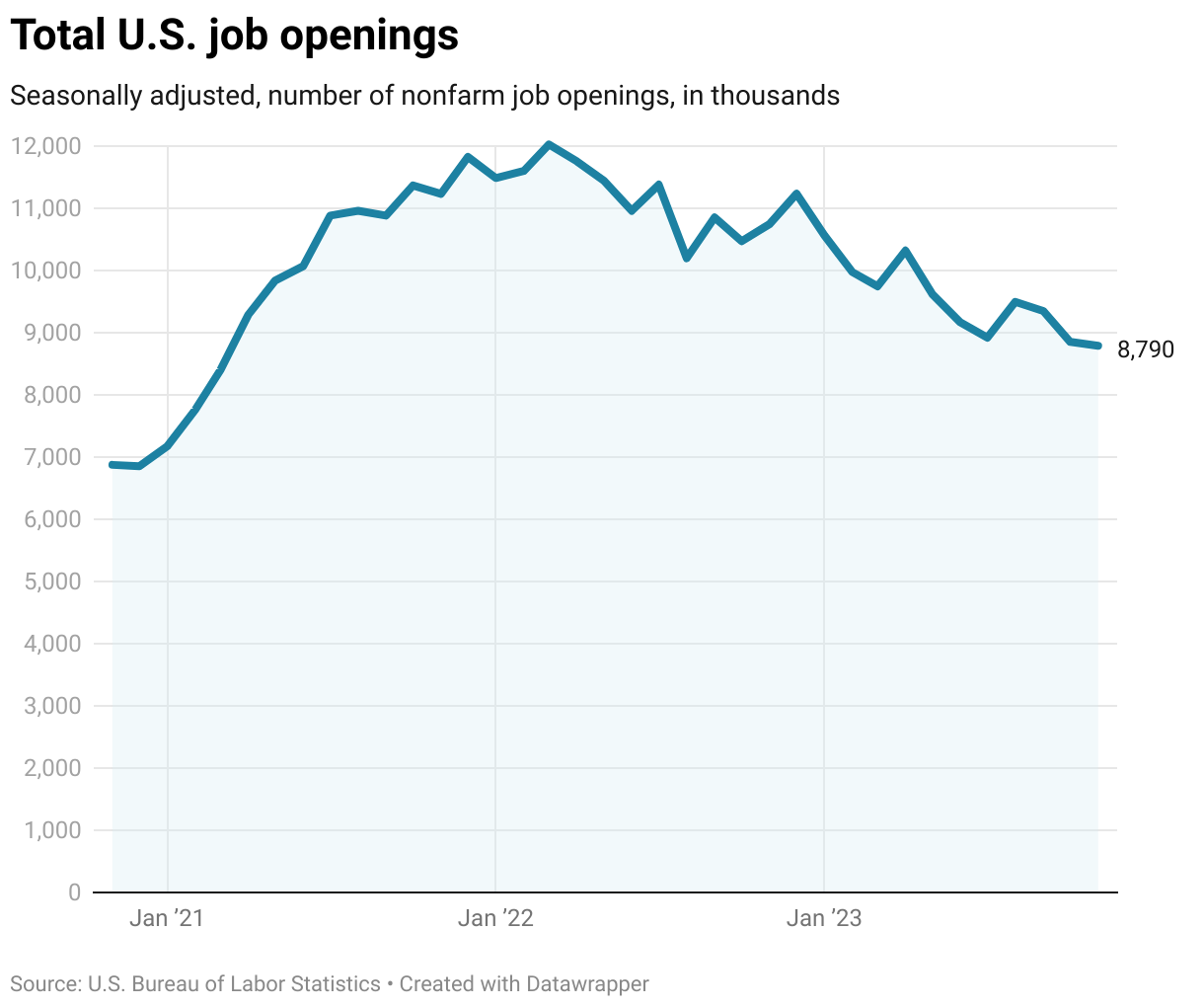

Piping hot economic data in recent weeks has supported the notion that the Fed will keep rates higher for longer. The economy added an eye-popping 353,000 jobs in January, underscoring the labor market’s continued resilience despite elevated rates. The Consumer Price Index rose 3.4% annually in December, still above the central bank’s 2% target.

People are also reading…

A stronger dollar is bad news for American companies, but it also means that US companies and consumers could spend less for imported goods, and Americans’ purchasing power increases when traveling abroad.

Take a look at how the economy is performing in Texas.