Eamon Gordon has been interested in finances ever since he stumbled across the stock market app on his iPod touch when he was 4 years old.

The fascination began as an accident. Gordon was trying to watch “Mickey Mouse Clubhouse” on his iPod while on a family trip, but instead of clicking on the iTunes app, he clicked on the stock market app.

“Then I just got really fascinated by it, because I saw a bunch of lines and then a bunch of numbers, and red and green colors,” Gordon said.

His said his interest in finances only grew as he got older.

“Starting in fifth or sixth grade, I started getting more into it, investing in stocks, actually having a portfolio and reading the market news,” Gordon said

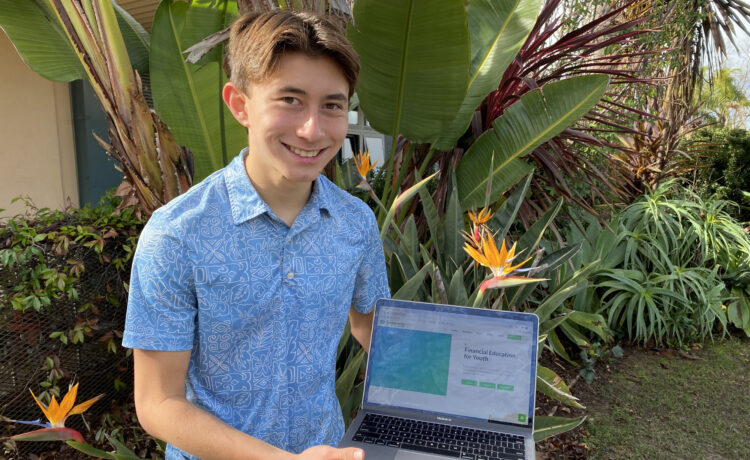

Now a junior at Dos Pueblos High School, Gordon was recently honored with the Congressional App Challenge award by Congressman Salud Carbajal.

Gordon won with his online learning course Financedu, which he designed to have free, comprehensive and engaging financial courses in order to empower more young people as they begin to make financial decisions.

“I made it free because I want everyone to be able to access it,” Gordon said. “Because we’re going into something as an adult with so much responsibility, we need training for that or we need to be prepared, because it can impact us for the rest of our life.”

The Congressional App Challenge has been ongoing since 2015 and involves participating U.S. representatives to pick a middle or high school student from their district who submits an app for consideration. The contest was designed to encourage students to learn coding and pursue careers in computer science.

Gordon came up with the idea for Financedu after participation in a science fair in 2021 when one of the essay questions on the application asked, if they could take a course at their school, what would it be?

“I figured if I just start making a course, then I can make something for teachers to be able to use,” Gordon said. “Then I just took it from there.”

Gordon began working on the course content two years ago and the website’s software a year ago, and began testing it over last summer.

“I was initially doing this myself with the support of my parents,” Gordon told Noozhawk. “They didn’t quite know what I was doing, but they knew roughly and they supported it. They helped me, and they gave me guidance.”

While Gordon developed the course content and software alone, he was able to get a group of volunteers to go through the course and give feedback on how it needed to be improved.

Gordon’s main goal when applying for the contest was to bring more awareness and publicity to Financedu so that more people can go through the coursework.

Gordon found out he was chosen as a winner of the contest in late December and got to attend an award ceremony in January.

“I felt a lot of satisfaction that something that I’d worked on for so long came to fruition,” Gordon said. “I felt satisfied with the course and all of the work I had done before and also excited for this sort of new chapter in the project that will be facing the public and being used by a bunch of students and teachers.”

Contest winners get the chance to attend an event called House of Code, where students can showcase their projects in the U.S. Capitol to corporate sponsors, companies and nonprofit organizations.

Gordon said his next step will be focusing on improving the platform’s features to get rid of any bugs in order to improve the user experience.

“I’d also like to create a platform for districts and schools to monitor the progress of their classes so they’d be able to see across their schools or across their classes how students are making progress, what educational standards or career technical standards they’re accomplishing in the course,” Gordon said.

Gordon said he also hopes to see the platform expand its reach to schools outside the Santa Barbara Unified School District, especially as the push for financial literacy classes grows across California.

In October, the Attorney General’s Office submitted an initiative that, if qualified for the upcoming November ballot and approved by voters, would require schools to offer a one-semester personal finance course for high school students by the 2026-27 school year.

“If that happens, a lot of schools I feel are going to need financial education, and a platform that they can assign content to students is going to be in demand,” Gordon said.

Dos Pueblos Principal Bill Woodard said he’s excited by the push for more financial literacy in public schools.

“All these kinds of stars are lining up for personal finance and financial literacy in public education,” Woodard said. “This is such an important topic for students that I’m obviously really proud of any app that wins a competition, but the fact that it’s a financial literacy app and that we’re starting a new personal finance class, literally right now when this app is being recognized, is super cool.”

All three Santa Barbara Unified high schools started a personal finance elective this year. Woodard said he would like to see personal finance classes replace or be embedded into the traditional economics classes that high school students take.

“I hope kids can graduate from high school, knowing about interest rates, credit cards and starting a Roth IRA,” Woodard said. “People are scared about personal finance, and I think that the fact that this app makes it user friendly and not scary is going to make it even more valuable.”