What You Need to Know Ahead of Coca-Cola’s Earnings Report Tomorrow

13 minutes ago

Coca-Cola Co. (KO) is expected to keep up the momentum from the past quarter, when the beverage giant showed that consumers continue to buy its drinks despite inflation pushing prices higher.

Analysts project another quarter of growth for the soft drinks maker, both in the top and bottom lines, when it reports earnings before Tuesday’s market open.

According to data from Visible Alpha, analysts anticipate Coca-Cola’s 2023 fourth-quarter net income will increase by nearly 10% to $2.15 billion on revenue of $10.76 billion, a nearly 7% jump from the year-ago quarter.

The world’s most valuable beverage company has been forecasting improved results after recent reports showed that higher prices were meaningfully affecting its sales. After stronger-than-expected sales in the prior quarter, Coca-Cola raised its full-year guidance for EPS and lifted its full-year revenue forecast to 10% to 11% for 2024.

Monday.com Learns Wall Street Is Getting Picky

45 minutes ago

Shares of Monday.com (MNDY) sank Monday after the enterprise software maker’s sales forecast disappointed Wall Street and overshadowed its better-than-expected fourth-quarter results.

Monday.com reported adjusted earnings of $33.7 million, or 65 cents per share, compared with $22.2 million, or 44 cents per share, in the year-ago quarter. Revenue grew 35% to $202.6 million. Both profit and sales were higher than analysts had expected.

For the first quarter of its 2024 fiscal year, Monday.com forecast revenue growth would decelerate slightly to between 28% and 30%. And full year-revenue growth is expected to fall somewhere between 27% and 28%, implying a further deceleration later in the year.

The prospect of slowing sales growth hit the stock, which had risen more than 10% in the week leading up to the report. Monday.com shares were down about 11% at $209.76 late in the session on Monday. Still, they have gained more than 60% in the past twelve months.

CymaBay Therapeutics Stock Jumps on $4.3 Billion Acquisition

1 hr 14 min ago

Shares of CymaBay Therapeutics (CBAY) soared to an all-time high Monday after Gilead Sciences (GILD) announced it’s buying the developer of medicine for liver and other chronic diseases for $4.3 billion.

Gilead said Monday that it will pay $32.50 per share in cash for CymaBay, a 26.5% premium to CymaBay’s closing price Friday.

CymaBay’s investigational lead product, seladelpar, is a treatment for primary biliary cholangitis (PBC), an autoimmune disease that affects the bile ducts in the liver. It achieved statistical significance across its primary endpoints in a Phase 3 trial.

The transaction is expected to close this quarter.

CymaBay shares were up 25% at $32.10 Monday after the acquisition was announced. Shares of Gilead ticked up 0.9% to $74.36.

VF Corp Soars as Founding Family Supports Activist’s Board Shake-Up

2 hr 9 min ago

VF Corp (VFC) was the best-performing stock in the S&P 500 Monday amid reports activist investors Engaged Capital had attained the support of founding family members in its efforts to shake up the Vans and North Face owner’s board.

Kelley Barbey, a descendant of VF Corp. founder John Barbey, said family members with a cumulative stake of about 15%, would support Engaged Capital as it seeks to gain a seat on the apparel holding company’s board.

Barbey also said the family supported removing two long-time board members—Clarence Otis and Juliana Chugg—who they blamed for failing to address the challenges that have led VF’s stock to lose more than 80% of its value in the last three years.

Engaged Capital first disclosed its 1.3% stake in the company in October 2023 and has since forced the company to consider non-core brands and cut costs.

VF Corp. shares surged more than 15% to $17.68 Monday afternoon.

Midday Movers

2 hr 40 min ago

VF Corporation (VFC) was the best-performing stock in the S&P 500 following a report the family that founded the firm supports activist investor Engaged Capital in its effort to shake up the owner of North Face and Vans brands.

Shares of Diamondback Energy (FANG) soared after the oil producer announced it is buying Endeavor Energy Partners for $26 billion to expand its reach in the Permian Basin.

Lowe’s (LOW) shares gained as JPMorgan raised its rating on the stock, suggesting Fed interest rate cuts could help boost sales at the home improvement retailer.

Hershey (HSY) shares declined as Morgan Stanley cut its rating on the stock, writing the chocolate maker’s margins could be hurt by falling consumer demand and soaring cocoa prices.

A downgrade from Barclays sent shares of Rivian Automotive (RIVN) lower. The bank cited the slowing sales of electric vehicles (EVs).

Bitcoin Soars Past $49K as ETF Inflows Pick Up Pace

3 hr 26 min ago

The price of Bitcoin surged Monday morning to nearly $50,000—its highest in more than 2 years.

Bitcoin ETFs last week recorded their largest inflows since their debut last month. The funds raked in $1.1 billion, bringing their total inflows to $2.8 billion, according to digital asset manager CoinShares.

BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Bitcoin Fund (FBTC) were the biggest winners, with a combined $1.2 billion of inflows.

Nvidia Stock Rises, Market Value Passes Amazon

4 hr 22 min ago

Nvidia (NVDA) leapfrogged Amazon (AMZN) to become America’s fourth-most valuable company in early trading Monday.

Nvidia shares rose as much as 2.6% to a record high of $741 Monday morning, giving it a market cap of $1.83 trillion. Meanwhile, Amazon stock slipped 0.6% to $173.36, reducing its market cap to $1.8 trillion.

Nvidia shares have climbed relentlessly since OpenAI’s ChatGPT in late 2022 sparked a market rally, driven by big tech companies that stood to gain from investments in artificial intelligence. No company has benefited more than Nvidia, a leading supplier of the advanced graphics processing units on which AI relies. Its stock has risen nearly 250% in the last year.

With Monday’s gains, Nvidia closed in on the $2 trillion mark, a feat only three U.S. companies have achieved: Apple (AAPL), Microsoft (MSFT) and Alphabet (GOOGL). It also came closer to surpassing Alphabet, which on Monday had a market cap of about $1.849 trillion.

Nvidia will report earnings on February 21 after markets close.

Diamondback Energy Stock Rises After Deal to Acquire Endeavor

5 hr 26 min ago

Diamondback Energy (FANG) shares rose more than 7% Monday morning to trade around $164 after the company announced plans for a merger with Endeavor Energy Resources, the latest in a string of big energy sector deals in recent months.

Under the transaction, which values Endeavor at about $26 billion, Diamondback shareholders will own about 60.5% of the combined company, while Endeavor’s equity holders will own the remainder, the companies said in a press release early Monday. The combined company will be worth about $53 billion, based on Diamondback’s current market capitalization.

Diamondback successfully held off larger players, including ConocoPhillips (COP), according to The Wall Street Journal, which first reported on Sunday that a deal was in the works. Endeavor, a private energy company founded by wildcat billionaire Autry Stephens, has an operation that stretches over 350,000 acres in the Midland section of the Permian Basin, located in West Texas.

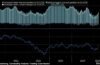

Source: TradingView.com.

Diamondback shares have traded within a textbook ascending triangle since early June 2022, indicating a continuation of the longer-term uptrend upon a breakout. Interestingly, share turnover has decreased in recent weeks as the price consolidates toward the triangle’s apex. In upcoming trading sessions, keep an eye out for volume-back breakouts on either side of the pattern for clues on the stock’s future price direction.

Stocks Making the Biggest Moves Premarket

6 hr 36 min ago

Gains:

- Joby Aviation Inc. (JOBY) Shares of the electric aircraft developer added 6% after it said it had signed an agreement with Dubai to launch air taxi services in the city by early 2026.

- Arista Networks Inc. (ANET): Shares of the cloud networking company rose 4% in anticipation of its quarterly earnings report after the bell.

- New York Community Bancorp (NYCB): The regional bank, which last week had its debt downgraded to junk status by Moody’s, gained 3%, adding to Friday’s rebound after regulatory filings showed executives piled into the battered stock.

Losses:

- Monday.com Ltd. (MNDY): Shares of the enterprise software maker tumbled 12% after it topped earnings expectations but offered current-quarter revenue guidance that was just in line with estimates.

- Trimble Inc. (TRMB): Shares of the positioning technology company fell nearly 5% after its full-year earnings and sales guidance came up short of Wall Street’s expectations.

- Citigroup Inc. (C): Shares fell more than 1% after federal regulators ordered the bank to make changes to its risk management procedures.

Stock Futures Little Changed Ahead of Fresh Inflation Data

7 hr 8 min ago

Futures contracts connected to the Dow Jones Industrial Average were down about 0.1% in premarket trading on Monday.

S&P 500 contracts were unchanged.

Nasdaq 100 contracts were up less than 0.1% about an hour before markets opened.